FxGrow Daily Technical Analysis – 02nd Sept, 2016

By FxGrow Research & Analysis Team

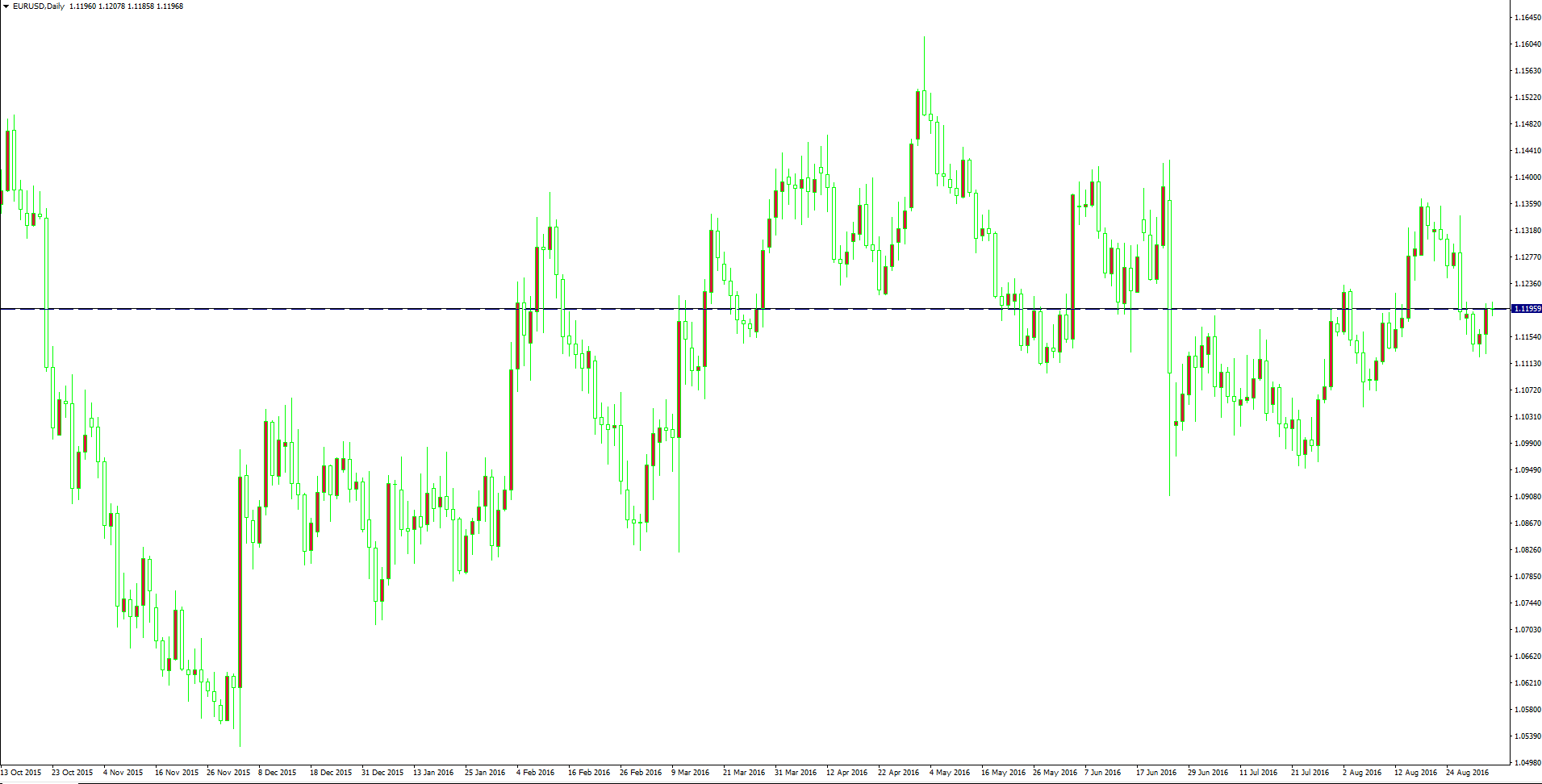

The EURUSD rose ahead of US payroll

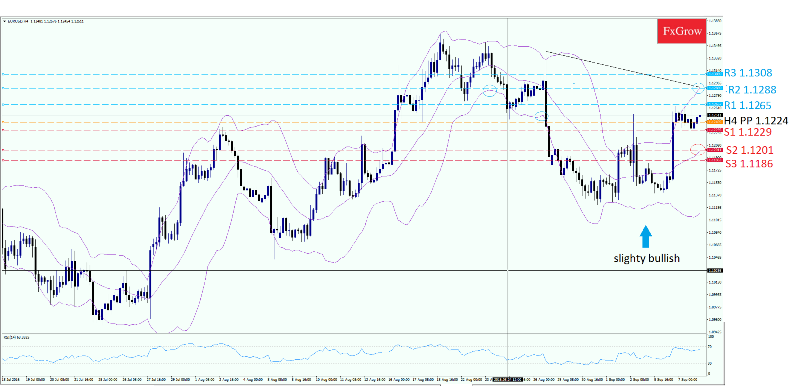

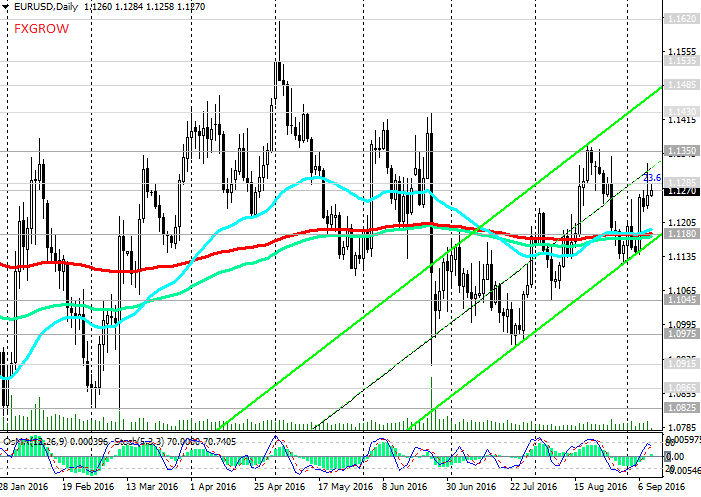

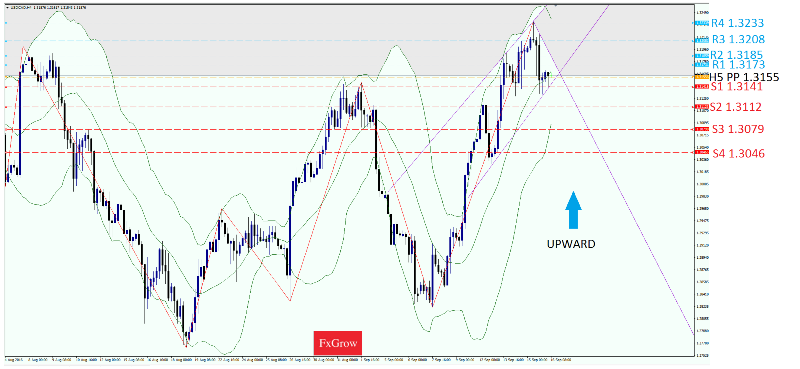

The EURUSD turned higher and traded at 1.1208 high this morning above the 23.6% Fibonacci Expansion ahead of US employment change report. Weak US payroll today will open the door for euro fresh rebounds especially as it breaks the 100 days moving average 1.1215 to pave its way toward 1.1237 and 1.1266.

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...alysis-fxgrow-free-forex-analysis-tools#close

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

By FxGrow Research & Analysis Team

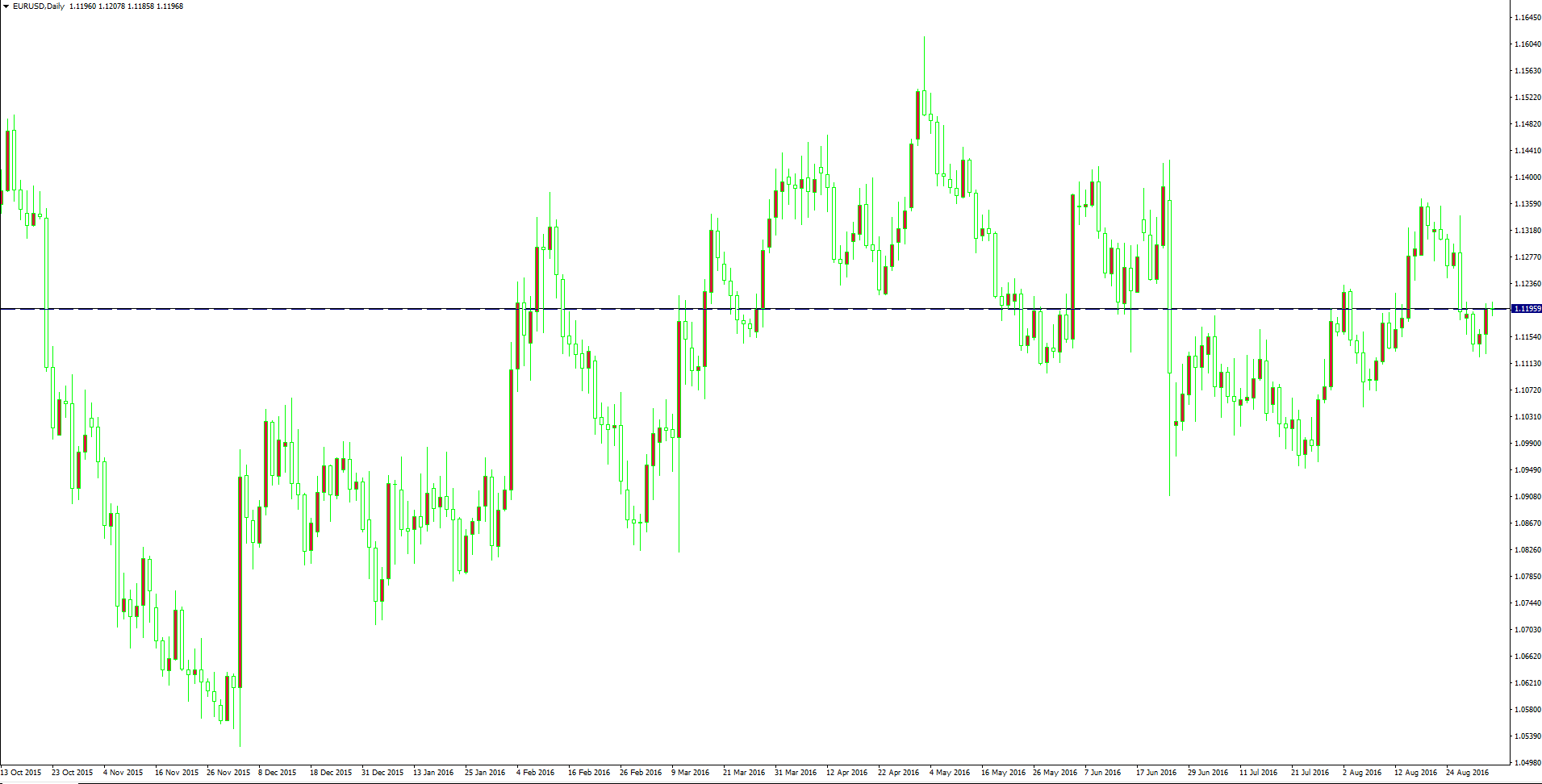

The EURUSD rose ahead of US payroll

The EURUSD turned higher and traded at 1.1208 high this morning above the 23.6% Fibonacci Expansion ahead of US employment change report. Weak US payroll today will open the door for euro fresh rebounds especially as it breaks the 100 days moving average 1.1215 to pave its way toward 1.1237 and 1.1266.

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...alysis-fxgrow-free-forex-analysis-tools#close

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.