GBPAUD analysis for 07.11.2023

Time Zone: GMT +2

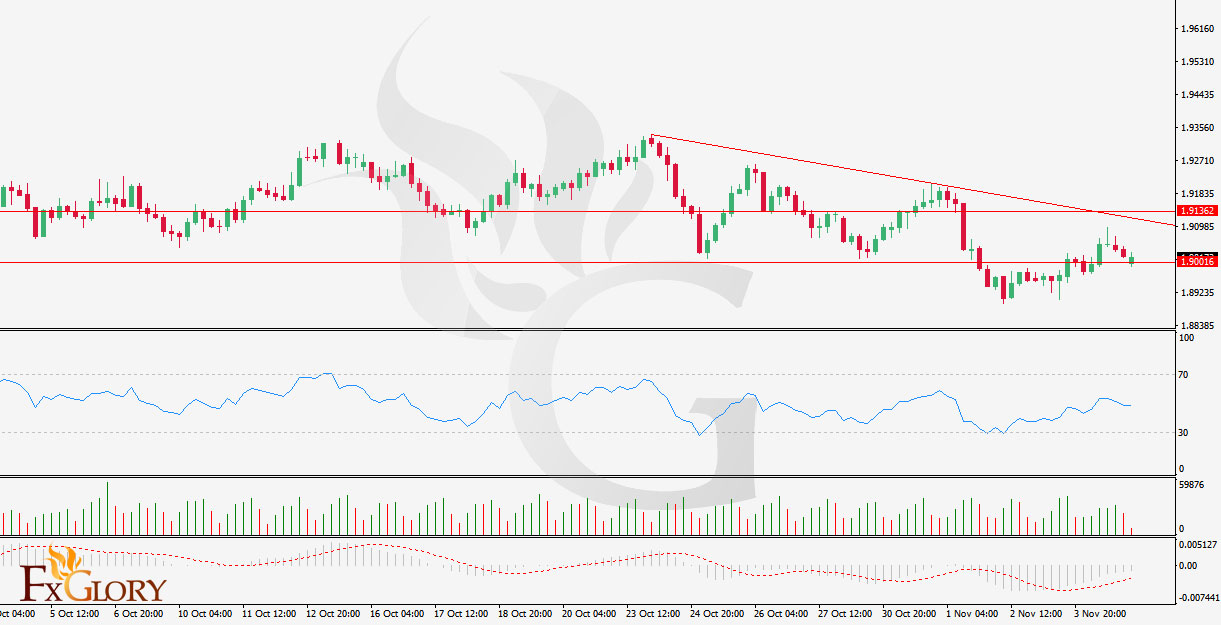

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The GBPAUD pair represents the exchange rate between the British Pound (GBP) and the Australian Dollar (AUD). Factors affecting this currency pair often include economic indicators from both the UK and Australia, such as interest rate decisions, GDP growth rates, employment changes, and trade balances. Additionally, global commodity prices, particularly metal and mineral markets, significantly impact the AUD due to Australia's large export economy. Brexit-related news continues to influence the GBP as the UK adjusts its trade and economic policies post its exit from the European Union. As these economies react to changes in global financial stability and currency market volatility, these fundamental aspects must be monitored closely by traders.

Price Action:

The H4 chart for GBPAUD displays a descending trendline, indicating a bearish bias in recent price movements. The pair has been making lower highs, which is characteristic of a downtrend. However, there is also a level of support that has been tested multiple times, suggesting a consolidation phase could be forming.

Key Technical Indicators:

RSI (Relative Strength Index): The RSI is hovering just above the 30 level, suggesting that the market may be in oversold territory and could potentially reverse or bounce back in the short term.

Volumes: The trading volume has shown variability with spikes that may correspond with price volatility. This indicates a market that is actively engaged with the current price trend.

MACD (Moving Average Convergence Divergence): The MACD line is below the signal line and has been residing in negative territory, confirming the bearish momentum. However, the histogram shows reduced bearish momentum, which could suggest a potential weakening of the current downtrend.

Support and Resistance:

Resistance: The descending trendline currently near the 1.9132 level acts as a dynamic resistance.

Support: The horizontal support line around the 1.8883 level has been tested multiple times, indicating a strong area of buyer interest.

Conclusion and Consideration:

The GBPAUD pair on the H4 timeframe is exhibiting a bearish trend, highlighted by the descending trendline. The RSI and MACD indicators support this view but also caution about the potential for a reversal given the RSI's proximity to the oversold territory and the MACD's reduced negative momentum. Traders should stay vigilant for any shifts in fundamental factors from both the UK and Australia that might influence the pair's direction. Given the current price action, there may be opportunities to look for bearish signals off the trendline or bullish signals for a potential bounce from support. It's advisable for traders to use stop losses and consider profit targets around the key support and resistance levels to manage risks appropriately.

Disclaimer: We do not suggest any investment advice, and these analyses are just to increase the traders' awareness but not a certain instruction for trading.

FXGlory

07.11.2023

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The GBPAUD pair represents the exchange rate between the British Pound (GBP) and the Australian Dollar (AUD). Factors affecting this currency pair often include economic indicators from both the UK and Australia, such as interest rate decisions, GDP growth rates, employment changes, and trade balances. Additionally, global commodity prices, particularly metal and mineral markets, significantly impact the AUD due to Australia's large export economy. Brexit-related news continues to influence the GBP as the UK adjusts its trade and economic policies post its exit from the European Union. As these economies react to changes in global financial stability and currency market volatility, these fundamental aspects must be monitored closely by traders.

Price Action:

The H4 chart for GBPAUD displays a descending trendline, indicating a bearish bias in recent price movements. The pair has been making lower highs, which is characteristic of a downtrend. However, there is also a level of support that has been tested multiple times, suggesting a consolidation phase could be forming.

Key Technical Indicators:

RSI (Relative Strength Index): The RSI is hovering just above the 30 level, suggesting that the market may be in oversold territory and could potentially reverse or bounce back in the short term.

Volumes: The trading volume has shown variability with spikes that may correspond with price volatility. This indicates a market that is actively engaged with the current price trend.

MACD (Moving Average Convergence Divergence): The MACD line is below the signal line and has been residing in negative territory, confirming the bearish momentum. However, the histogram shows reduced bearish momentum, which could suggest a potential weakening of the current downtrend.

Support and Resistance:

Resistance: The descending trendline currently near the 1.9132 level acts as a dynamic resistance.

Support: The horizontal support line around the 1.8883 level has been tested multiple times, indicating a strong area of buyer interest.

Conclusion and Consideration:

The GBPAUD pair on the H4 timeframe is exhibiting a bearish trend, highlighted by the descending trendline. The RSI and MACD indicators support this view but also caution about the potential for a reversal given the RSI's proximity to the oversold territory and the MACD's reduced negative momentum. Traders should stay vigilant for any shifts in fundamental factors from both the UK and Australia that might influence the pair's direction. Given the current price action, there may be opportunities to look for bearish signals off the trendline or bullish signals for a potential bounce from support. It's advisable for traders to use stop losses and consider profit targets around the key support and resistance levels to manage risks appropriately.

Disclaimer: We do not suggest any investment advice, and these analyses are just to increase the traders' awareness but not a certain instruction for trading.

FXGlory

07.11.2023