Andrea ForexMart

Broker Representative

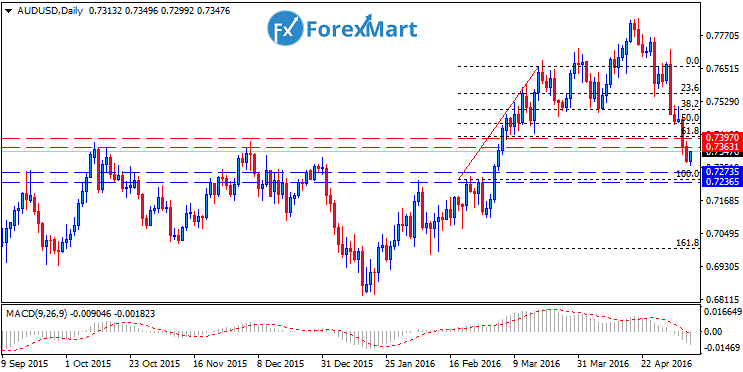

Technical Analysis for AUD/USD: May 10, 2016

The AUD/USD has now settled at the 0.73 handle as data from China, Australia’s largest trade partner, did little to boost the Australian dollar’s value against the greenback. The AUD bottomed at 0.7299 today and peaked at 0.7351.

The impact of China’s bearish consumer prices, which grew by 2.3 percent in April from the same period last year, was lukewarm. Markets were expecting a 2.4 percent rise. Its PPI fell by 3.4 percent, not as much as the forecasted 3.8 percent decline. Exports and imports, which stood at -1.8 percent and -10.9 percent y/y respectively, were also on the red.

Buying interest on the USD firmed slightly due to an increase in wages, which was up 0.3 percent m/m in April and 2.5 percent y/y. Only 160,000 jobs were added to the nonfarm payrolls opposed to a projected 202,000 additional positions.

The spot exchange is now at 0.7339 and the price is rising. However, we are yet to see the AUD breach 0.74 today.

The immediate support is at 0.7272 and 0.7236 subsequently while the first resistance is at 0.7364 and 0.7397 subsequently. The MACD indicator is in a negative location.

The AUD/USD has now settled at the 0.73 handle as data from China, Australia’s largest trade partner, did little to boost the Australian dollar’s value against the greenback. The AUD bottomed at 0.7299 today and peaked at 0.7351.

The impact of China’s bearish consumer prices, which grew by 2.3 percent in April from the same period last year, was lukewarm. Markets were expecting a 2.4 percent rise. Its PPI fell by 3.4 percent, not as much as the forecasted 3.8 percent decline. Exports and imports, which stood at -1.8 percent and -10.9 percent y/y respectively, were also on the red.

Buying interest on the USD firmed slightly due to an increase in wages, which was up 0.3 percent m/m in April and 2.5 percent y/y. Only 160,000 jobs were added to the nonfarm payrolls opposed to a projected 202,000 additional positions.

The spot exchange is now at 0.7339 and the price is rising. However, we are yet to see the AUD breach 0.74 today.

The immediate support is at 0.7272 and 0.7236 subsequently while the first resistance is at 0.7364 and 0.7397 subsequently. The MACD indicator is in a negative location.