Andrea ForexMart

Broker Representative

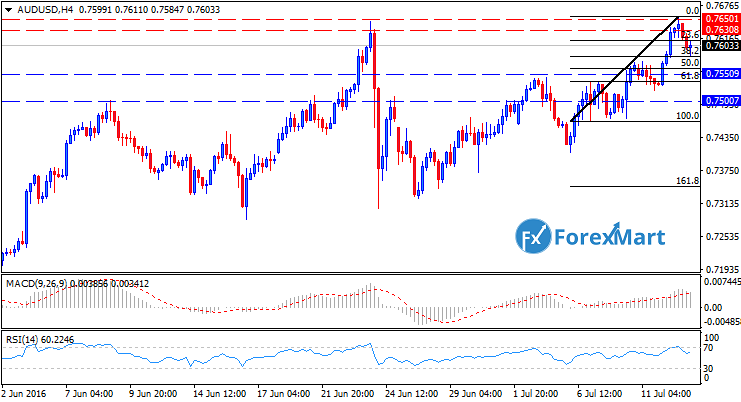

AUD/USD Technical Analysis: July 13 2016

AUD/USD recorded its highest stock price on May 3. But today the pair obtained a lower rate after a growth surge that happened yesterday. The recent strength of the market's trend was remarked by the appetite for risk in the global economy.

The Aussie Dollar has improved since the Reserve Bank of Australia reduced interest rates and they are now regenerating all their losses during the post-Brexit.

The daily swing chart defined the pair's main trend as an uptrend and made it cut down the Brexit top that changed the .7645 into .7285 as the market bottom.

The main price range is .7834 to .7145. The retracement alert level is close above .7569 to .7487, this shows a chance of an upside strengthening.

The market movement occurred to an uptrending angle at .7665 by which it is close to the result of yesterday’s strength at .7622.

Meanwhile, AUD/USD may take a bullish or long position in certain securities due to a sustained market movement over .7665 and this would probably begin an upside momentum to rotate the downtrending angle at .7687.

Technically, it is difficult to deal with .7665 and coping with this real time exchange rate will signal the presence of more sellers than buyers. If the price continued a downward sloping average below .7539, it indicates weakness for the next target.

AUD/USD recorded its highest stock price on May 3. But today the pair obtained a lower rate after a growth surge that happened yesterday. The recent strength of the market's trend was remarked by the appetite for risk in the global economy.

The Aussie Dollar has improved since the Reserve Bank of Australia reduced interest rates and they are now regenerating all their losses during the post-Brexit.

The daily swing chart defined the pair's main trend as an uptrend and made it cut down the Brexit top that changed the .7645 into .7285 as the market bottom.

The main price range is .7834 to .7145. The retracement alert level is close above .7569 to .7487, this shows a chance of an upside strengthening.

The market movement occurred to an uptrending angle at .7665 by which it is close to the result of yesterday’s strength at .7622.

Meanwhile, AUD/USD may take a bullish or long position in certain securities due to a sustained market movement over .7665 and this would probably begin an upside momentum to rotate the downtrending angle at .7687.

Technically, it is difficult to deal with .7665 and coping with this real time exchange rate will signal the presence of more sellers than buyers. If the price continued a downward sloping average below .7539, it indicates weakness for the next target.