Daily Forex Market Preview, 04/08/2016

The Bank of England's monetary policy meeting today will be the big event as the markets brace for a rate cut. What will determine the price action in GBPUSD will be how much the BoE can loosen monetary policy, which if disappoints could see a strong short squeeze that could shake out the weak short positions at the current levels. Watch for GBPUSD's breakout above $1.34, while $1.28 remains the lower end of the range.

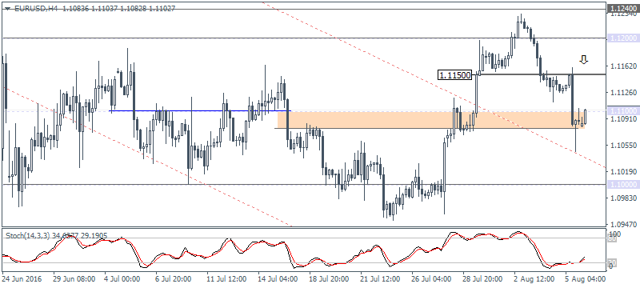

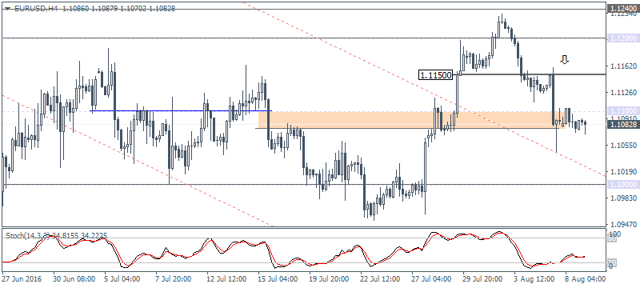

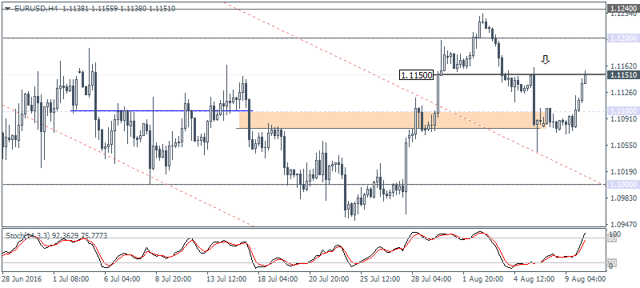

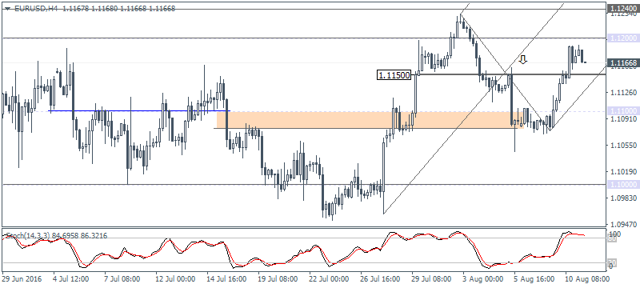

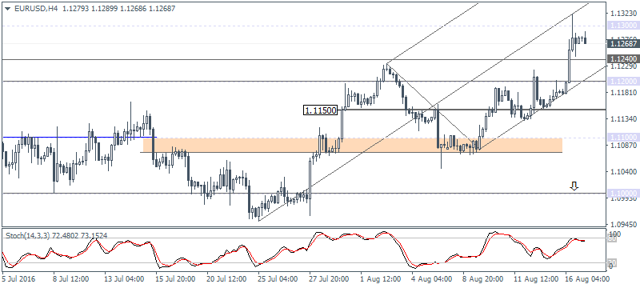

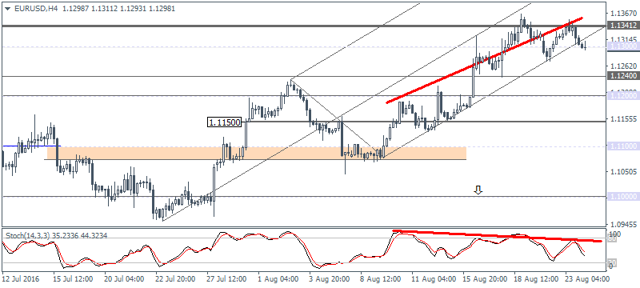

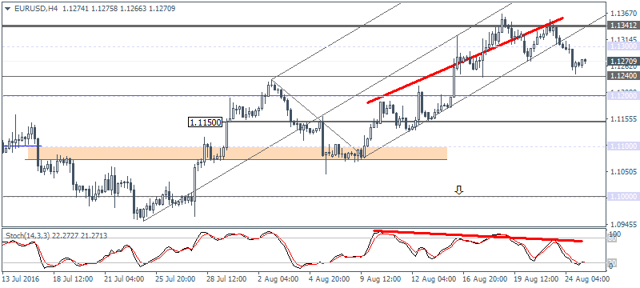

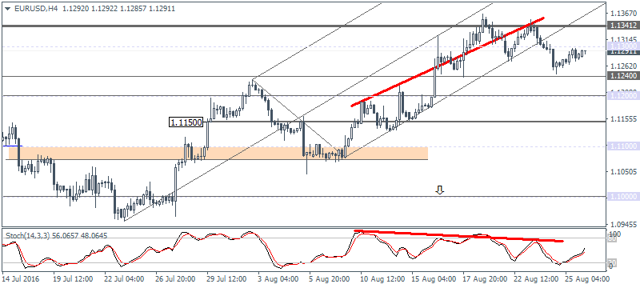

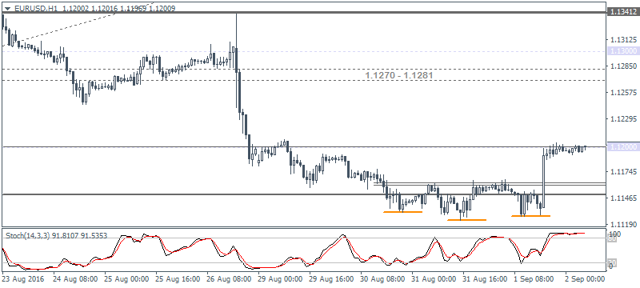

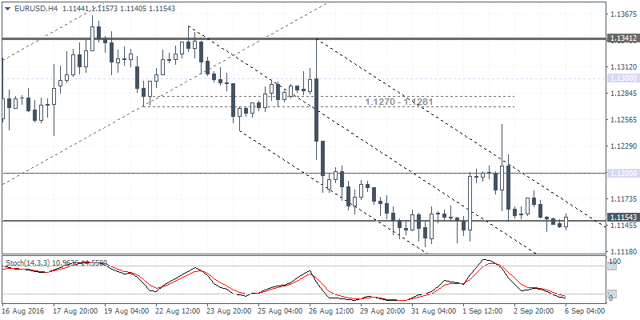

EURUSD Daily Analysis

(click to enlarge)

EURUSD (1.1143): EURUSD closed bearish following the retest to 1.120 and gave up Tuesday's gains completely. Interestingly, following the upside breakout from the inside bar previously noted, the Tuesday/Wednesday price action in EURUSD has perhaps caught a lot of weak long positions on the wrong side of the market. A close below 1.11492 is essential to confirm the move to the downside, where support at 1.110 - 1.1076 is likely to be targeted. Looking at the Stochastics on the 4-hour time frame, the lower low in Stochs compared to the higher low in price is likely to see some near term bounce to the upside on a dip to 1.110 - 1.076.

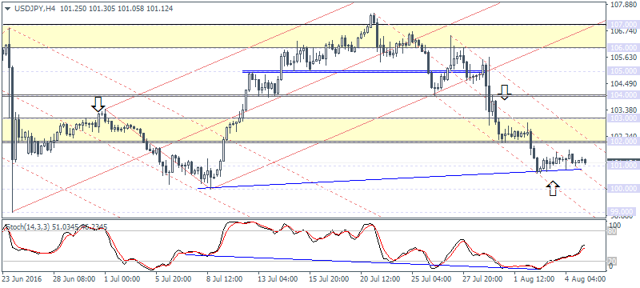

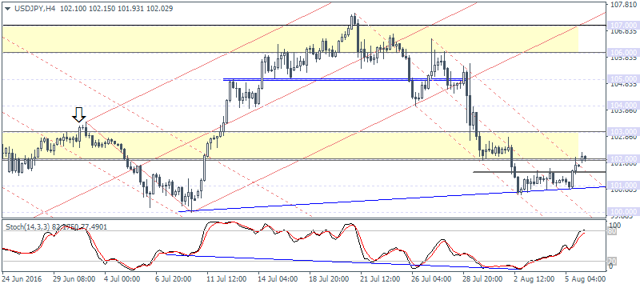

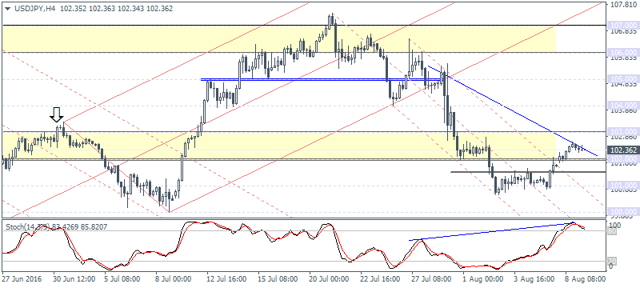

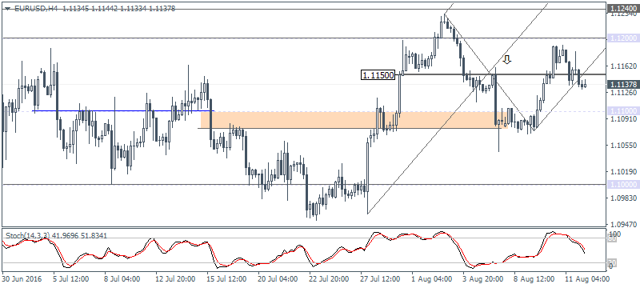

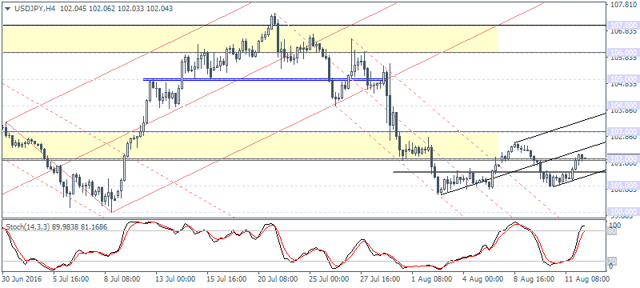

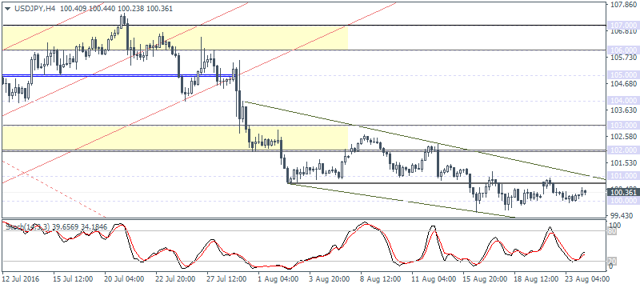

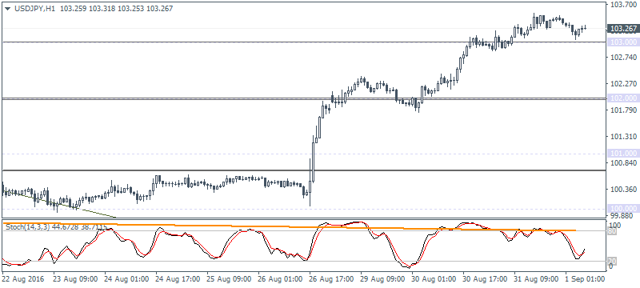

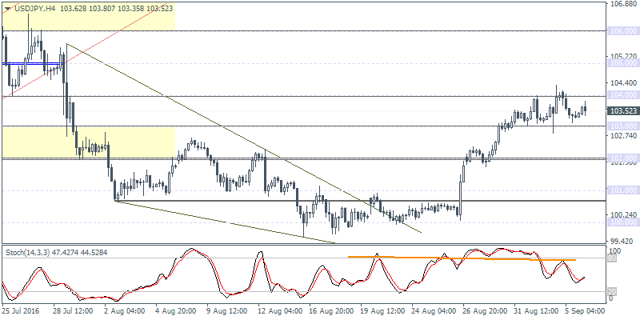

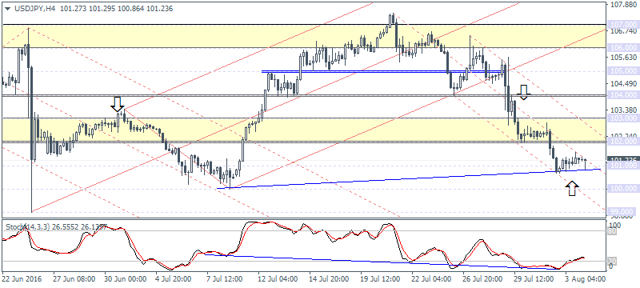

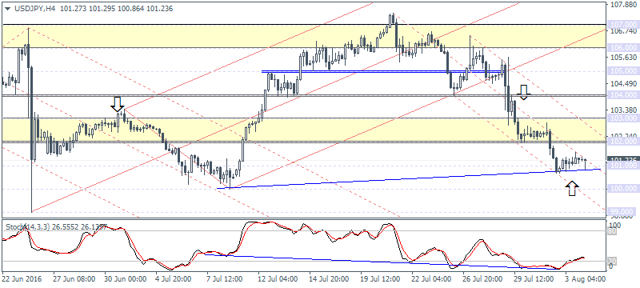

USDJPY Daily Analysis

(click to enlarge)

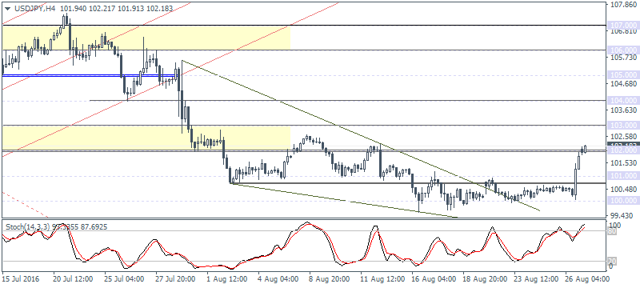

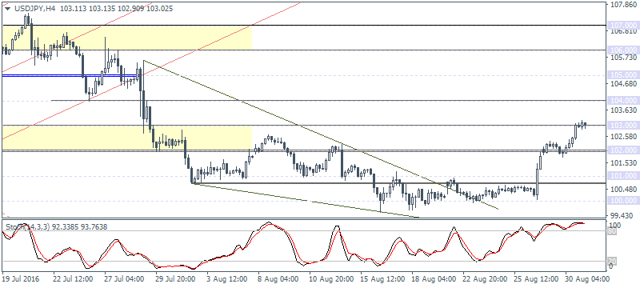

USDJPY (101.23): USDJPY broke down below the 102 support, but the declines have been limited so far. The daily chart shows a potential for price to recover from current lows on a close back above 102.00. However, the 4-hour chart still hasn't signaled any upside bias just as yet. Following the low formed below 101, USDJPY needs to bounce off the current level to form a higher low on the pullback. As such, watch for 102 level acting as resistance in the near term. A confirmed break down below 101 could see USDJPY extend declines to 100.

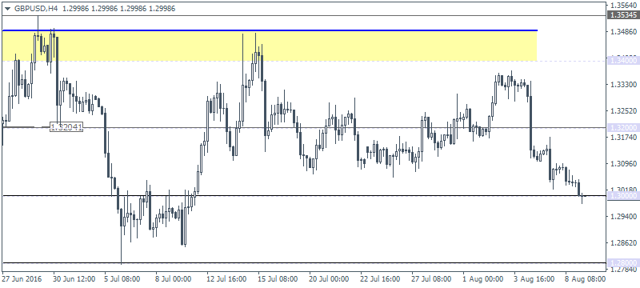

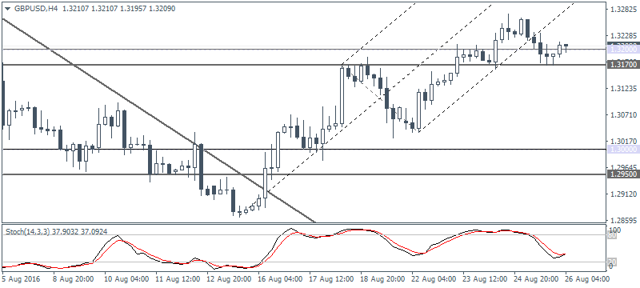

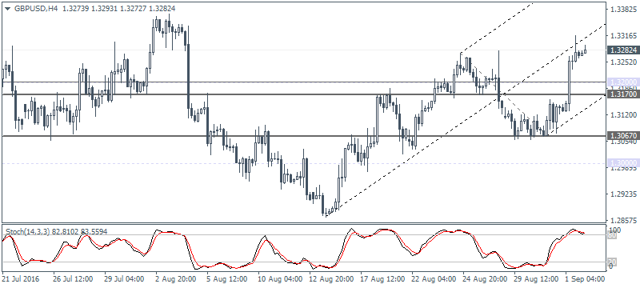

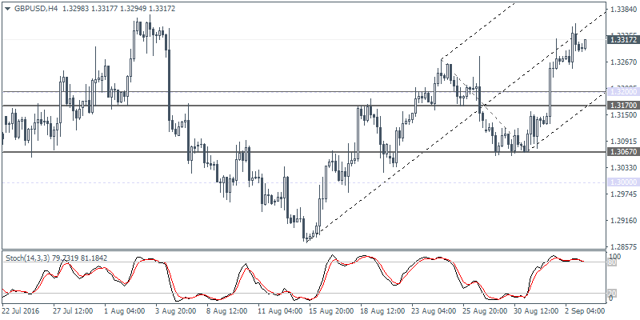

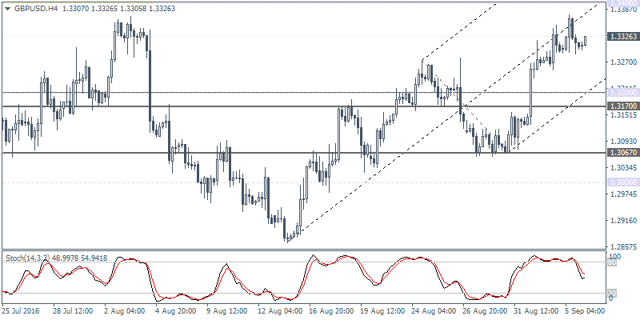

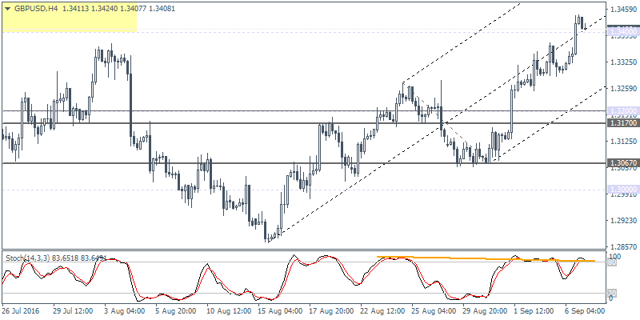

GBPUSD Daily Analysis

(click to enlarge)

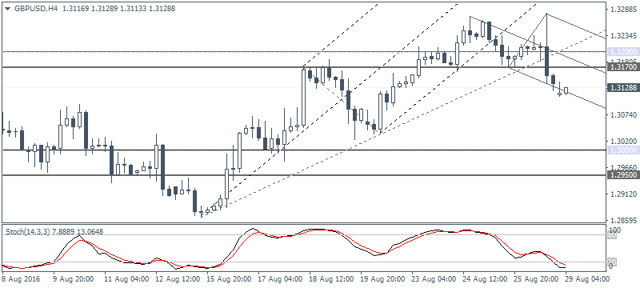

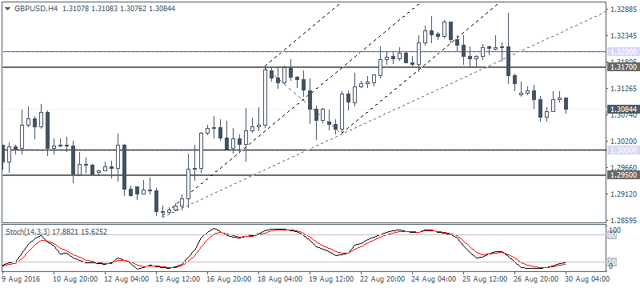

GBPUSD (1.332): GBPUSD remains firmly above 1.32 despite yesterday's price action being fairly limited. With today's BoE meeting on the horizon, GBPUSD could see some volatility led price moves. Watch for a pullback to the support at 1.32 as the upside bias is likely to continue on a breakout above 1.34 - 1.3488, which would mark the inverse head and shoulders pattern breakout, targeting 1.38 and potentially to 1.40. To the downside, a break down below 1.32 - 1.30 could signal further declines in GBPUSD to 1.280 support.

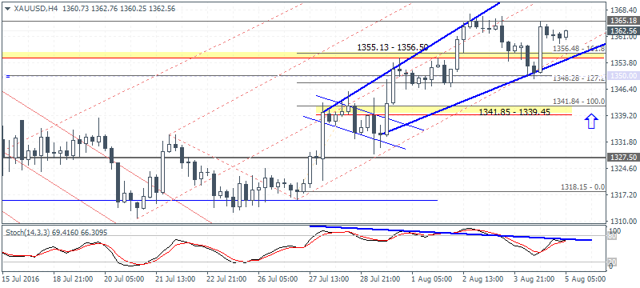

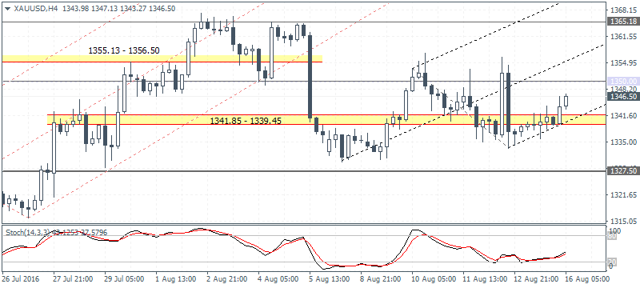

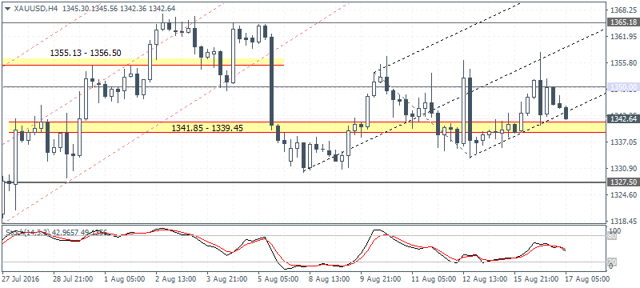

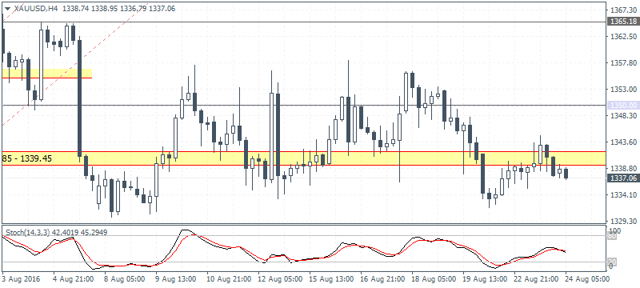

Gold Daily Analysis

(click to enlarge)

XAUUSD (1351.12): Gold prices were bearish yesterday but formed an inside bar near the 1360 top. A close below yesterday's low at 1347.20 will confirm near term declines with support at 1315.20 - 1300 likely to stall the declines in the near term. On the 4-hour chart, there is a potential for gold prices to retest the 1355 - 1357 price level to test for resistance before declining further. On the intraday basis watch for gold to hold up near 1341.85 - 1340 support.

The Bank of England's monetary policy meeting today will be the big event as the markets brace for a rate cut. What will determine the price action in GBPUSD will be how much the BoE can loosen monetary policy, which if disappoints could see a strong short squeeze that could shake out the weak short positions at the current levels. Watch for GBPUSD's breakout above $1.34, while $1.28 remains the lower end of the range.

EURUSD Daily Analysis

(click to enlarge)

EURUSD (1.1143): EURUSD closed bearish following the retest to 1.120 and gave up Tuesday's gains completely. Interestingly, following the upside breakout from the inside bar previously noted, the Tuesday/Wednesday price action in EURUSD has perhaps caught a lot of weak long positions on the wrong side of the market. A close below 1.11492 is essential to confirm the move to the downside, where support at 1.110 - 1.1076 is likely to be targeted. Looking at the Stochastics on the 4-hour time frame, the lower low in Stochs compared to the higher low in price is likely to see some near term bounce to the upside on a dip to 1.110 - 1.076.

USDJPY Daily Analysis

(click to enlarge)

USDJPY (101.23): USDJPY broke down below the 102 support, but the declines have been limited so far. The daily chart shows a potential for price to recover from current lows on a close back above 102.00. However, the 4-hour chart still hasn't signaled any upside bias just as yet. Following the low formed below 101, USDJPY needs to bounce off the current level to form a higher low on the pullback. As such, watch for 102 level acting as resistance in the near term. A confirmed break down below 101 could see USDJPY extend declines to 100.

GBPUSD Daily Analysis

(click to enlarge)

GBPUSD (1.332): GBPUSD remains firmly above 1.32 despite yesterday's price action being fairly limited. With today's BoE meeting on the horizon, GBPUSD could see some volatility led price moves. Watch for a pullback to the support at 1.32 as the upside bias is likely to continue on a breakout above 1.34 - 1.3488, which would mark the inverse head and shoulders pattern breakout, targeting 1.38 and potentially to 1.40. To the downside, a break down below 1.32 - 1.30 could signal further declines in GBPUSD to 1.280 support.

Gold Daily Analysis

(click to enlarge)

XAUUSD (1351.12): Gold prices were bearish yesterday but formed an inside bar near the 1360 top. A close below yesterday's low at 1347.20 will confirm near term declines with support at 1315.20 - 1300 likely to stall the declines in the near term. On the 4-hour chart, there is a potential for gold prices to retest the 1355 - 1357 price level to test for resistance before declining further. On the intraday basis watch for gold to hold up near 1341.85 - 1340 support.