Hungary HUF Interest Rate November 16 2021

What does the data mean to the market?

The Hungarian National Bank Monetary Policy Committee's decision on where to set the benchmark interest rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation.

A higher than expected rate is positive/bullish for the HUF - (Hungarian Forint), while a lower than expected rate is negative/bearish for the HUF.

Historic deviations and their outcome

July 27 2021 A small +0.1 deviation gave a nice 2-minute move on USDHUF and EURHUF, providing 150 pips total move. If you have a good broker with tight spreads, there were pips available from this event.

Check out the price action here:

July 21 2020 June 23rd 2020, We got a negative -0.15bps (basis points) cut to the interest rate which gave a nice slow move on USDHUF, with many opportunities to enter the market!

See the price action here

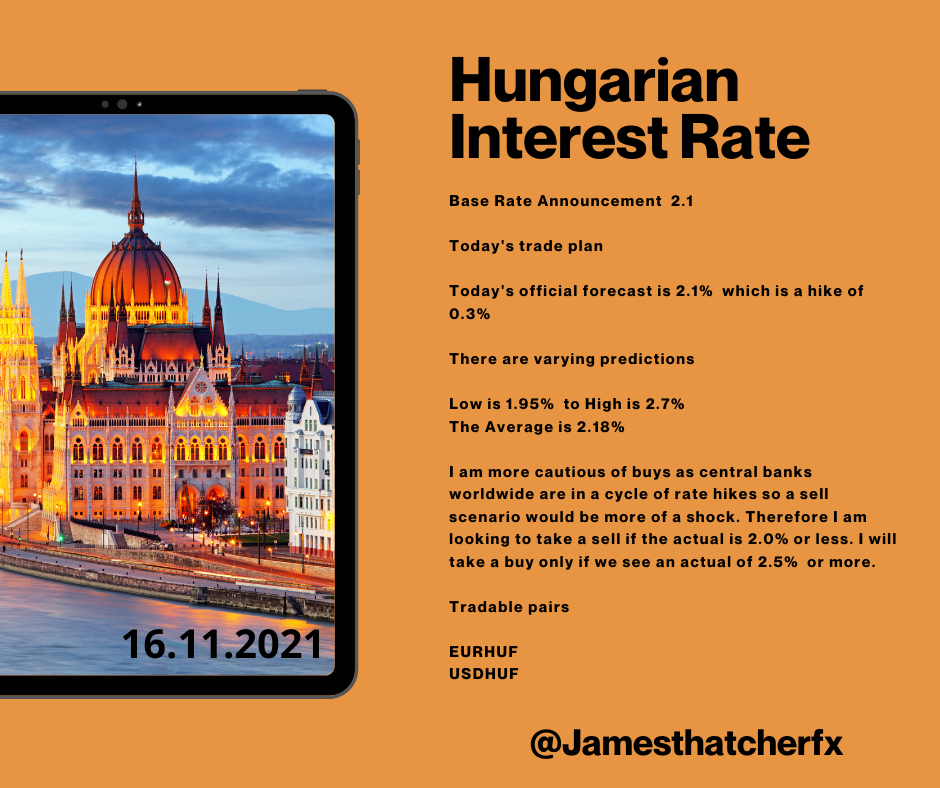

I will use forecasts of:

Base Rate Announcement 2.1

Today's trade plan

Today's official forecast is 2.1% which is a hike of 0.3%

There are varying predictions

Low is 1.95% to High is 2.7%

The Average is 2.18%

I am more cautious of buys as central banks worldwide are in a cycle of rate hikes so a sell scenario would be more of a shock. Therefore I am looking to take a sell if the actual is 2.0% or less. I will take a buy only if we see an actual of 2.5% or more.

Tradable pairs

EURHUF

USDHUF

Hope this helps but please do your own analysis!!

Good luck!!

James Thatcher

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

What does the data mean to the market?

The Hungarian National Bank Monetary Policy Committee's decision on where to set the benchmark interest rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation.

A higher than expected rate is positive/bullish for the HUF - (Hungarian Forint), while a lower than expected rate is negative/bearish for the HUF.

Historic deviations and their outcome

July 27 2021 A small +0.1 deviation gave a nice 2-minute move on USDHUF and EURHUF, providing 150 pips total move. If you have a good broker with tight spreads, there were pips available from this event.

Check out the price action here:

HU Interest Rate Decision 2021-07-27 12:00:00.0

HU Interest Rate Decision 2021-07-27 12:00:00.0

calendarapi.galaxysoftwareinc.com

July 21 2020 June 23rd 2020, We got a negative -0.15bps (basis points) cut to the interest rate which gave a nice slow move on USDHUF, with many opportunities to enter the market!

See the price action here

HU Interest Rate Decision 2020-06-23 12:00:00.0

HU Interest Rate Decision 2020-06-23 12:00:00.0

calendarapi.galaxysoftwareinc.com

I will use forecasts of:

Base Rate Announcement 2.1

Today's trade plan

Today's official forecast is 2.1% which is a hike of 0.3%

There are varying predictions

Low is 1.95% to High is 2.7%

The Average is 2.18%

I am more cautious of buys as central banks worldwide are in a cycle of rate hikes so a sell scenario would be more of a shock. Therefore I am looking to take a sell if the actual is 2.0% or less. I will take a buy only if we see an actual of 2.5% or more.

Tradable pairs

EURHUF

USDHUF

Hope this helps but please do your own analysis!!

Good luck!!

James Thatcher

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.