POWELL’S FIRST TESTIMONY: WILL THE DOLLAR FINALLY RISE?

14:51 27.02.2018

Last week the greenback could strengthen its position a little bit. However, since yesterday the US dollar was weakening against most major currencies because of the expectations of the today Jerome Powell’s first testimony to the Congress as Fed Chair. Traders were waiting if the new chairman will continue the monetary policy of his predecessor Janet Yellen or his policy will be more hawkish.

Let’s look at the main ideas of Powell’s testimony and will try to forecast its impact on the US dollar’s future.

As expected, Powell’s speech was hawkish. In his testimony Mr. Powell gave positive comments about the labour market, said that financial conditions are accommodative in spite of volatility, export is firm, fiscal policy is more stimulative. At the same time, he mentioned that inflation is still below 2% objective. As a conclusion, the chairman said that the Fed is aimed at the further gradual increases in the federal funds rate. It led to the rise of the US dollar.

However, the new chairman did not give clear clues on the amount of the future rate hikes. Furthermore, he did not mention the last important events that happened in the US economic world such as stock market selloff and an increase of the US Treasury yields. So the speech was superficial.

It creates doubts about the term of the dollar’s increase. First of all, Jerome Powell did not mention the number of rate hikes. Secondly, his testimony was not more hawkish than expected. Thirdly, the Fed is anticipated to raise the interest rate next month, so it is questionable that the traders will overvalue the increase. More likely they will look for further rate hikes. And the last but not least, the greenback is affected by a lot of factors: political and economic, so they will have a huge influence as well.

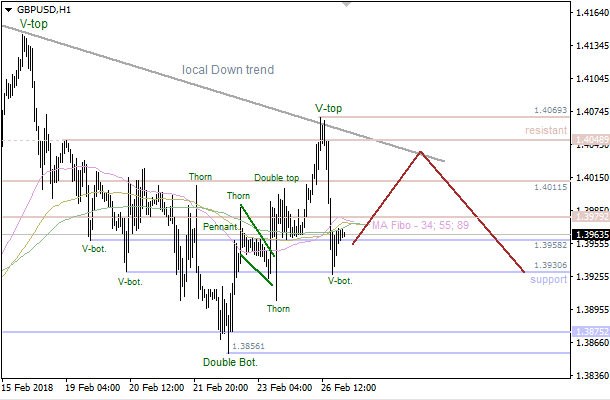

Making a conclusion we can say that the speech of Mr. Powell was expectedly optimistic. However, he did not risk, so did not give any additional comments about the rate hikes. “Further gradual increases” let the dollar recover after this week fall, however, it is still under pressure. More clues on the future monetary policy we can get during Powell’s testifies on Thursday, March 1 at 17:00 MT time.

More:

https://goo.gl/nZMH32