Murrey Math Lines 09.04.2024 (AUDUSD, NZDUSD)

AUDUSD, "Australian Dollar vs US Dollar"

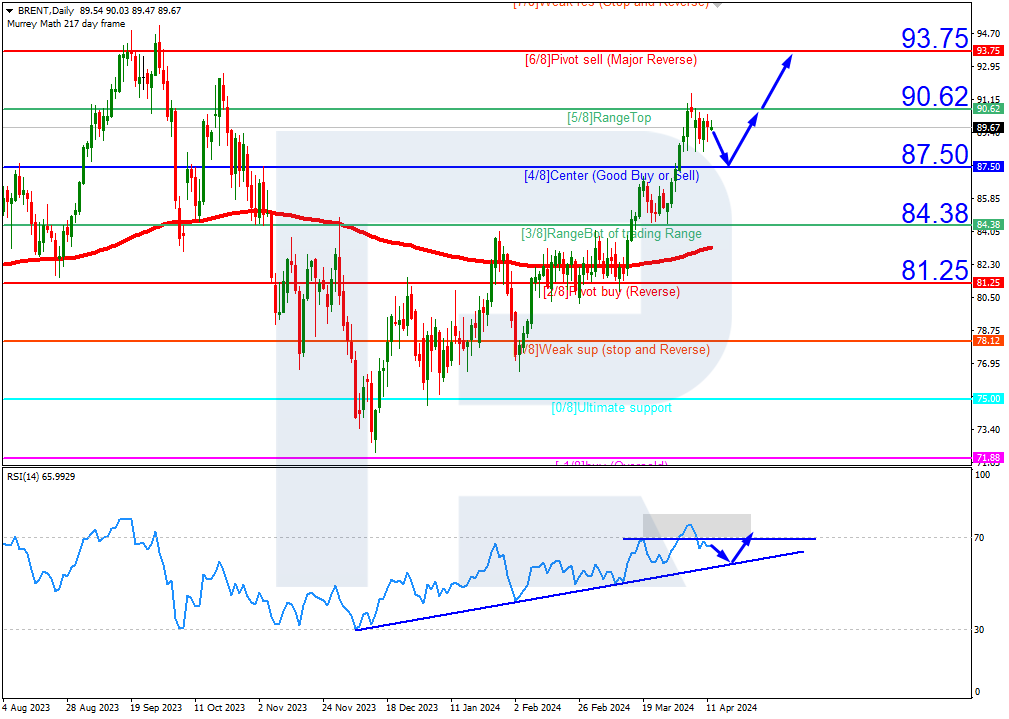

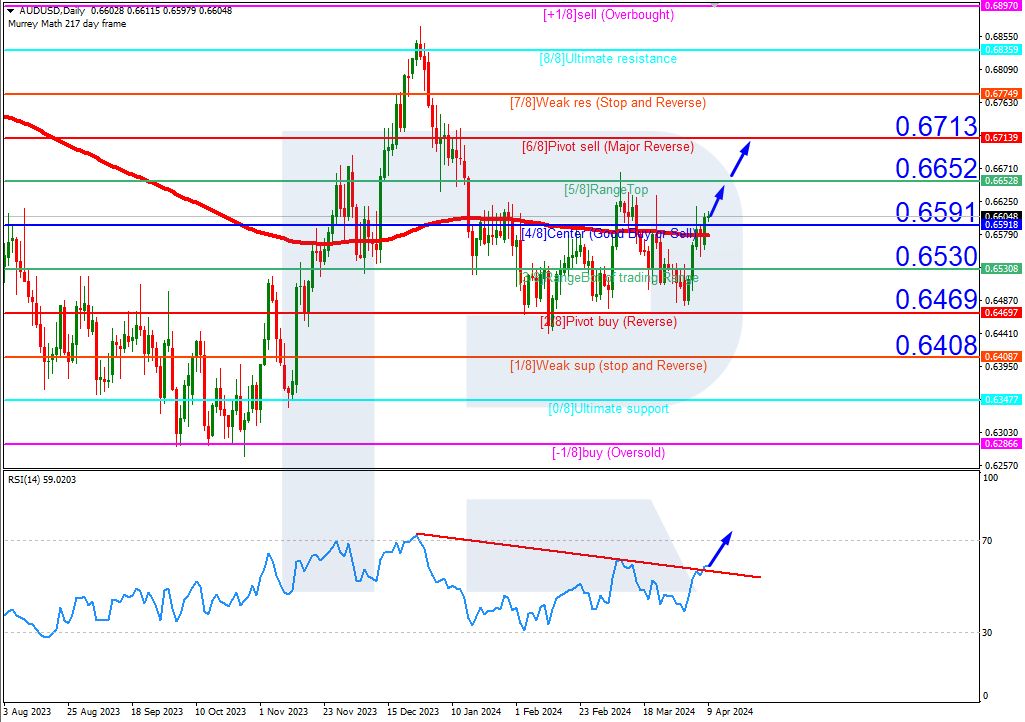

AUDUSD quotes have broken the 200-day Moving Average on D1 and rest above it, revealing the probability of an uptrend development. The RSI has broken the resistance line. In this situation, the quotes are expected to breach the 5/8 (0.6652) level and rise to the resistance at 6/8 (0.6713). The scenario could be cancelled by a breakout of 4/8 (0.6591). In this case, the price might drop to the support at 3/8 (0.6530).

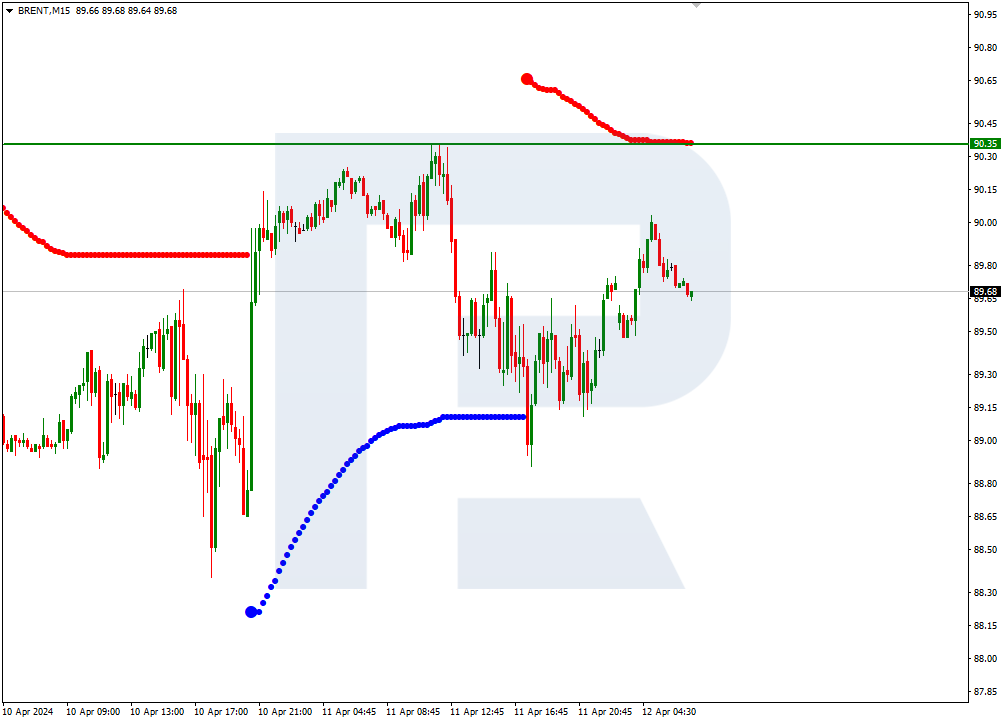

On M15, the upper boundary of the VoltyChannel is broken, increasing the probability of further price growth.

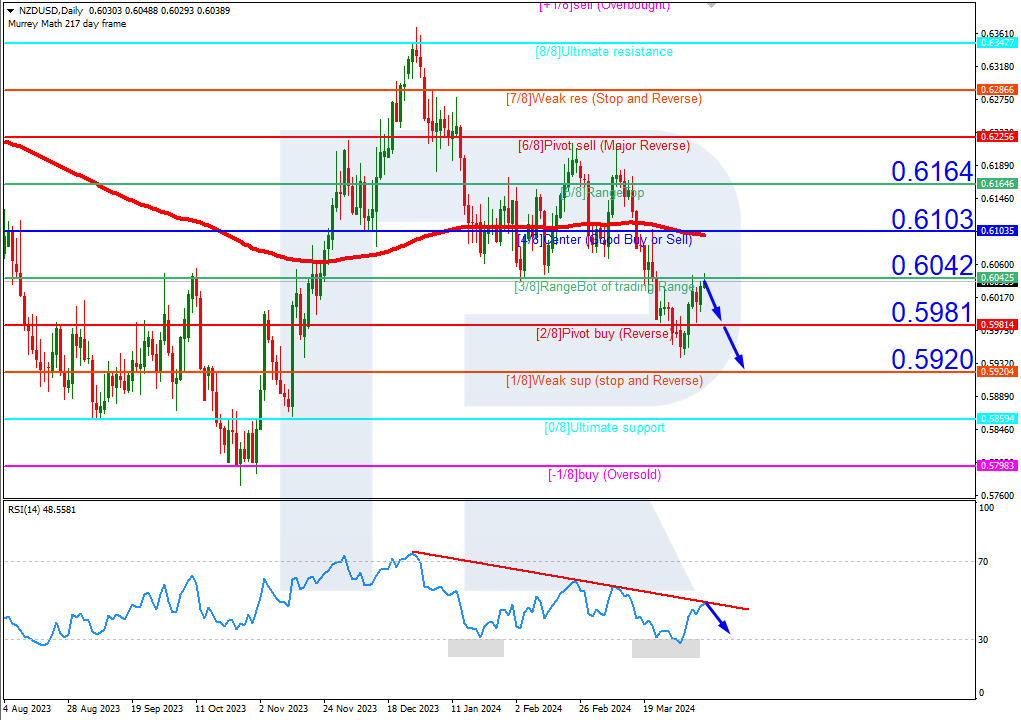

NZDUSD, "New Zealand Dollar vs US Dollar"

NZDUSD quotes are below the 200-day Moving Average on D1, which indicates the prevalence of a downtrend. The RSI is testing the resistance line. In these circumstances, a rebound from the 3/8 (0.6042) level is expected, followed by a decline to the support at 1/8 (0.5920). The scenario could be cancelled by rising above 3/8 (0.6042), in which case, the pair might rise to the resistance at 4/8 (0.6103).

Read more - Murrey Math Lines (AUDUSD, NZDUSD)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

AUDUSD, "Australian Dollar vs US Dollar"

AUDUSD quotes have broken the 200-day Moving Average on D1 and rest above it, revealing the probability of an uptrend development. The RSI has broken the resistance line. In this situation, the quotes are expected to breach the 5/8 (0.6652) level and rise to the resistance at 6/8 (0.6713). The scenario could be cancelled by a breakout of 4/8 (0.6591). In this case, the price might drop to the support at 3/8 (0.6530).

On M15, the upper boundary of the VoltyChannel is broken, increasing the probability of further price growth.

NZDUSD, "New Zealand Dollar vs US Dollar"

NZDUSD quotes are below the 200-day Moving Average on D1, which indicates the prevalence of a downtrend. The RSI is testing the resistance line. In these circumstances, a rebound from the 3/8 (0.6042) level is expected, followed by a decline to the support at 1/8 (0.5920). The scenario could be cancelled by rising above 3/8 (0.6042), in which case, the pair might rise to the resistance at 4/8 (0.6103).

Read more - Murrey Math Lines (AUDUSD, NZDUSD)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team