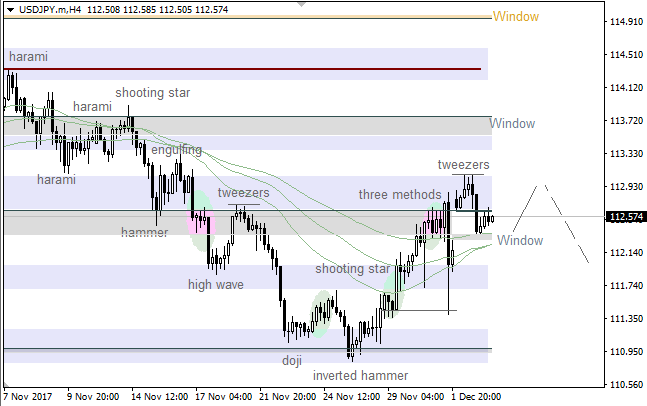

USD/JPY Daily Analytics

08:03 05.12.2017

Technical levels: support – 112.25; resistance – 113.00.

Trade recommendations:

Buy — 112.25; SL — 112.00; TP1 — 113.00; TP2 — 113.50.

Reason: bearish Ichimoku Cloud with horizontal Senkou Span A and B; a golden cross of Tenkan-sen and Kijun-sen, with rising Kijun-sen; the market is in consolidation inside a Cloud and may supported by Tenkan and Kijun.

More:

https://fbs.com/analytics/articles/usd-jpy-dollar-returned-into-cloud-5503

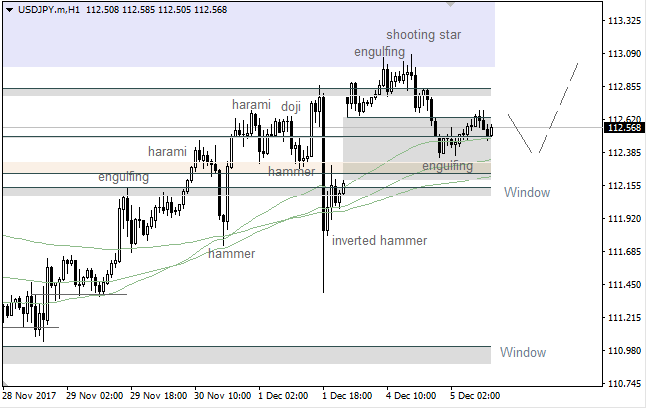

08:03 05.12.2017

Technical levels: support – 112.25; resistance – 113.00.

Trade recommendations:

Buy — 112.25; SL — 112.00; TP1 — 113.00; TP2 — 113.50.

Reason: bearish Ichimoku Cloud with horizontal Senkou Span A and B; a golden cross of Tenkan-sen and Kijun-sen, with rising Kijun-sen; the market is in consolidation inside a Cloud and may supported by Tenkan and Kijun.

More:

https://fbs.com/analytics/articles/usd-jpy-dollar-returned-into-cloud-5503