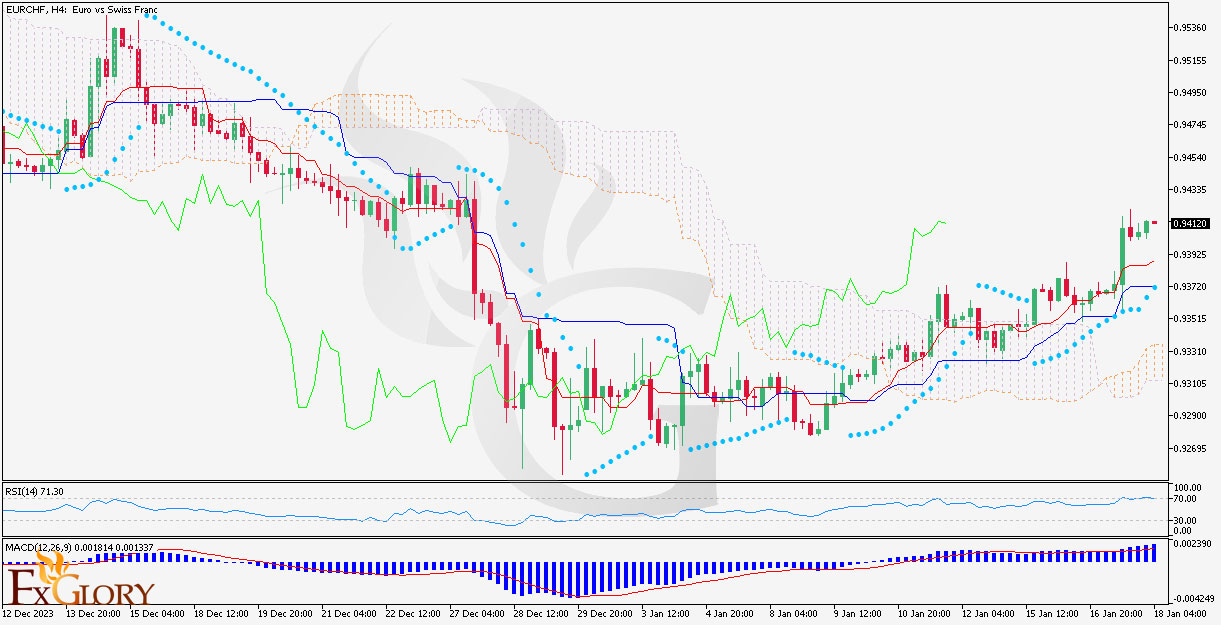

EURCHF analysis for 18.01.2024

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EURCHF currency pair reflects the exchange rate between the Euro and the Swiss Franc. Fundamental factors that may affect this pair include the monetary policies of the European Central Bank (ECB) and the Swiss National Bank (SNB), differential inflation rates, and the economic health of the Eurozone and Switzerland. Given the Eurozone's expansive market size and the Swiss economy's reliance on banking and financial services, changes in fiscal policies or economic indicators such as GDP growth, unemployment rates, and consumer confidence can significantly impact this pair. Additionally, geopolitical events in Europe, as well as global risk sentiment, can lead to fluctuations in the EURCHF exchange rate.

Price Action:

The price action on the EURCHF H4 chart shows a clear uptrend, with the price moving above the key moving averages, indicating bullish momentum. The pair has been making higher highs and higher lows, which is characteristic of a strong uptrend. The recent candles are green and sizable, which suggests a continuation of buying interest in the market.

Key Technical Indicators:

Ichimoku: The price is above the Ichimoku cloud, and the cloud is bullish (green), indicating that the overall trend is upwards. The future cloud also appears to be bullish, suggesting that the trend may continue.

Parabolic SAR: The dots of the Parabolic SAR are below the candles, which confirms the bullish trend, indicating that the market sentiment is favoring the upside.

RSI: The RSI is above 70, which often indicates overbought conditions; however, in a strong trend, the RSI can remain overbought for extended periods.

MACD: The MACD line is above the signal line and above zero, which reinforces the bullish momentum. There is no immediate sign of a bearish crossover, which could suggest that the bullish trend may sustain in the near term.

Support and Resistance:

Support: The immediate support is observed at the recent swing low around the 0.93200 level.

Resistance: The next resistance level is likely near the recent highs around the 0.94350 level.

Conclusion and Consideration:

The EURCHF pair on the H4 chart exhibits a strong uptrend, confirmed by price action and the key technical indicators. The Ichimoku cloud and Parabolic SAR support the bullish sentiment, while the overbought RSI suggests a cautious approach as the market may be due for a correction or consolidation in the near future. Traders should watch for potential retracements to the support level as entry points and consider resistance levels for taking profits. It's also important to stay updated with the fundamental developments from the Eurozone and Switzerland, as they can abruptly affect the pair's direction. As with any trading strategy, risk management is crucial, including the use of stop losses to protect against unexpected market movements.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Trading involves risks, and it's essential to conduct your own research or consult with a financial advisor before making any trading decisions.

FXGlory

18.01.2024

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EURCHF currency pair reflects the exchange rate between the Euro and the Swiss Franc. Fundamental factors that may affect this pair include the monetary policies of the European Central Bank (ECB) and the Swiss National Bank (SNB), differential inflation rates, and the economic health of the Eurozone and Switzerland. Given the Eurozone's expansive market size and the Swiss economy's reliance on banking and financial services, changes in fiscal policies or economic indicators such as GDP growth, unemployment rates, and consumer confidence can significantly impact this pair. Additionally, geopolitical events in Europe, as well as global risk sentiment, can lead to fluctuations in the EURCHF exchange rate.

Price Action:

The price action on the EURCHF H4 chart shows a clear uptrend, with the price moving above the key moving averages, indicating bullish momentum. The pair has been making higher highs and higher lows, which is characteristic of a strong uptrend. The recent candles are green and sizable, which suggests a continuation of buying interest in the market.

Key Technical Indicators:

Ichimoku: The price is above the Ichimoku cloud, and the cloud is bullish (green), indicating that the overall trend is upwards. The future cloud also appears to be bullish, suggesting that the trend may continue.

Parabolic SAR: The dots of the Parabolic SAR are below the candles, which confirms the bullish trend, indicating that the market sentiment is favoring the upside.

RSI: The RSI is above 70, which often indicates overbought conditions; however, in a strong trend, the RSI can remain overbought for extended periods.

MACD: The MACD line is above the signal line and above zero, which reinforces the bullish momentum. There is no immediate sign of a bearish crossover, which could suggest that the bullish trend may sustain in the near term.

Support and Resistance:

Support: The immediate support is observed at the recent swing low around the 0.93200 level.

Resistance: The next resistance level is likely near the recent highs around the 0.94350 level.

Conclusion and Consideration:

The EURCHF pair on the H4 chart exhibits a strong uptrend, confirmed by price action and the key technical indicators. The Ichimoku cloud and Parabolic SAR support the bullish sentiment, while the overbought RSI suggests a cautious approach as the market may be due for a correction or consolidation in the near future. Traders should watch for potential retracements to the support level as entry points and consider resistance levels for taking profits. It's also important to stay updated with the fundamental developments from the Eurozone and Switzerland, as they can abruptly affect the pair's direction. As with any trading strategy, risk management is crucial, including the use of stop losses to protect against unexpected market movements.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Trading involves risks, and it's essential to conduct your own research or consult with a financial advisor before making any trading decisions.

FXGlory

18.01.2024