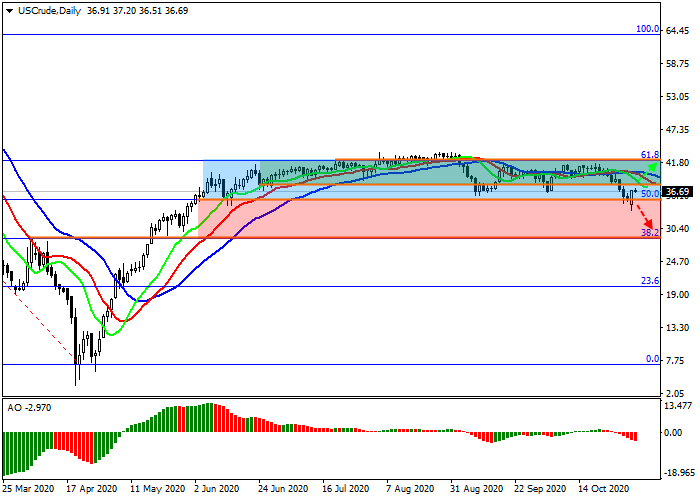

WTI Crude Oil: a new growth wave

Current trend

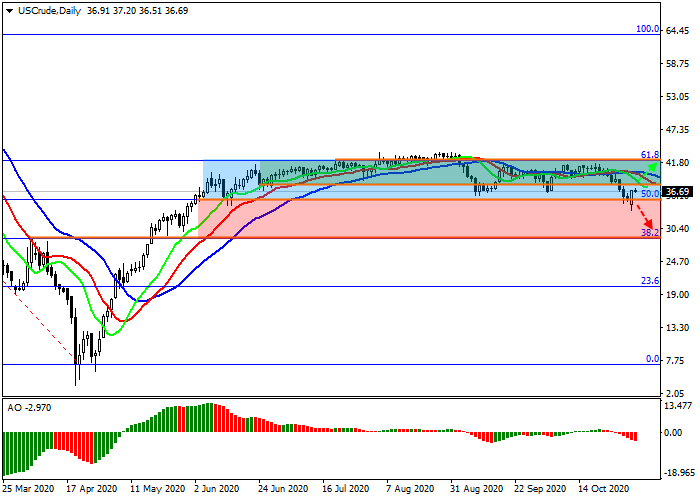

The oil price came to a standstill after a sharp rise, trading near the level of 36.70.

The oil market is at extremely low levels, and traders’ hopes were focused on the new parameters of the OPEC+ deal, which assumed an increase in production volumes from the beginning of 2021 in proportion to the increase in demand. However, demand is declining more and more, so only new reductions are being discussed.

On Friday, OPEC published production levels in its member countries. As the data showed, most countries reduced it according to the last monitoring committee meeting’s plan, and growth is observed only in Libya, which is also expected. The volume of production there amounted to 0.16 million against 0.11 million earlier. The largest reduction was achieved in the UAE, where production is 2.53 million barrels per day against 2.71 million earlier. Saudi Arabia also slightly increased production, where it is 8.96 million barrels per day against the background of 8.89 million a month earlier.

Support and resistance

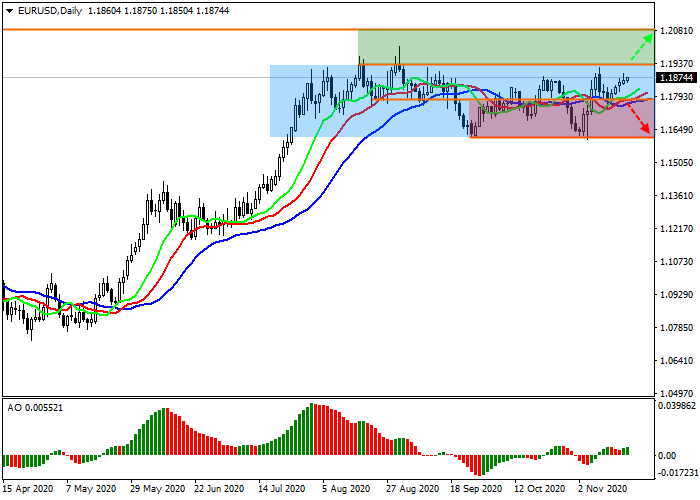

The corrective movement continues within the global sideways channel, within which the price forms a new growth wave. Technical indicators remain in a sell signal state. Alligator indicator’s EMA fluctuations range begins to narrow, and the histogram of the AO oscillator moves in the negative zone.

Resistance levels: 37.90, 42.00.

Support levels: 34.20, 28.70.

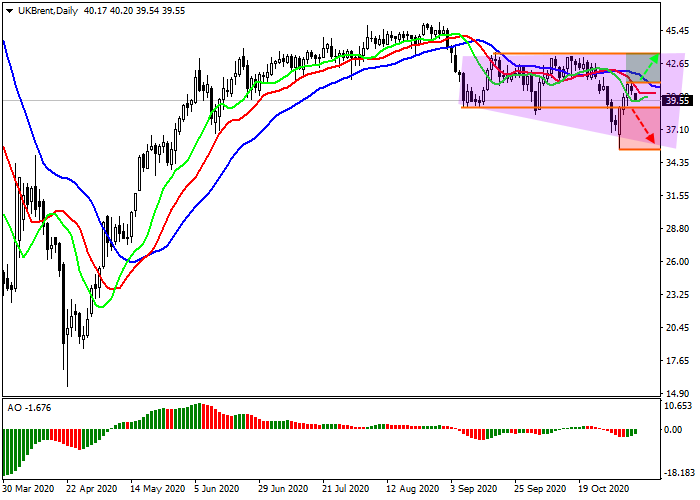

Current trend

The oil price came to a standstill after a sharp rise, trading near the level of 36.70.

The oil market is at extremely low levels, and traders’ hopes were focused on the new parameters of the OPEC+ deal, which assumed an increase in production volumes from the beginning of 2021 in proportion to the increase in demand. However, demand is declining more and more, so only new reductions are being discussed.

On Friday, OPEC published production levels in its member countries. As the data showed, most countries reduced it according to the last monitoring committee meeting’s plan, and growth is observed only in Libya, which is also expected. The volume of production there amounted to 0.16 million against 0.11 million earlier. The largest reduction was achieved in the UAE, where production is 2.53 million barrels per day against 2.71 million earlier. Saudi Arabia also slightly increased production, where it is 8.96 million barrels per day against the background of 8.89 million a month earlier.

Support and resistance

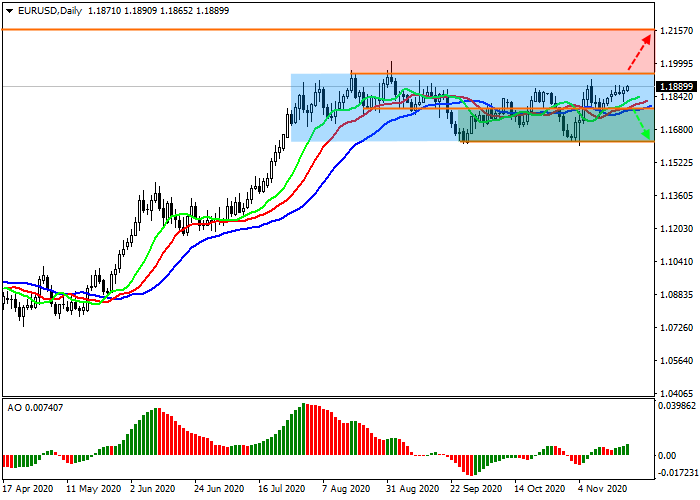

The corrective movement continues within the global sideways channel, within which the price forms a new growth wave. Technical indicators remain in a sell signal state. Alligator indicator’s EMA fluctuations range begins to narrow, and the histogram of the AO oscillator moves in the negative zone.

Resistance levels: 37.90, 42.00.

Support levels: 34.20, 28.70.