Technical Analysis

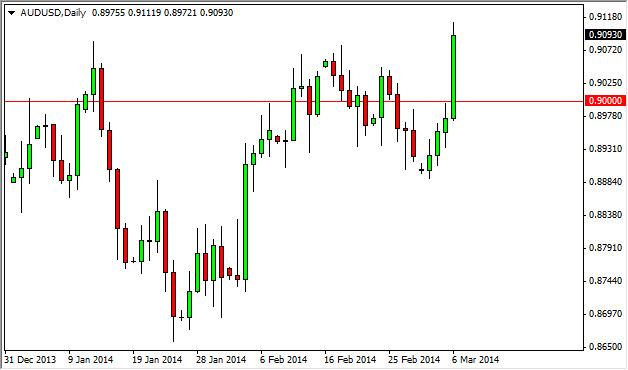

AUD/USD Forecast March 7, 2014, Technical Analysis

The AUD/USD pair rose during the session on Thursday, smashing through the barriers of resistance that we have seen for some time now. Because of this, the outlook on this market has changed drastically, as a move above the 0.91 level on a daily close would be enough to start buying it. It would essentially form the completion of an inverse head and shoulders, which of course would be a very bullish outlook. We believe that today’s nonfarm payroll report might be the volatility needed to break out. The meantime though, we are on the sidelines

More Info

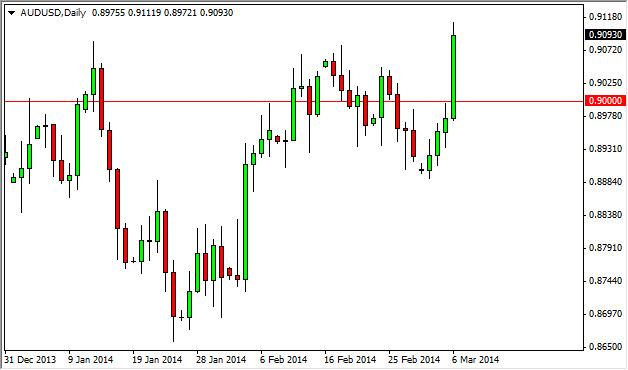

AUD/USD Forecast March 7, 2014, Technical Analysis

The AUD/USD pair rose during the session on Thursday, smashing through the barriers of resistance that we have seen for some time now. Because of this, the outlook on this market has changed drastically, as a move above the 0.91 level on a daily close would be enough to start buying it. It would essentially form the completion of an inverse head and shoulders, which of course would be a very bullish outlook. We believe that today’s nonfarm payroll report might be the volatility needed to break out. The meantime though, we are on the sidelines

More Info