Morning Market Review

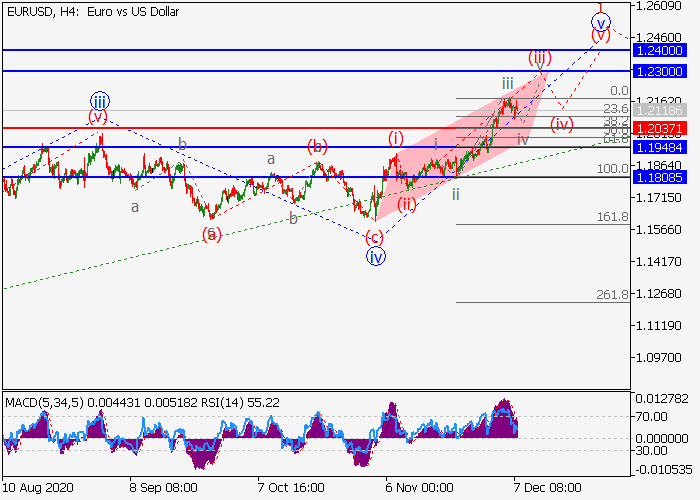

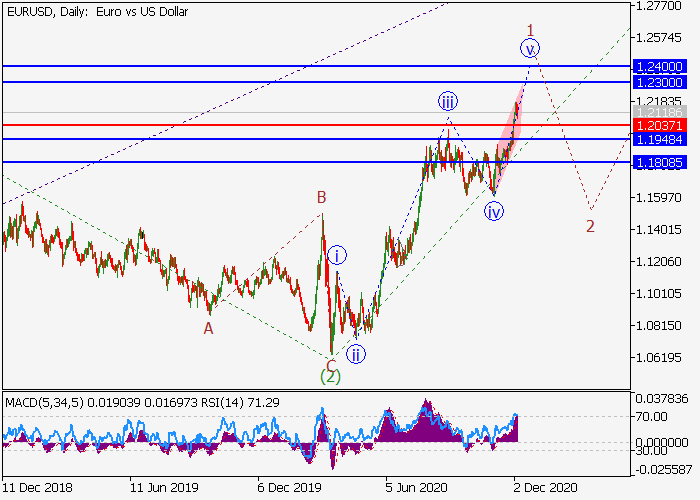

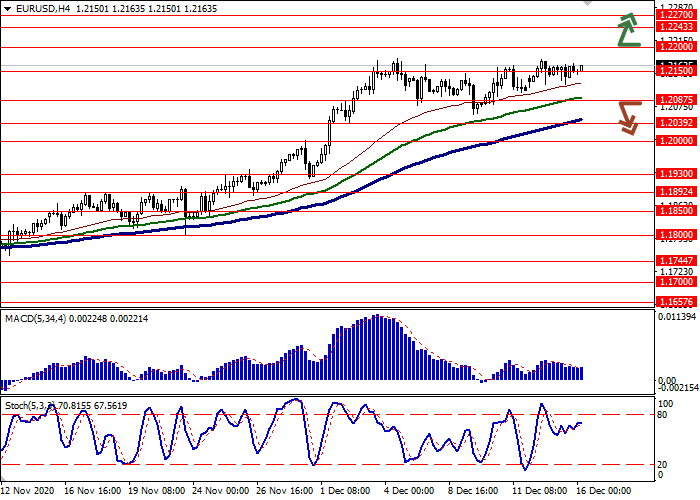

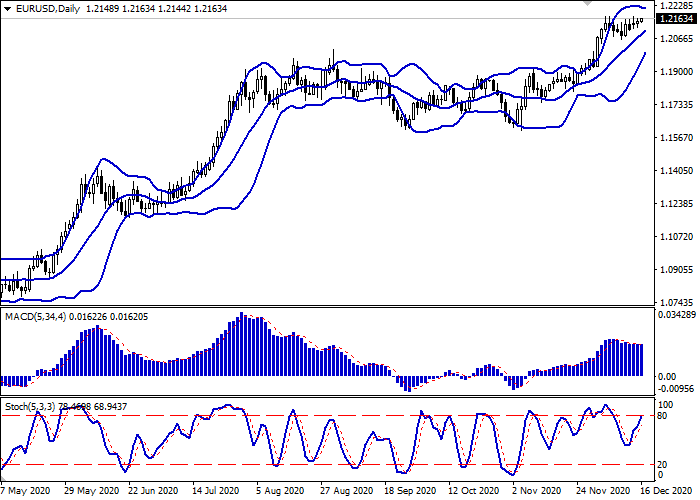

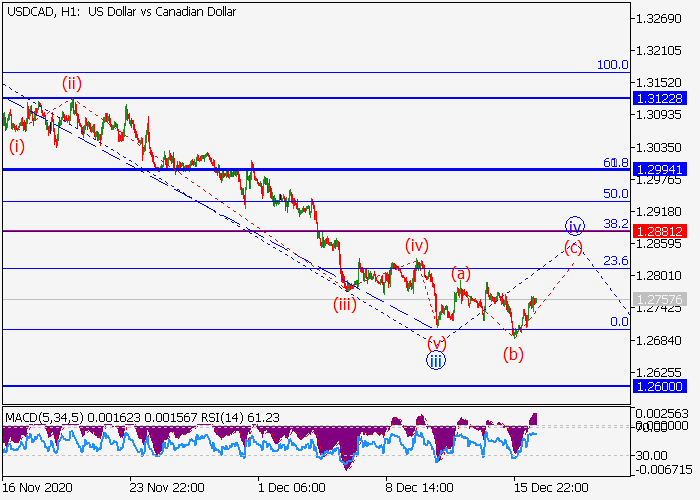

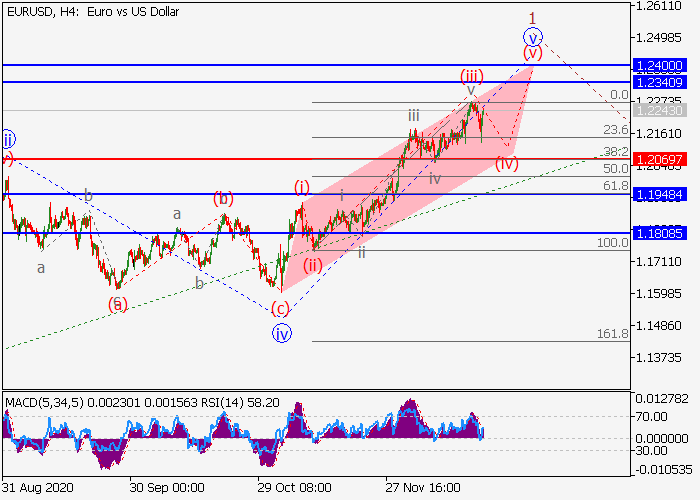

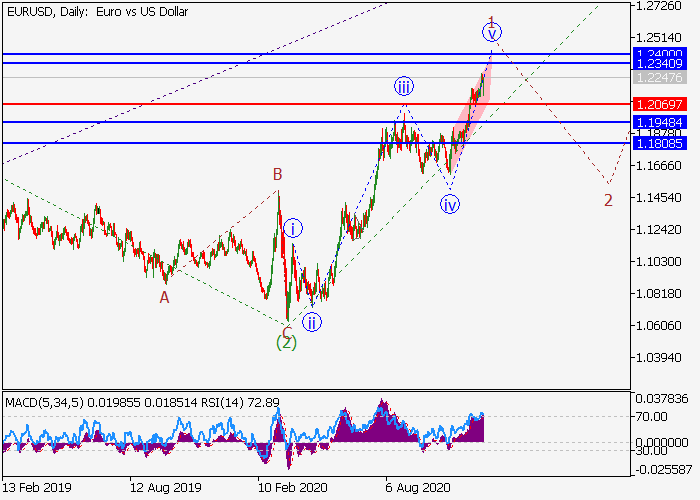

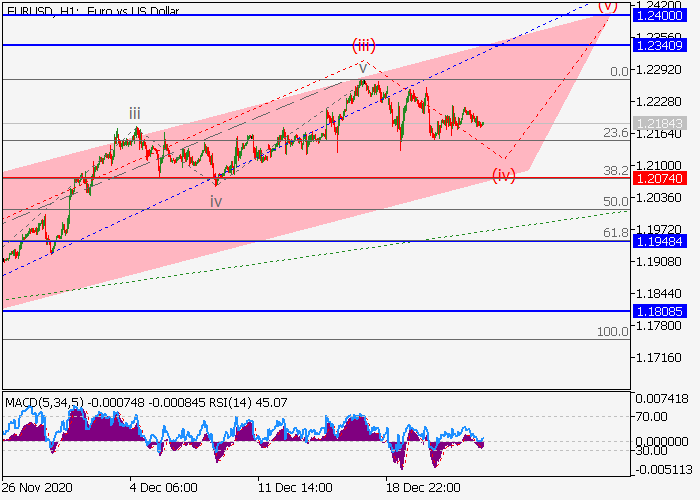

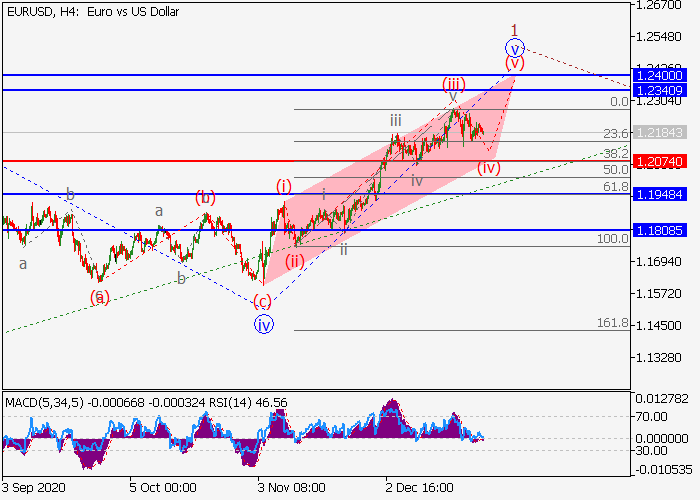

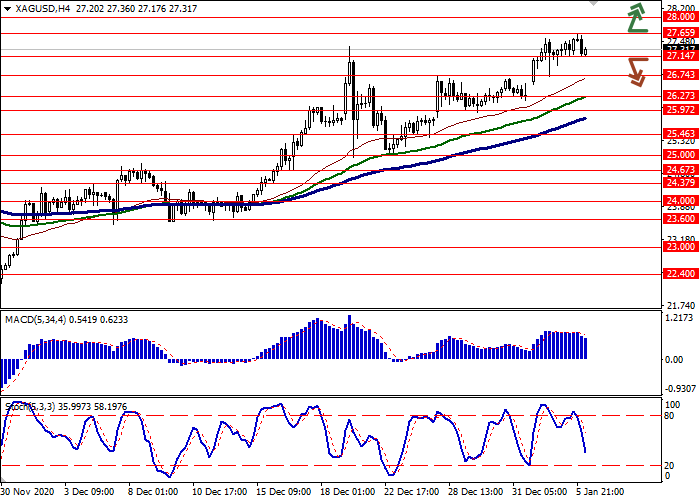

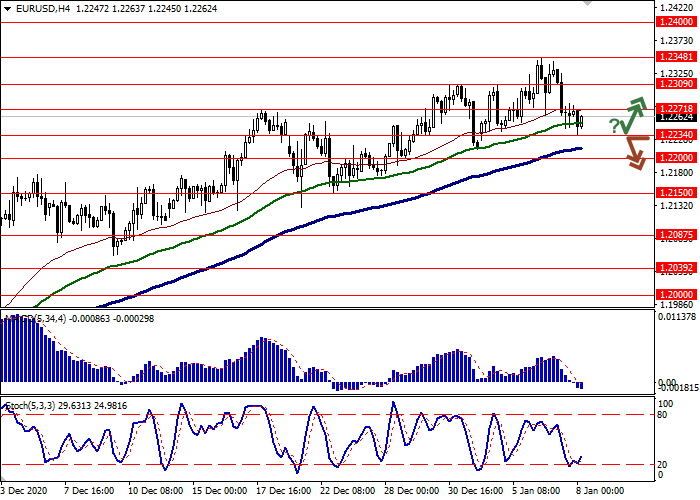

EUR/USD

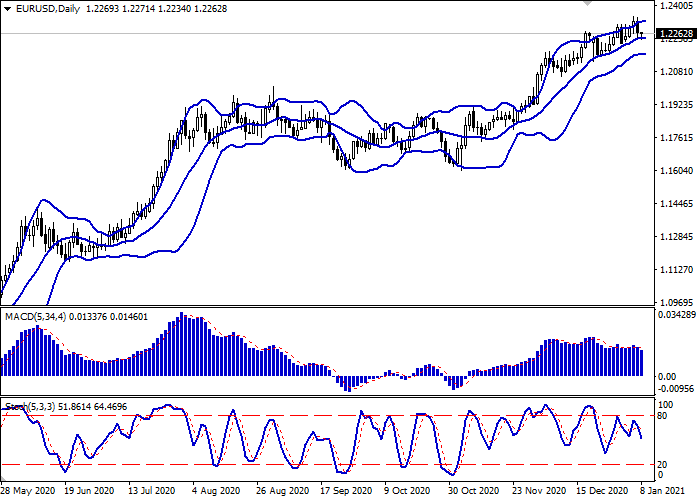

EUR shows flat dynamics of trading against USD during today's Asian session, consolidating after an active decline of the instrument last Friday. EUR ended the session on December 4 in the red, responding to technical factors, while USD remained under pressure after the publication of weak data on employment in the country. The November labor market report reflected an increase in Nonfarm Payrolls by only 245K after an increase of 610K in October. Investors expected a slowdown in the dynamics of the indicator, but hoped for 469K new jobs. At the same time, the Unemployment Rate fell from 6.9% to 6.7%, and Average Hourly Earnings in November increased from +0.1% MoM to +0.3% MoM, which also turned out to be better than the neutral market forecasts. Today, traders expect publication of data on industrial production in Germany for October. Interesting statistics from the US will appear only on Thursday, and before that investors will actively discuss the prospects for further easing of monetary policy from the Fed in the light of the published report on the US labor market.

GBP/USD

GBP is showing ambiguous trading dynamics against USD in today's Asian session, consolidating near 1.3400. The instrument managed to update record highs since May 2018 last week; however, GBP failed to consolidate at new levels, since the technical factors of the correction were very strong. The trading of the new week starts quite carefully. Some support for GBP is provided by weak data from the US, which appeared at the end of last week, but there are still few fundamental growth factors. It became known on Saturday that the UK and the EU again failed to agree on a trade agreement within the framework of the Brexit transition period, and therefore the negotiators will continue joint meetings this week. Meanwhile, British Prime Minister Boris Johnson and the European Commission President Ursula von der Leyen announced significant progress in the negotiations; however, the market got used to these statements.

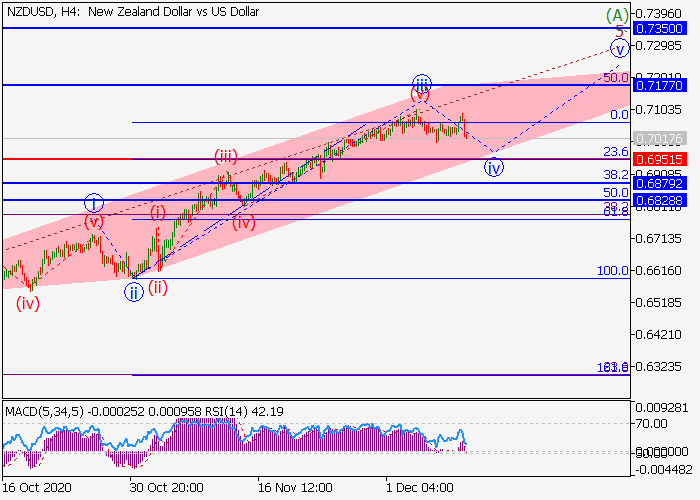

NZD/USD

NZD is trading ambiguously against USD in today's Asian session, preparing to test the level of 0.7000 for a breakdown again. The instrument showed an active decline last Friday, retreating from the record highs, updated the day before. The reason for the development of the "bearish" trend were technical factors, while the long-awaited report on the US labor market, released last Friday, disappointed investors with a slowdown in the growth of Nonfarm Payrolls (+245K against +610K in October). The Chinese statistics provide moderate support to the instrument today. China's Exports in November showed an impressive 21.1% YoY growth after rising only by 11.4% YoY in October. Forecasts suggested an increase of 12% YoY only. Imports over the same period, on the contrary, slowed down from +4.7% YoY to +4.5% YoY, which led to a noticeable increase in the trade surplus from USD 58.44B to 75.42B, which is significantly ahead of forecasts investors at USD 53.5B.

USD/JPY

USD is trading with a downtrend against JPY during today's Asian session, leveling the growth of the instrument last Friday, when the "bulls" still managed to recover, despite the publication of not very successful macroeconomic statistics from the US. At the beginning of the week, investors are returning to strategies that are still characterized by high demand for "safe" assets, given the tense epidemiological situation in the world. Japanese investors expect the publication of statistics from Japan tomorrow. Among other things, traders will be interested in the updated data on the dynamics of Japan's GDP for Q3 2020. In addition, Japan will release the dynamics of changes in Labor Cash Earnings and Household Spending for October.

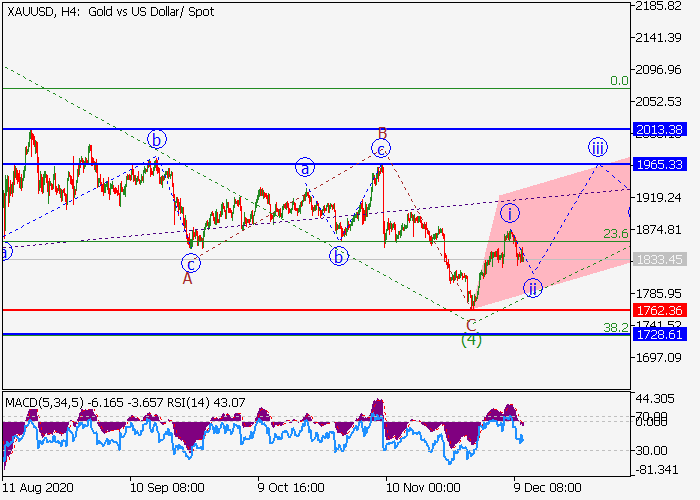

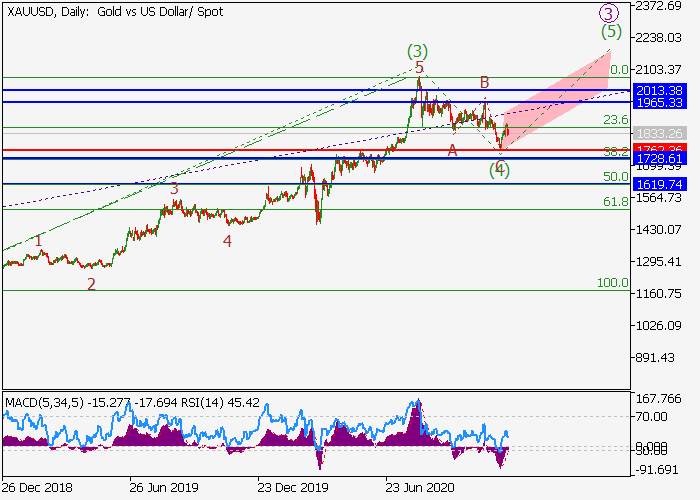

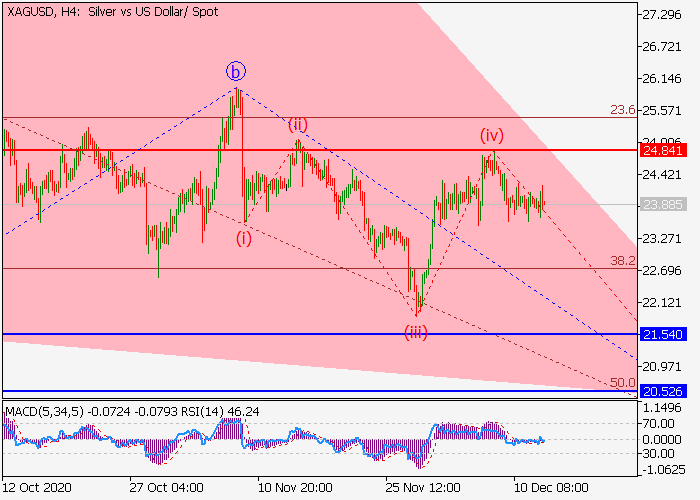

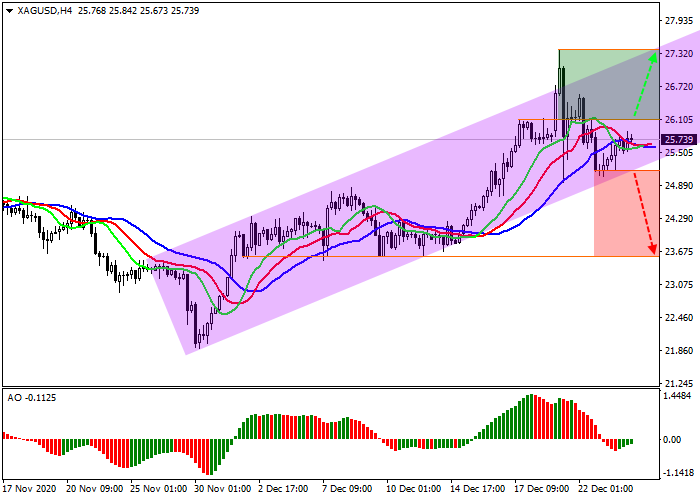

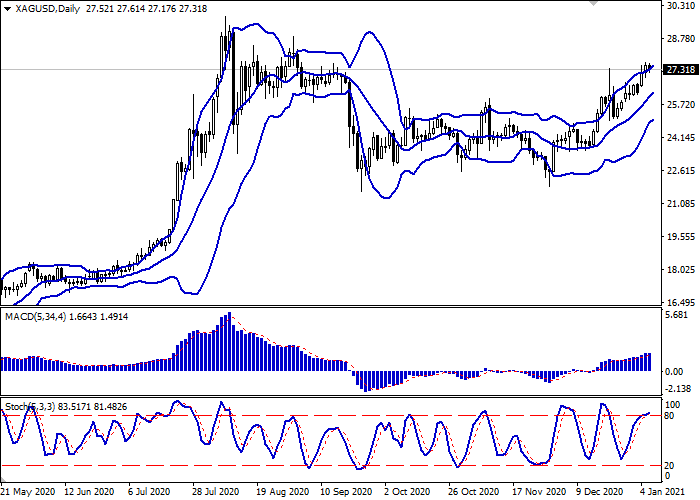

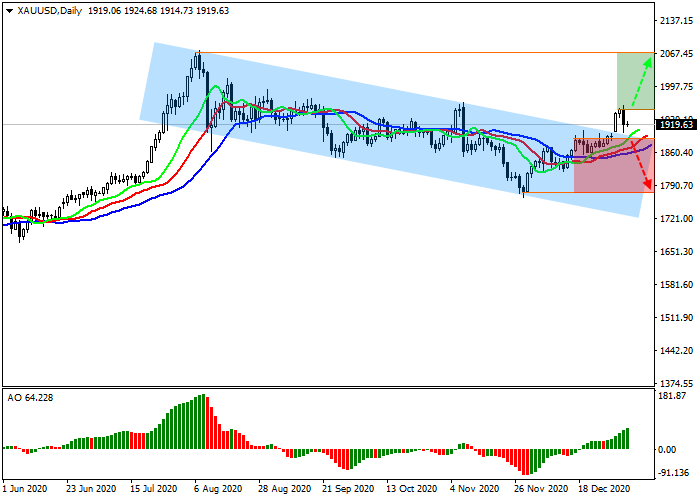

XAU/USD

Gold prices are consolidating in today's Asian session, being located near the level of 1840.00 and local highs since November 23, updated at the end of the last trading week. Technical factors contributed to the decline in the instrument last Friday, while fundamentally USD remains under pressure after the publication of an uncertain report on the US labor market for November and in anticipation of new support measures for the American economy. In turn, the optimistic news regarding the development of vaccines against the coronavirus makes traders keep some of the risky positions, and the stock market is kept near record highs. Since December 7, Great Britain is one of the first in the world to begin a large-scale vaccination of the population (starting with risk groups) with a vaccine from Pfizer and BioNTech.