IFCMarkets

Broker Representative

US stocks fell on Monday after disappointing economic data from China and Thanksgiving holiday sales. The National Retail Federation estimates indicate retail spending over the Thanksgiving weekend fell 11%, the second straight annual decline, contributing to decline of retailer stocks such as Wal-Mart Inc., Target Corp. The negative retail sales hit also Tech stocks after disappointing sales on Cyber Monday. Internet-retailing giant Amazon.com Inc. shares declined by 1.2%, Apple Inc. fell 3% and other e-commerce companies including eBay Inc , Google Inc , Yahoo! Inc. , Facebook Inc Netflix Inc. and Chinese Internet giant Alibaba Group suffered losses too. The S&P 500 and the Dow saw their biggest one-day loss since Oct 22. The S&P 500 fell 0.7% to 2,053.44, while the Dow Jones Industrial lost 0.3% to 17.776.80. The Nasdaq Composite’s decline was the biggest in seven weeks, after falling 1.3%, to 4,727.35.

European stocks fell on Monday, as investors weighed economic data indicating slowing in economic activity in euro zone and China. Data firm Markit said its monthly survey of euro zone purchasing managers fell to 50.1 in November, down from a preliminary estimate of 50.4. HSBC early Monday said its China PMI fell to a six-month low of 50.0 and China’s National Bureau of Statistics said official PMI fell to 50.3, the lowest level since March. The Stoxx Europe 600 index fell 0.5% to 345.64, the oil and mining shares leading the losses after OPEC decision not to cut oil production and the reported weakness of the world’s second largest economy.

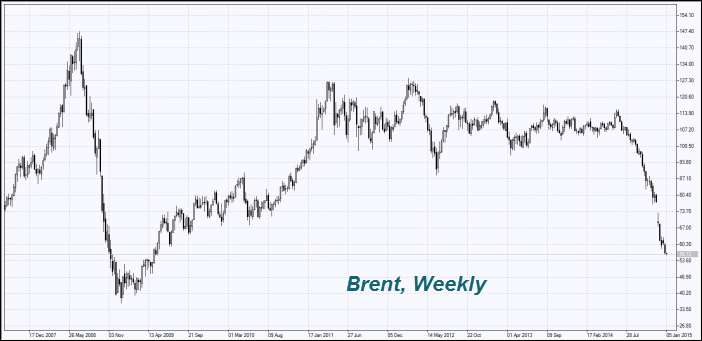

WTI futures gained more than 4% Monday after crude futures plunged 10% on Friday in reaction to the OPEC decision to maintain production levels. January Brent crude on London’s ICE Futures exchange rose $2.39, or 3.4%, to finish at $72.54 a barrel after a five-session decline. Investors expect the price slump to continue unless major energy producers take steps to limit the supply to match the falling global demand. Analysts estimate a massive oversupply in the first half of 2015 roughly equal to 1.5 million barrels per day. And as OPEC didn’t agree to curb its oil output the decision of other major producers will determine future price movement.

After meeting with his Turkish counterpart in Ankara yesterday President Putin said Russia will concentrate on supplying gas to Turkey through a different Black Sea pipeline, scrapping the $45 billion South Stream project that would bypass Ukraine to supply European markets. Russia will supply gas to Turkey through the Blue Stream pipeline, increasing deliveries by 3 billion cubic meters a year and offering a 6 percent discount from January 1. The ruble moved off record lows against the US dollar Monday as oil prices recovered slightly.

Gold and silver bounced on Monday as lowering of Japan’s sovereign credit rating by Moody’s Investors Service, import restrictions easing by India and softer dollar increased investor demand for safe haven assets. Gold for February delivery jumped $42.60 or 3.6%, to settle at $1,218.10 an ounce. Meanwhile, March silver surged $1.14 or 7.3%, to $16.69 an ounce. Asian stocks rose on Tuesday, with a rebound in crude oil and commodities including iron ore and copper prices lifting the stock markets of resource-exporting countries. MSCI's broadest index of Asia-Pacific shares outside Japan climbed 0.6 percent. The Nikkei posted gains of 0.4 percent to end at 17,663.22.

European stocks fell on Monday, as investors weighed economic data indicating slowing in economic activity in euro zone and China. Data firm Markit said its monthly survey of euro zone purchasing managers fell to 50.1 in November, down from a preliminary estimate of 50.4. HSBC early Monday said its China PMI fell to a six-month low of 50.0 and China’s National Bureau of Statistics said official PMI fell to 50.3, the lowest level since March. The Stoxx Europe 600 index fell 0.5% to 345.64, the oil and mining shares leading the losses after OPEC decision not to cut oil production and the reported weakness of the world’s second largest economy.

WTI futures gained more than 4% Monday after crude futures plunged 10% on Friday in reaction to the OPEC decision to maintain production levels. January Brent crude on London’s ICE Futures exchange rose $2.39, or 3.4%, to finish at $72.54 a barrel after a five-session decline. Investors expect the price slump to continue unless major energy producers take steps to limit the supply to match the falling global demand. Analysts estimate a massive oversupply in the first half of 2015 roughly equal to 1.5 million barrels per day. And as OPEC didn’t agree to curb its oil output the decision of other major producers will determine future price movement.

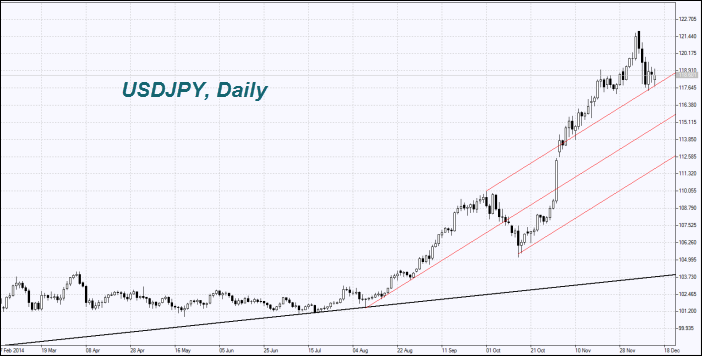

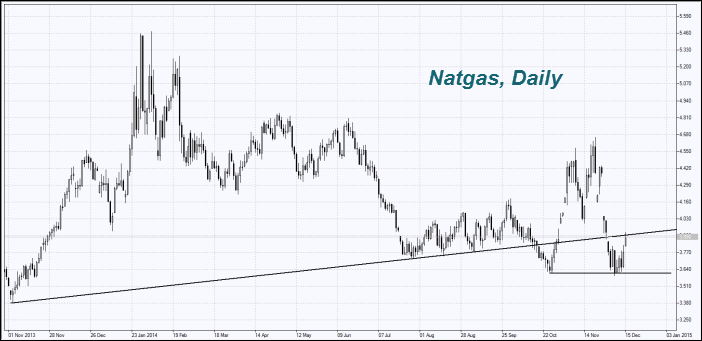

After meeting with his Turkish counterpart in Ankara yesterday President Putin said Russia will concentrate on supplying gas to Turkey through a different Black Sea pipeline, scrapping the $45 billion South Stream project that would bypass Ukraine to supply European markets. Russia will supply gas to Turkey through the Blue Stream pipeline, increasing deliveries by 3 billion cubic meters a year and offering a 6 percent discount from January 1. The ruble moved off record lows against the US dollar Monday as oil prices recovered slightly.

Gold and silver bounced on Monday as lowering of Japan’s sovereign credit rating by Moody’s Investors Service, import restrictions easing by India and softer dollar increased investor demand for safe haven assets. Gold for February delivery jumped $42.60 or 3.6%, to settle at $1,218.10 an ounce. Meanwhile, March silver surged $1.14 or 7.3%, to $16.69 an ounce. Asian stocks rose on Tuesday, with a rebound in crude oil and commodities including iron ore and copper prices lifting the stock markets of resource-exporting countries. MSCI's broadest index of Asia-Pacific shares outside Japan climbed 0.6 percent. The Nikkei posted gains of 0.4 percent to end at 17,663.22.