Julia NordFX

Broker Representative

GENERALIZED FOREX FORECAST FOR 8-12 DECEMBER 2014

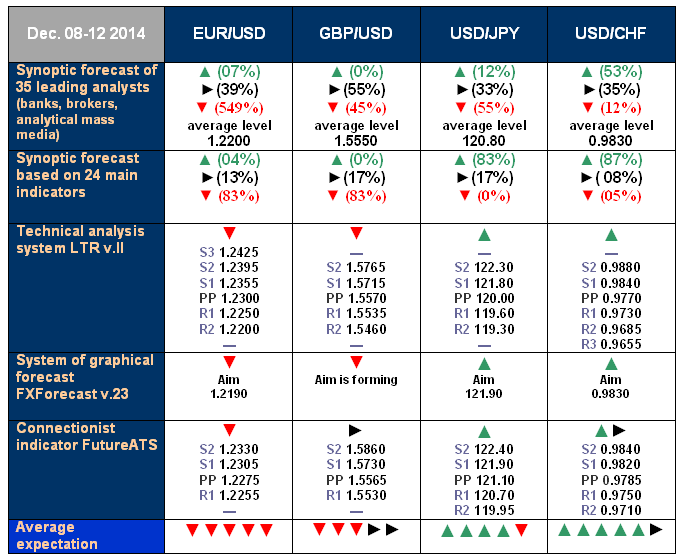

Generalizing in a table the opinions of 35 analysts from world leading banks and broker companies as well as forecasts based on most different methods of technical and graphical analysis, the following can be predicted:

- 8-12 December, the EUR/USD pair will fall further by approximately 100 points to 1.2200. However, it’s quite possible that this may take up to two weeks. Theresistance levelisexpectedtobe1.2375;

- GBP/USD is expected to have a sideways trend with a slight fall to 1.5550 approximately;

- as for the USD/JPY pair, experts continue to wait for the rebound downwards, although now to the level of 120.80. At the same time, the indicators point strictly upwards to the 122.00 mark. So, most probably the pair will be fluctuating in the range of 120.80-122.00;

- the USD/CHF pair is unanimously predicted to rise to the level of April 2013, i.e. from 0.9830 to 0.9850.

As for last week’s forecast:

- there was high probability that EUR/USDwould fall to 1.2350, which, in fact, happened already on Wednesday. The pair spent the rest of the week in a sideways trend, still demonstrating a downward tendency;

- the forecast for GBP/USD was a sideways trend in the corridor of 1.5580-1.5675 with quite strong bearish pressure. The outlook was fully confirmed, and the pair spent the last day of the week between 1.5570 and 1.5690;

- throughout the start of the week, the USD/JPY pair was fulfilling the forecast aiming for the 119.15 mark. Further on, however, instead of the predicted rebound, a sharp breakthrough upwards occurred, and the pair ended Friday at 121.45;

- finally, the USD/CHF pair fully justified the expectations by reaching the promised level of 0.9800. The support level of 0.9620 was also predicted correctly – by rebounding from this bottom level, the pair shot upwards.

Roman Butko, NordFX

Generalizing in a table the opinions of 35 analysts from world leading banks and broker companies as well as forecasts based on most different methods of technical and graphical analysis, the following can be predicted:

- 8-12 December, the EUR/USD pair will fall further by approximately 100 points to 1.2200. However, it’s quite possible that this may take up to two weeks. Theresistance levelisexpectedtobe1.2375;

- GBP/USD is expected to have a sideways trend with a slight fall to 1.5550 approximately;

- as for the USD/JPY pair, experts continue to wait for the rebound downwards, although now to the level of 120.80. At the same time, the indicators point strictly upwards to the 122.00 mark. So, most probably the pair will be fluctuating in the range of 120.80-122.00;

- the USD/CHF pair is unanimously predicted to rise to the level of April 2013, i.e. from 0.9830 to 0.9850.

As for last week’s forecast:

- there was high probability that EUR/USDwould fall to 1.2350, which, in fact, happened already on Wednesday. The pair spent the rest of the week in a sideways trend, still demonstrating a downward tendency;

- the forecast for GBP/USD was a sideways trend in the corridor of 1.5580-1.5675 with quite strong bearish pressure. The outlook was fully confirmed, and the pair spent the last day of the week between 1.5570 and 1.5690;

- throughout the start of the week, the USD/JPY pair was fulfilling the forecast aiming for the 119.15 mark. Further on, however, instead of the predicted rebound, a sharp breakthrough upwards occurred, and the pair ended Friday at 121.45;

- finally, the USD/CHF pair fully justified the expectations by reaching the promised level of 0.9800. The support level of 0.9620 was also predicted correctly – by rebounding from this bottom level, the pair shot upwards.

Roman Butko, NordFX