APRIL OUTLOOK ON THE FX MARKET

15:06 05.04.2018

Trade wars tensions are creating a high volatility in the FX market. Risk-on and risk-off sentiments make currencies rise and fall. However, not only trade wars affect the market. There are a lot of events that will support and weight on currencies this month.

We offer you a short outlook on April events.

USD

US steel and aluminum tariffs exacerbate further what are already tense ties between markets. The US tariffs met retaliations from other countries. For example, China enacted charges on 128 US goods. As a result, tensions between two largest world’s economies put pressure not only on the US dollar and Chinese yuan but also on the Australian dollar, Canadian dollar and Japanese yen.

The US dollar had been suffering from volatility for the previous month.

Besides trade wars issue, NAFTA negotiations were a driver of the greenback’s movement.

According to talks, Mr. Trump plans to agree on a previous version of the new NAFTA agreement to the middle of April. If negotiations are successful, it will support not only the greenback but Canadian dollar too. Pay attention to the Eighth Summit of the Americas that will be held on April 13 and 14, 2018. There is a high possibility that NAFTA parties will discuss the agreement there.

As you know, the Fed raised an interest rate in March. To assess a result of that decision, investors will look at inflation data (CPI m/m and Core CPI m/m on April 11 at 15:30 MT time). The Fed is anticipated to lift the interest rate at least 2 times this year, so the CPI figures will display if there is any reason to increase it to 3 times.

JPY

In March Haruhiko Kuroda was reappointed as the BOJ Governor. Mr. Kuroda is famous for his dovish policy. As a natural result, the Bank of Japan is anticipated to keep an interest rate on hold, that puts pressure on the yen.

Last month the USD/JPY pair fell to 104.625, so the yen reached new highs that is not good for the Japanese economy. Tankan manufacturing index and non-manufacturing index data appeared to be weaker for the first time in two years. Large Japanese manufacturers displayed a concern because of the strong yen as it negatively affects manufacturers.

An important event for this month is the BOJ policy rate on April 27. The possibility of the rate hike is still low as firstly the central bank has to taper its quantitative easing policy. However, the Governor may give some clues on the future monetary policy.

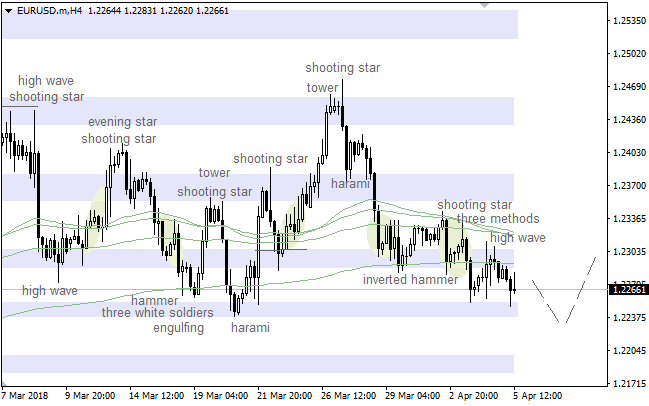

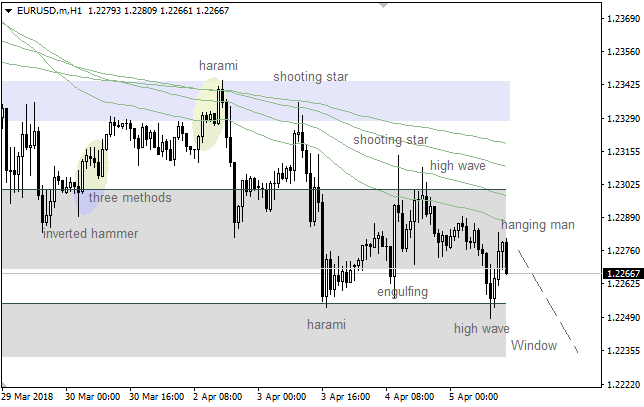

EUR

Trade wars covered not only Chinese and American economies but the European as well. After Trump’s move, the European Union claimed that it is going to impose 25% tariffs on $3.5 billion of American goods. So the previous month was risky for the euro.

The beginning of a new quarter appeared to be difficult for the European currency as well.

The European central bank has hinted on the soon quantitative easing tapering. Let’s look at the interest rate announcement on April 26 at 14:45 MT time. Mario Draghi may give prompts on the monetary policy.

GBP

The pound is showing good results. The UK currency managed to rise based on the positive economic data. However, March was not easy for the currency. Its rate highly depended on the Brexit negotiations. This month will not be an exclusion. If parties find areas of common interest, talks could start.

AUD

In March the Australian dollar plunged to the level of December 2017. The beginning of April is quite positive for the aussie but as you know, a positive trend cannot continue forever. Rate hikes always support domestic currencies. However, as we know the Reserve Bank of Australia does not plan to raise the interest rate until the end of 2018 that can have a negative impact on the aussie.

The RBA explains its decision at the meeting minutes. Follow monetary policy meeting minutes on April 17 at16:30 MT time.

Moreover, the Australian inflation is still below its target of 2-3%. Let’s look at the CPI q/q on April 24 at 4:30 MT time.

NZD

The New Zealand dollar tightly correlated with the US dollar and the Australian dollar.

The second quarter of this year began on a positive note for the New Zealand dollar. This month we do not anticipate a lot of crucial data from New Zealand. However, to predict the kiwi’s direction, you should pay attention to the US economic data. Moreover, follow trade wars news to predict the kiwi’s movement.

CAD

The environment of uncertainty around NAFTA negotiations affected the Canadian dollar. Canada was excluded from the US tariffs, however, it could not prevent the loonie from volatility. If NAFTA’s parties hammer out a deal this month, trade wars tensions will decline, the Canadian dollar will be able to rise.

Canada is one of the top oil producers in the world. So the loonie highly depends on the oil prices. When oil prices go up, the Canadian dollar rises. The OPEC and its allies are trying to control the oil output, however, US crude oil inventories put pressure on the oil market. As soon as the amount of US producers rise, the oil prices decline. The continuation of such rise will negatively affect the market and the Canadian dollar too.

There is a low chance that the Bank of Canada will increase the interest rate this month, however, Governor’s comments are highly important. Look at the BOC monetary policy report at 17:00 MT time on April 18.

Making a conclusion, we highly recommend you to follow the trade wars news to get ideas of the general currencies movement. Furthermore, do not forget about economic data that are crucial for your fundamental analysis.

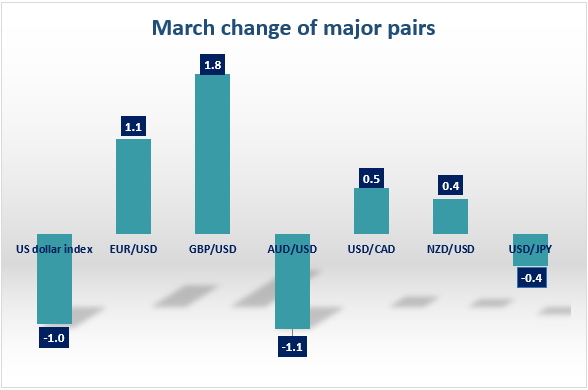

Extra: monthly change of the major currency pairs

More:

https://tinyurl.com/ybjr73ma