WILL THE EURO CHANGE ITS DIRECTION AFTER THE ITALIAN ELECTIONS?

10:34 06.03.2018

Italian parliamentary elections and German coalition votes started to affect the euro much earlier they were held. And when the German votes’ results could support the single currency, the Italian elections does not portend anything good for it.

The results of Italian votes were announced on Monday and created the environment of uncertainty not only for the euro but for Italy itself. No party or coalition won the majority in the government, so a hung parliament was formed. Moreover, the majority of all votes received the right-wing bloc of parties. The leader in the bloc is the anti-immigrant and euro-skeptic party “League”. A leader of the party Matteo Salvini is ready to leave the European Union and the Eurozone unless Brussels changes the current treatment Italy receives. He wants fewer constraints from the European Union. The anti-establishment Five Star Movement received the largest number of votes as the single party.

Where will Matteo Salvini lead Italy?

Why have these parties got such a huge support?

The answer is clear. Italian citizens are tired of enormous migration and economic problems.

The most crucial woe is poor career prospects. Unemployment is the biggest fear of Italians. Both parties promised to solve this issue, that led to their victory, especially, in the areas where the unemployment rate is incredibly high. Although Italy has the third-biggest economy in the Eurozone, its government debt is quite big. Net national debt is over 120% of GDP. So the Five Star Movement campaigned for a basic income. In addition, right-wing coalition promoted an anti-immigration policy, putting “Italians first”.

How will the results of elections affect the euro?

As we mentioned above, the active parliament has not been formed yet. It creates uncertainty both for Italy and the EU.

The hung parliament means the continuation of the parliament’s formation until one of the coalitions will get the majority. If parties do not back a coalition, Italy will not avoid another election. The period of the formation is unknown as well. So the euro will be under the pressure for the uncertain period that will be depicted by volatility.

More likely, that the euro-skeptic and anti-establishment parties will become the leading force in the government. It will create problems for the European Union, as the Italian economy is the third-biggest economy of the Eurozone after Germany and France. The EU managed to stabilize the economic growth, and now it is aiming to raise interest rates in soon future. It supposed to support the euro. However, if there are misunderstandings with the Italian government, the EU will have difficulties in the future.

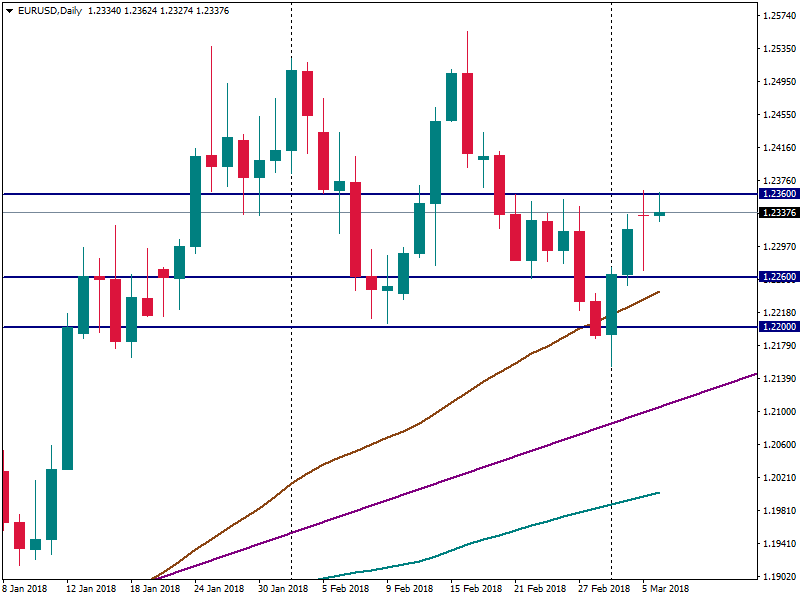

Let’s look at the chart.

On Monday the EUR/USD pair showed big volatility. After the results of the German elections were announced, the single currency climbed to the important level of 1.2360. But the pair could not break the resistance because of the uncertain news from Italy. So the single currency fell to 1.2268. However, the pair closed almost at the level of the opening price.

Today, EUR/USD is climbing to the resistance at 1.2360 and if it manages to break it, there will be a good chance for the euro to move further.

It means that although the Italian elections create uncertainty, currently the euro has chances to recover. If the euro-skeptic parties will get the majority in the government, it will take a long time to solve all issues between the European Union and Italy. However, the euro will stay under the pressure, until all misunderstandings will be solved.

But in the short-term, the euro can be supported by such events as European central bank’s meetings and US data.

To sum up we can say that the Italian parliamentary elections create uncertainty for the euro area in the medium term. Although the euro was not affected too much and still has chances for recovery after the last week falls, it is under the pressure until the government will be finally formed and the issues between Italy and the EU will be solved. Any news on this topic will create volatility of the euro. We recommend you to closely follow the news.

More:

https://goo.gl/ecgMRZ