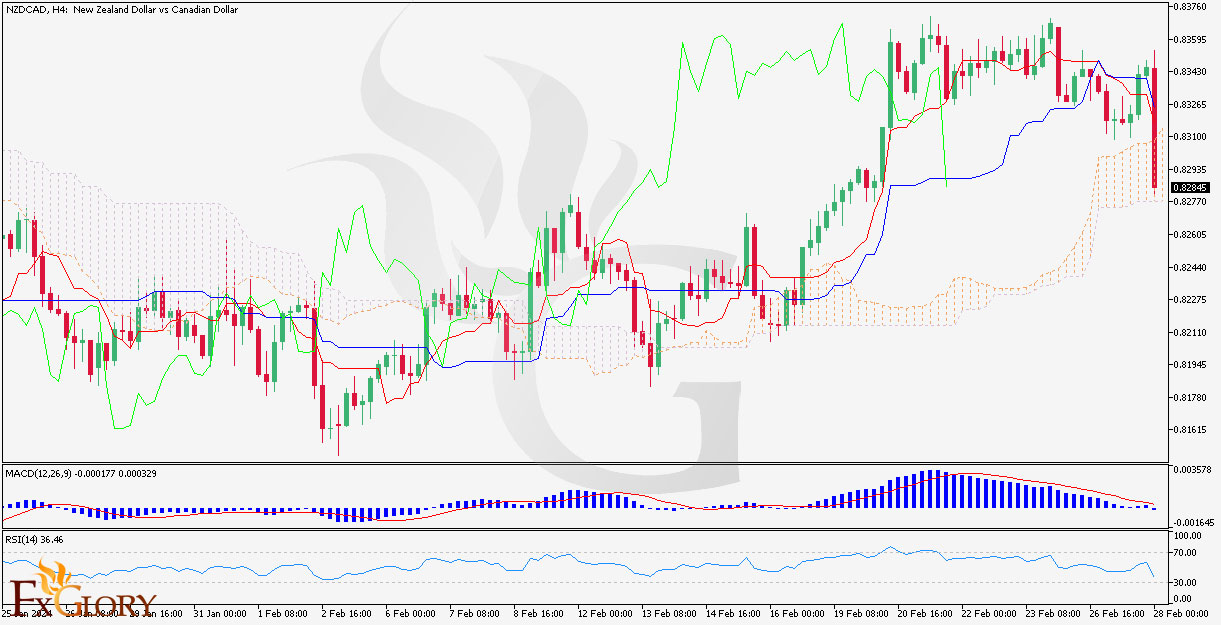

NZDCAD analysis for 28.02.2024

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The NZD/CAD currency pair reflects the exchange rate between the New Zealand Dollar and the Canadian Dollar, two commodity-dependent economies. The NZD is often influenced by dairy prices and New Zealand's economic indicators, while the CAD is closely tied to oil prices and economic developments in Canada. Trade relationships with global partners, especially China and the United States, can significantly impact these currencies. Additionally, monetary policy announcements from the Reserve Bank of New Zealand and the Bank of Canada, as well as changes in global risk sentiment, are important to monitor for their potential influence on the NZD/CAD exchange rate.

Price Action:

The H4 chart for NZDCAD displays a zigzag pattern, indicating a period of consolidation with clear swings between support and resistance levels. The price appears to be within a downtrend channel but recently showing signs of recovery, with the latest candles suggesting a potential reversal or pullback.

Key Technical Indicators:

MACD: The MACD line is close to the signal line, with the histogram showing minimal bars, indicating a lack of strong momentum in either direction. This could suggest a market in balance or indecision among traders.

RSI (Relative Strength Index): The RSI indicator is around the midpoint of 50, which does not indicate an overbought or oversold market. This suggests a neutral momentum currently in the market.

Ichimoku: The price is navigating around the Ichimoku cloud, which could be indicative of a potential trend change if the price breaks through the cloud.

Support and Resistance:

Support: The current support level can be identified by the lower boundary of the recent price channel and the consolidation area.

Resistance: Resistance is likely at the upper boundary of the price channel and the previous high points within the consolidation range.

Conclusion and Consideration:

The H4 chart for NZDCAD shows a market experiencing consolidation, with potential for a breakout in either direction. While recent price action suggests a slight bullish recovery, the key technical indicators do not present a clear direction, indicating a wait-and-see approach may be prudent. Traders should keep abreast of economic indicators from both New Zealand and Canada, as well as global commodity prices, to anticipate potential shifts in the currency pair's movement.

Disclaimer: This analysis is intended for informational purposes only and should not be taken as investment advice. Trading decisions should be based on individual risk tolerance, market knowledge, and thorough analysis.

FXGlory

28.02.2024

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The NZD/CAD currency pair reflects the exchange rate between the New Zealand Dollar and the Canadian Dollar, two commodity-dependent economies. The NZD is often influenced by dairy prices and New Zealand's economic indicators, while the CAD is closely tied to oil prices and economic developments in Canada. Trade relationships with global partners, especially China and the United States, can significantly impact these currencies. Additionally, monetary policy announcements from the Reserve Bank of New Zealand and the Bank of Canada, as well as changes in global risk sentiment, are important to monitor for their potential influence on the NZD/CAD exchange rate.

Price Action:

The H4 chart for NZDCAD displays a zigzag pattern, indicating a period of consolidation with clear swings between support and resistance levels. The price appears to be within a downtrend channel but recently showing signs of recovery, with the latest candles suggesting a potential reversal or pullback.

Key Technical Indicators:

MACD: The MACD line is close to the signal line, with the histogram showing minimal bars, indicating a lack of strong momentum in either direction. This could suggest a market in balance or indecision among traders.

RSI (Relative Strength Index): The RSI indicator is around the midpoint of 50, which does not indicate an overbought or oversold market. This suggests a neutral momentum currently in the market.

Ichimoku: The price is navigating around the Ichimoku cloud, which could be indicative of a potential trend change if the price breaks through the cloud.

Support and Resistance:

Support: The current support level can be identified by the lower boundary of the recent price channel and the consolidation area.

Resistance: Resistance is likely at the upper boundary of the price channel and the previous high points within the consolidation range.

Conclusion and Consideration:

The H4 chart for NZDCAD shows a market experiencing consolidation, with potential for a breakout in either direction. While recent price action suggests a slight bullish recovery, the key technical indicators do not present a clear direction, indicating a wait-and-see approach may be prudent. Traders should keep abreast of economic indicators from both New Zealand and Canada, as well as global commodity prices, to anticipate potential shifts in the currency pair's movement.

Disclaimer: This analysis is intended for informational purposes only and should not be taken as investment advice. Trading decisions should be based on individual risk tolerance, market knowledge, and thorough analysis.

FXGlory

28.02.2024