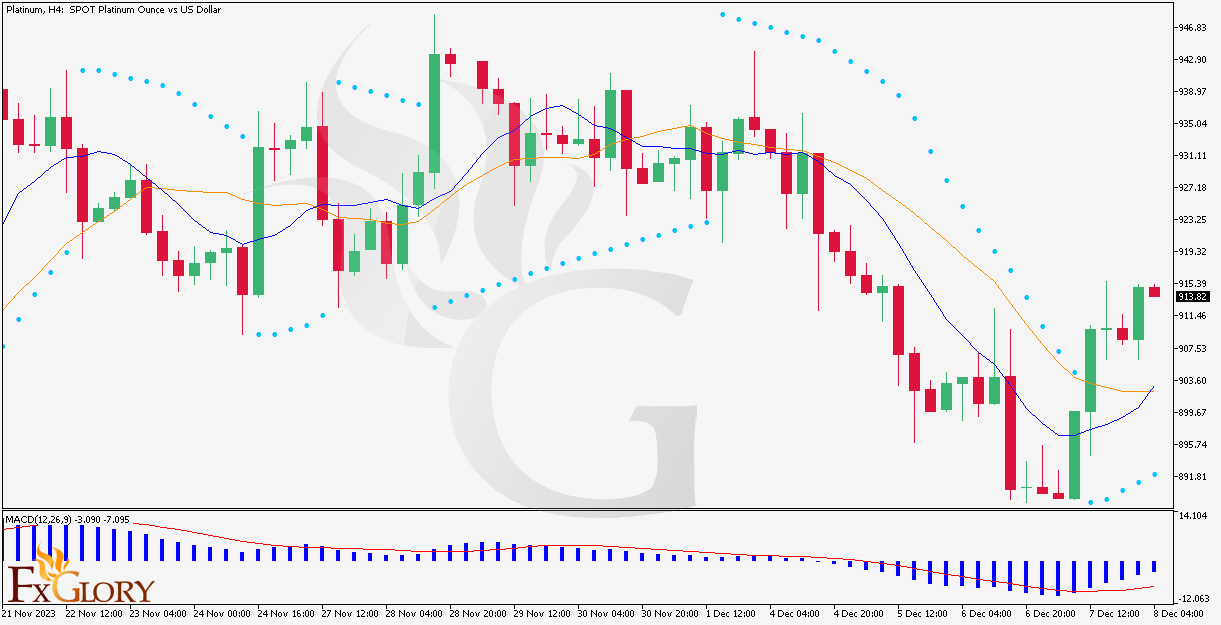

PLATINUM analysis for 08.12.2023

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The Platinum vs. US Dollar (XPTUSD) pair reflects the dynamics between the precious metal platinum and the US currency. Factors influencing the price of platinum include industrial demand, particularly from the automotive sector for catalytic converters, and investment demand for platinum as a safe-haven asset. The US dollar's strength, influenced by Federal Reserve policies, inflation rates, and economic indicators, also plays a crucial role. With shifts in green technology potentially impacting platinum demand, alongside economic data releases from the US, the XPTUSD pair is sensitive to changes in both industrial outlook and currency strength.

Price Action:

The H4 timeframe shows that the XPTUSD has experienced volatility with an overall downward trend in the recent period. The price action has formed a series of lower highs and lower lows, indicating bearish sentiment. However, the most recent candles have shown a bullish reversal, with the price moving upwards sharply, suggesting a possible change in market sentiment or a retracement.

Key Technical Indicators:

Moving Averages: The short-term moving average (MA) with a period of 9 has crossed above the longer-term MA with a period of 17, which may indicate a potential bullish trend reversal.

Parabolic SAR: The last dots of the Parabolic SAR are observed below the candles, supporting the recent bullish price movement.

MACD: The MACD histogram is below the baseline but shows diminishing bearish momentum, as the bars are becoming shorter, indicating a possible slowing of the downtrend.

Support and Resistance:

Resistance: The recent peak before the downtrend can serve as a resistance level, which may be around the $950 mark.

Support: The lowest point in the current downtrend serves as a support level, potentially near the $880 level.

Conclusion and Consideration:

The XPTUSD pair on the H4 chart suggests a recent bullish reversal following a predominant downtrend. While the moving averages and Parabolic SAR indicate a potential change in trend, the MACD suggests caution as the downtrend may be slowing, not reversing. Traders should monitor the strength of the current bullish movement and consider the potential impact of upcoming fundamental factors. Setting stop-loss orders below the support level and taking profit near the resistance level may be prudent, keeping in mind the inherent risks associated with volatile markets.

Disclaimer: The provided analysis does not constitute investment advice. It is intended for informational purposes only, and traders should conduct their own research and risk assessment before making any trading decisions.

FXGlory

08.12.2023

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The Platinum vs. US Dollar (XPTUSD) pair reflects the dynamics between the precious metal platinum and the US currency. Factors influencing the price of platinum include industrial demand, particularly from the automotive sector for catalytic converters, and investment demand for platinum as a safe-haven asset. The US dollar's strength, influenced by Federal Reserve policies, inflation rates, and economic indicators, also plays a crucial role. With shifts in green technology potentially impacting platinum demand, alongside economic data releases from the US, the XPTUSD pair is sensitive to changes in both industrial outlook and currency strength.

Price Action:

The H4 timeframe shows that the XPTUSD has experienced volatility with an overall downward trend in the recent period. The price action has formed a series of lower highs and lower lows, indicating bearish sentiment. However, the most recent candles have shown a bullish reversal, with the price moving upwards sharply, suggesting a possible change in market sentiment or a retracement.

Key Technical Indicators:

Moving Averages: The short-term moving average (MA) with a period of 9 has crossed above the longer-term MA with a period of 17, which may indicate a potential bullish trend reversal.

Parabolic SAR: The last dots of the Parabolic SAR are observed below the candles, supporting the recent bullish price movement.

MACD: The MACD histogram is below the baseline but shows diminishing bearish momentum, as the bars are becoming shorter, indicating a possible slowing of the downtrend.

Support and Resistance:

Resistance: The recent peak before the downtrend can serve as a resistance level, which may be around the $950 mark.

Support: The lowest point in the current downtrend serves as a support level, potentially near the $880 level.

Conclusion and Consideration:

The XPTUSD pair on the H4 chart suggests a recent bullish reversal following a predominant downtrend. While the moving averages and Parabolic SAR indicate a potential change in trend, the MACD suggests caution as the downtrend may be slowing, not reversing. Traders should monitor the strength of the current bullish movement and consider the potential impact of upcoming fundamental factors. Setting stop-loss orders below the support level and taking profit near the resistance level may be prudent, keeping in mind the inherent risks associated with volatile markets.

Disclaimer: The provided analysis does not constitute investment advice. It is intended for informational purposes only, and traders should conduct their own research and risk assessment before making any trading decisions.

FXGlory

08.12.2023