FxGrow Daily Technical Analysis – 07th Oct, 2016

By FxGrow Research & Analysis Team

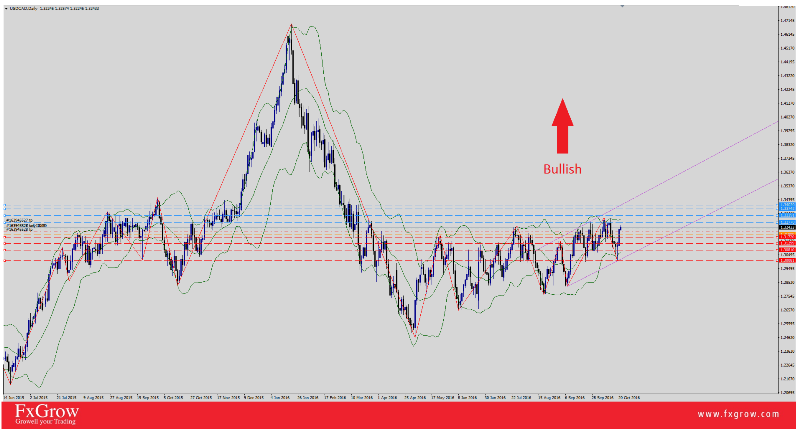

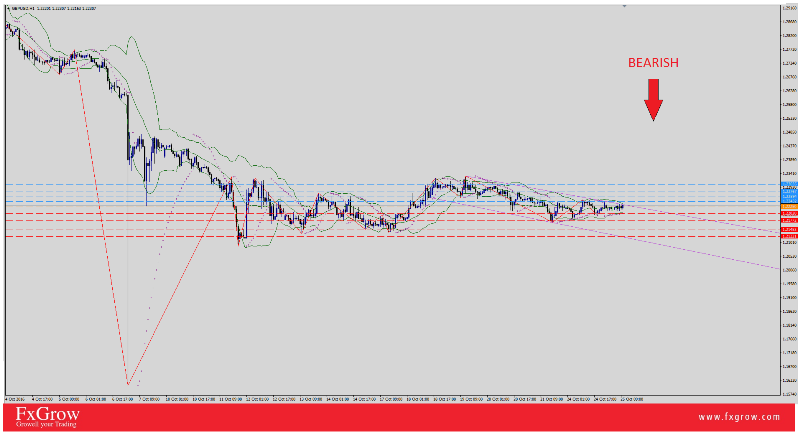

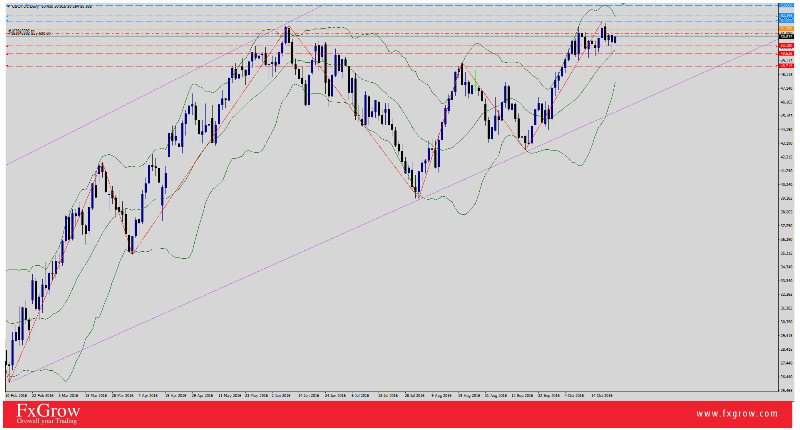

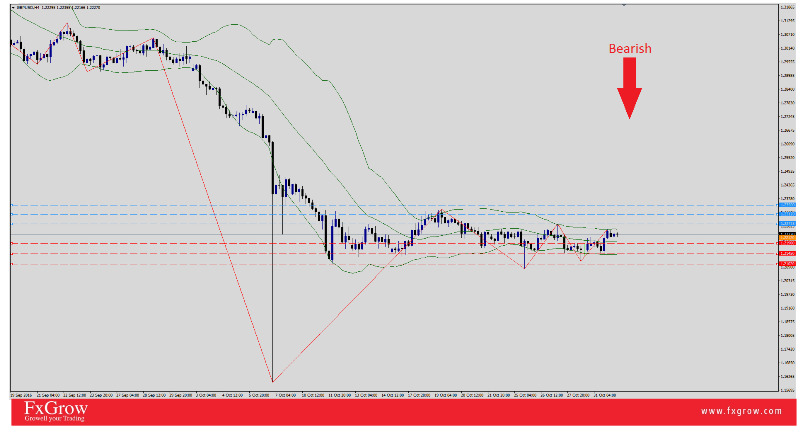

U.S DOLLAR EXTENDS MARKET DOMINATION STILL, SENDING USD/CAD TO 1.3252 HIGH

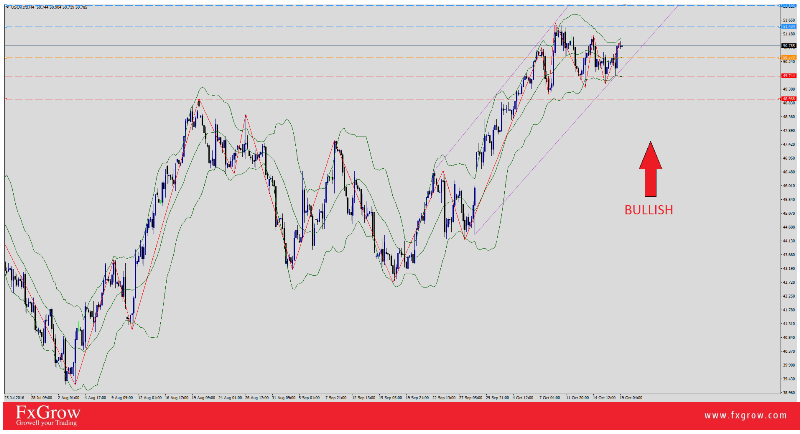

The greenback keeps a tight fist on the Canadian dollar for the 7th consecutive day pushing USD/CAD close to a new high since 24th march. USD/CAD opened in Asian session with a continuous bullish rise rallying from 1.3213 to 1.3263 high . Weak Crude oil inventories was not enough to interfere in USD/CAD bullish trend given that local Canadian economic data beats expectations. Right now, USD/CAD is trading at 1.3256 intraday and all eyes today first on Canadian Employment change and Unemployment rate, next U.S NFP and unemployment rate. This will create a battle between U.S and Canadian Dollar to decide which trend will take on.

Trend: Bullish

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...alysis-fxgrow-free-forex-analysis-tools#close

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

By FxGrow Research & Analysis Team

U.S DOLLAR EXTENDS MARKET DOMINATION STILL, SENDING USD/CAD TO 1.3252 HIGH

The greenback keeps a tight fist on the Canadian dollar for the 7th consecutive day pushing USD/CAD close to a new high since 24th march. USD/CAD opened in Asian session with a continuous bullish rise rallying from 1.3213 to 1.3263 high . Weak Crude oil inventories was not enough to interfere in USD/CAD bullish trend given that local Canadian economic data beats expectations. Right now, USD/CAD is trading at 1.3256 intraday and all eyes today first on Canadian Employment change and Unemployment rate, next U.S NFP and unemployment rate. This will create a battle between U.S and Canadian Dollar to decide which trend will take on.

Trend: Bullish

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...alysis-fxgrow-free-forex-analysis-tools#close

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.