FxGrow Daily Technical Analysis – 22nd Nov, 2016

By FxGrow Research & Analysis Team

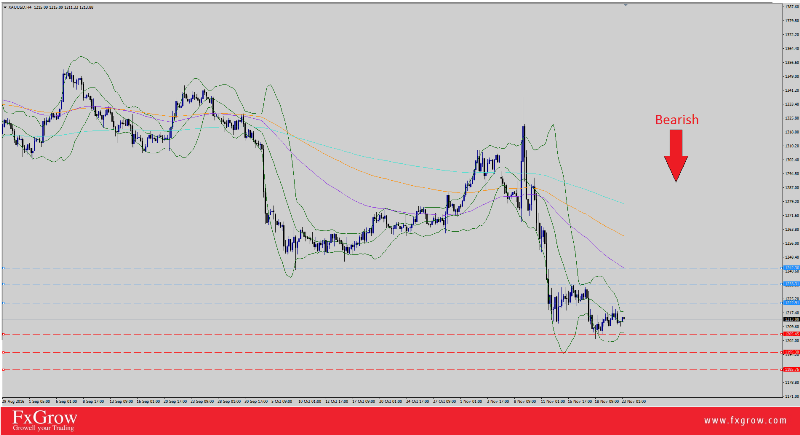

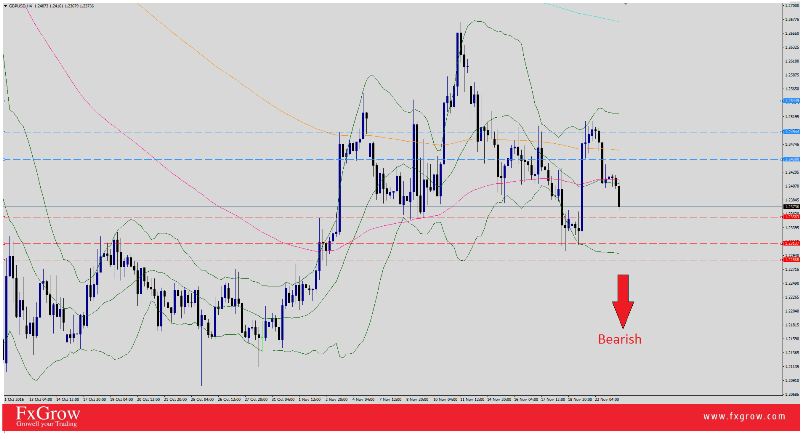

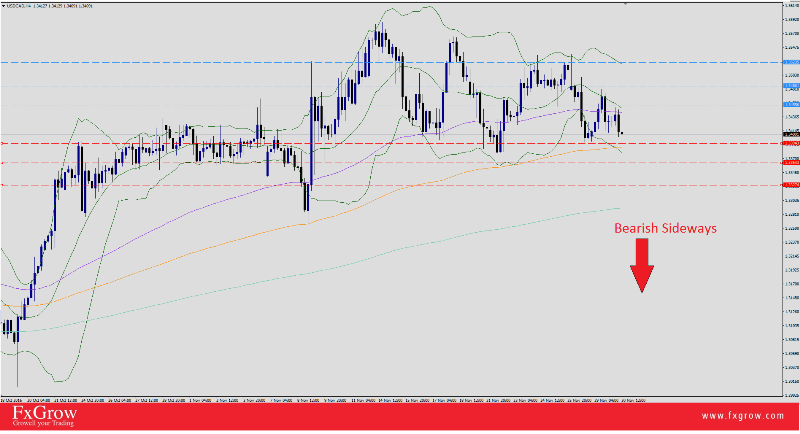

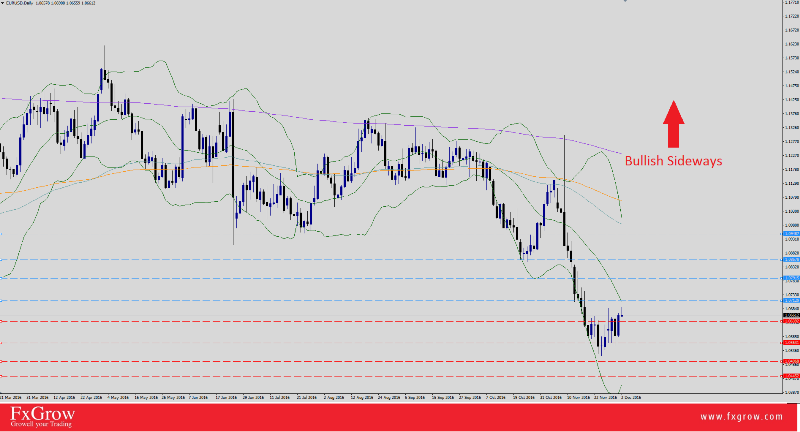

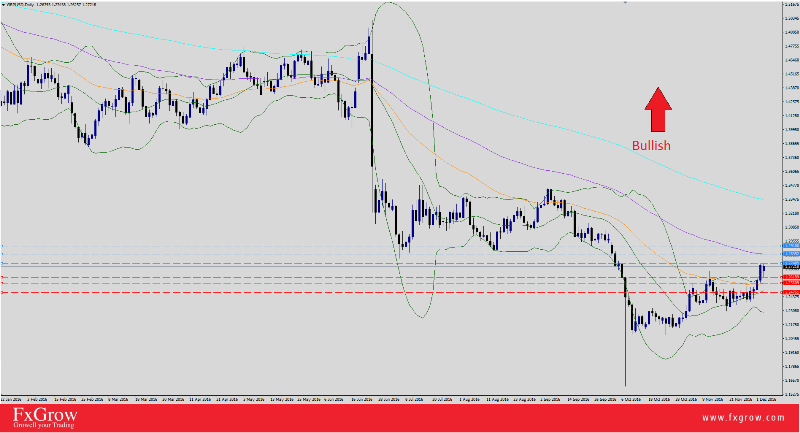

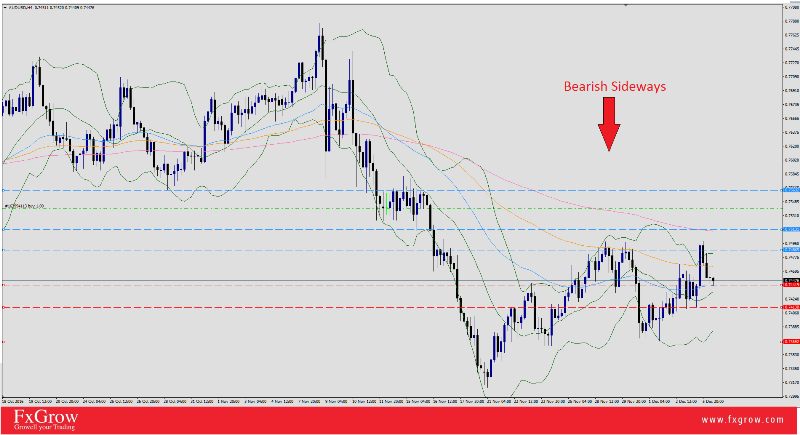

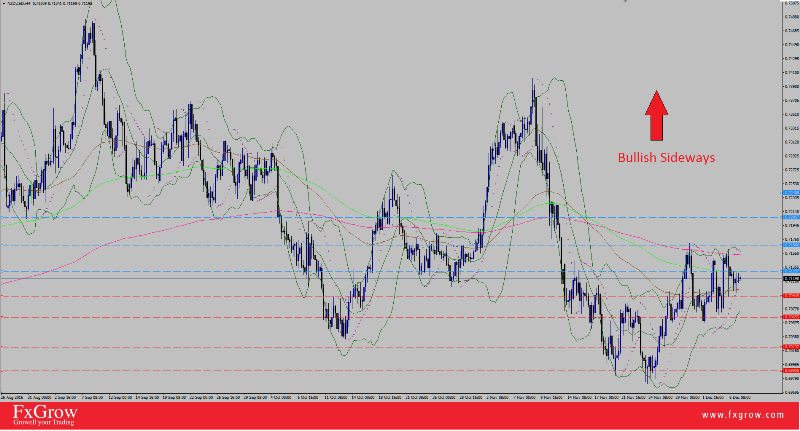

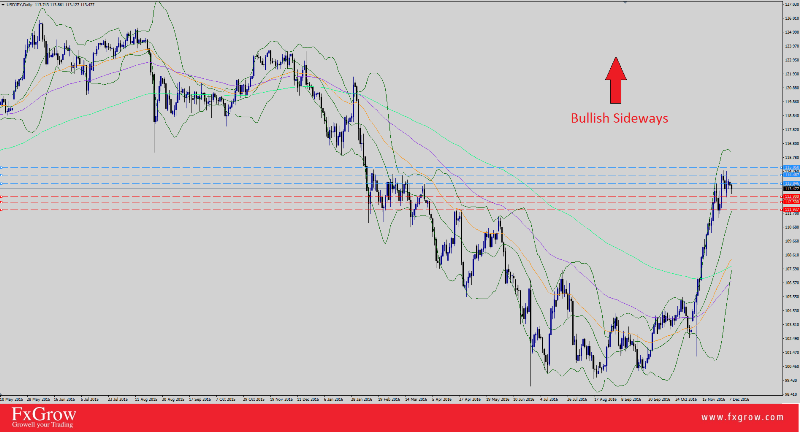

USD/CAD Plunges Ahead of Canadian Retail Sales Data

The Canadian Dollar managed to stay ahead of its south neighbor although Canadian wholesales data scored a negative of -1.2% yesterday. USD/CAD extended bearish mood yesterday taking advantage of weaker US dollar index dropping 100.81 after being on to at 101.51. Add to that, a surge in oil prices at a 48.96 monthly fresh high, boosted the Canadian dollar to score against the greenback. In early trading sessions, the pair sank to 1.3396 low, but failed to sustain the 1.33 level, touched 50 SMA at 1.3428, then marched to 1.3433 high, currently trading at 1.3410 intraday. Today, USD/CAD awaits Canadian Retail Sales data, which in case, came to the favor of Canadian dollar, and taking into consideration the hikes in oil prices on optimism of OPEC-cut-deal, the market might witness a new lows for the pair this November.

Trend : Bearish sideways

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-education/fxgrow-academia/fxgrow-blog

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

By FxGrow Research & Analysis Team

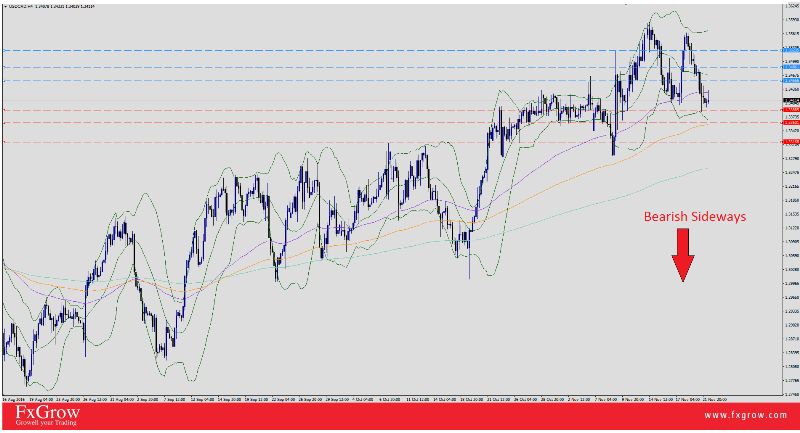

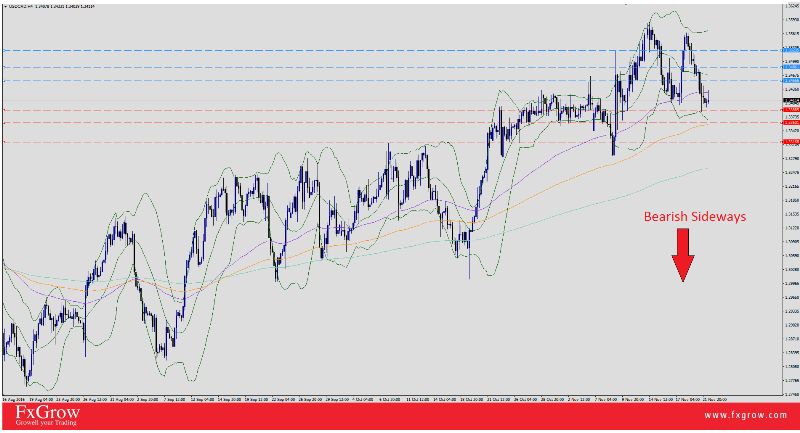

USD/CAD Plunges Ahead of Canadian Retail Sales Data

The Canadian Dollar managed to stay ahead of its south neighbor although Canadian wholesales data scored a negative of -1.2% yesterday. USD/CAD extended bearish mood yesterday taking advantage of weaker US dollar index dropping 100.81 after being on to at 101.51. Add to that, a surge in oil prices at a 48.96 monthly fresh high, boosted the Canadian dollar to score against the greenback. In early trading sessions, the pair sank to 1.3396 low, but failed to sustain the 1.33 level, touched 50 SMA at 1.3428, then marched to 1.3433 high, currently trading at 1.3410 intraday. Today, USD/CAD awaits Canadian Retail Sales data, which in case, came to the favor of Canadian dollar, and taking into consideration the hikes in oil prices on optimism of OPEC-cut-deal, the market might witness a new lows for the pair this November.

Trend : Bearish sideways

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-education/fxgrow-academia/fxgrow-blog

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.