Date: 22nd January 2024.

Economic Indicators & Central Banks:

Market Trends:

Financial Markets Performance:

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

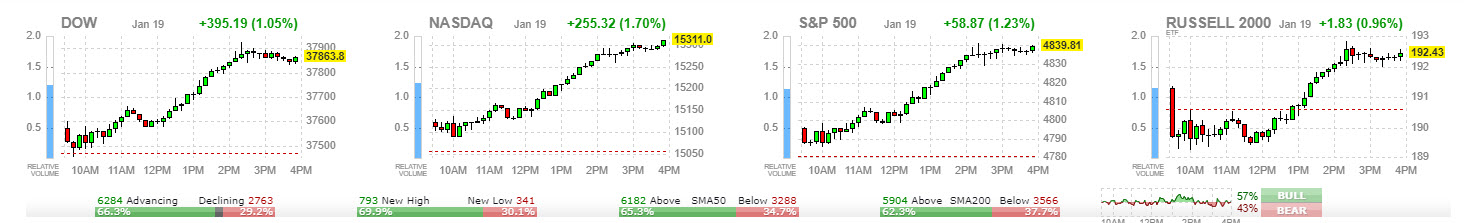

Market Recap: Stocks extend rally.

Economic Indicators & Central Banks:

- China’s lending rates remain unchanged. That followed the PBOC’s decision to maintain borrowing costs earlier this month, which was another disappointment that did little to boost Chinese stock markets.

- Recent data showing resilient US economic activity has caused a shift in expectations, with markets now predicting rate cuts to start in May instead of March.

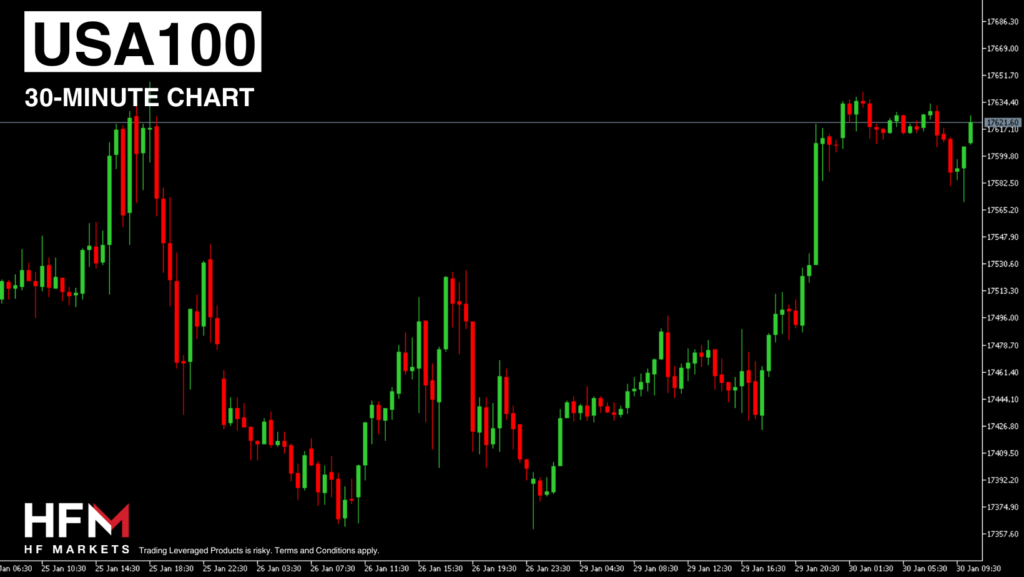

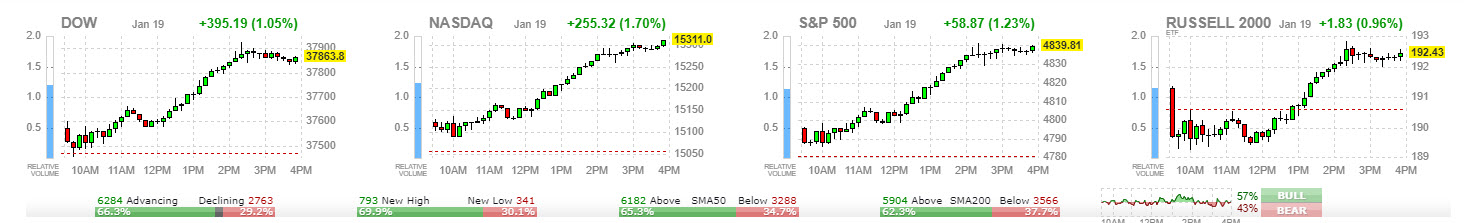

- European & US stock futures keep rising, extending the rally in global equities that pushed the US500, US100 and US30 to all-time highs. Optimism over expected Federal Reserve interest-rate cuts and the artificial-intelligence boom boosted Equities.

- Interest rate futures indicate a 100 basis points gap between market expectations and the Fed’s own projections for year-end rates, contributing to the dollar’s struggles.

- In political news, Ron DeSantis withdraws from the US presidential race and endorses Republican front-runner Donald Trump ahead of the New Hampshire primary on Tuesday.

Market Trends:

- Chinese markets underperformed again today toward their lowest level in almost two decades. The Hang Seng plunged -2.8%, the CSI 300 -1.5%. Chinese tech behemoths including Meituan and Tencent Holdings Ltd. were among the biggest drags.

- JPN225 rallied to a fresh 34-year peak today (closed at 36,546.85) on weaker yen but also mainly as the US500’s record-high close on Friday buoyed investor sentiment, despite continued signs of overheating in the Asian market.

- DAX and FTSE 100 are up 0.9% and 0.5% respectively while Treasuries have pared overnight gains, and the 10-year rate is now up 0.8 bp at 4.13%. The short end is underperforming in both the US and the EU.

Financial Markets Performance:

- The USDIndex is struggling to extend above 103 due to uncertainties related to central bank decisions in Japan and Europe this week. EURUSD down to 1.0890.

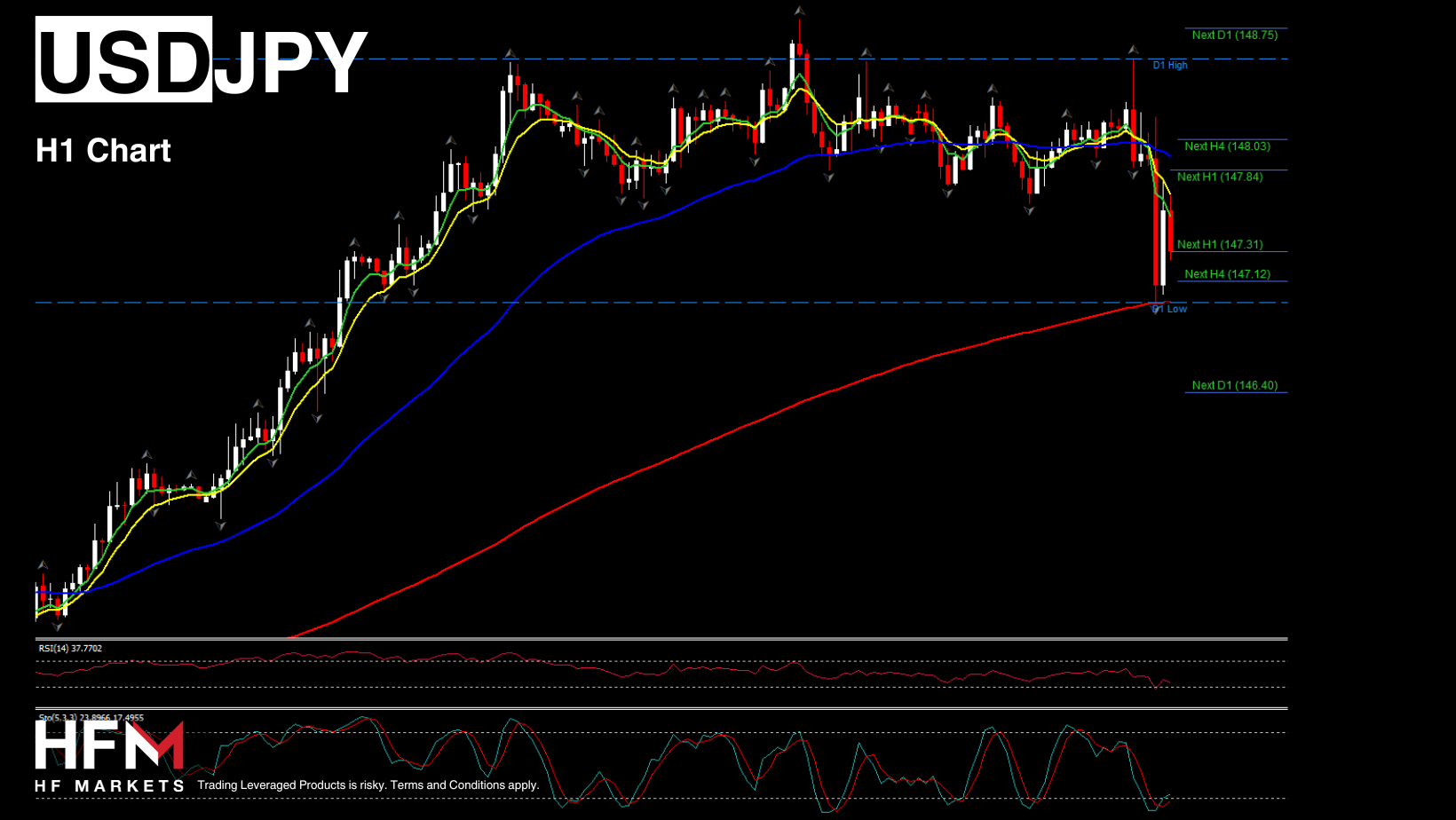

- USDJPY had a notable movement, bouncing from a 1-month low to a high, impacted by the Bank of Japan’s 2-day meeting and the expiry of a large amount of currency options.

- Oil prices are down as OPEC member Libya restarted output at its largest field, bolstering global supplies and overshadowing for now concerns about tensions in the Red Sea that look set to continue disrupting shipping.

- Key events for the week include the first estimate of US Q4 GDP, central bank meetings in Japan, Canada and Europe, South Korean economic output data, and initial readings of purchasing managers’ surveys in Europe for 2024.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.