Andrea ForexMart

Broker Representative

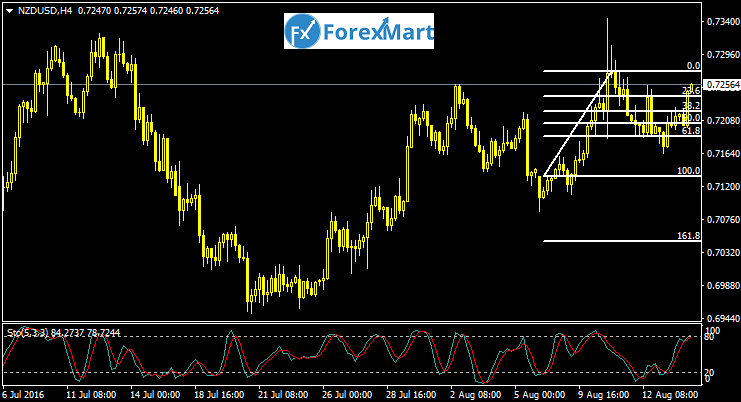

Fundamental Analysis for NZD/USD: August 16, 2016

The NZD/USD pair weakened its stance and traded down at 0.7177, although this is still a relatively strong value compared to its counterparts. Investors are taking into consideration China’s mixed signals and the lack of stimulus from the People’s Bank of China. The RBA and RBNZ statements on its rate decisions are making investors and traders uneasy. The retail sales volume rose by 2.3% last June, which is the biggest increase in the last nine years. This is in comparison with a 1% increase last year.

According to Statistics New Zealand, the increase was mainly caused by surges in vehicle sales, personal and pharmaceutical products, and more people spending on eating and drinking out. The retail sales’ total value rose from 2.2% last quarter to almost $20 billion. According to Westpac economist Satish Ranchhod, consumers are benefiting from low inflation and interest rates, which are putting money back in domestic pockets. A strengthened tourist season and strong migration rates are also helping in the surge in spending figures.

Zespri has also stated that it has already improved its pre-export checking procedures, which has already been approved by the MPI, who is currently advising China with regards to kiwifruit exports. Kiwifruit sales has also exceeded last year’s total volume sales, with another 7 million kiwifruit trays in line for export this coming season.

The NZD/USD pair weakened its stance and traded down at 0.7177, although this is still a relatively strong value compared to its counterparts. Investors are taking into consideration China’s mixed signals and the lack of stimulus from the People’s Bank of China. The RBA and RBNZ statements on its rate decisions are making investors and traders uneasy. The retail sales volume rose by 2.3% last June, which is the biggest increase in the last nine years. This is in comparison with a 1% increase last year.

According to Statistics New Zealand, the increase was mainly caused by surges in vehicle sales, personal and pharmaceutical products, and more people spending on eating and drinking out. The retail sales’ total value rose from 2.2% last quarter to almost $20 billion. According to Westpac economist Satish Ranchhod, consumers are benefiting from low inflation and interest rates, which are putting money back in domestic pockets. A strengthened tourist season and strong migration rates are also helping in the surge in spending figures.

Zespri has also stated that it has already improved its pre-export checking procedures, which has already been approved by the MPI, who is currently advising China with regards to kiwifruit exports. Kiwifruit sales has also exceeded last year’s total volume sales, with another 7 million kiwifruit trays in line for export this coming season.