How to Trade by Reversal Strategy

Author: Andrey Goilov

Dear Clients and Partners,

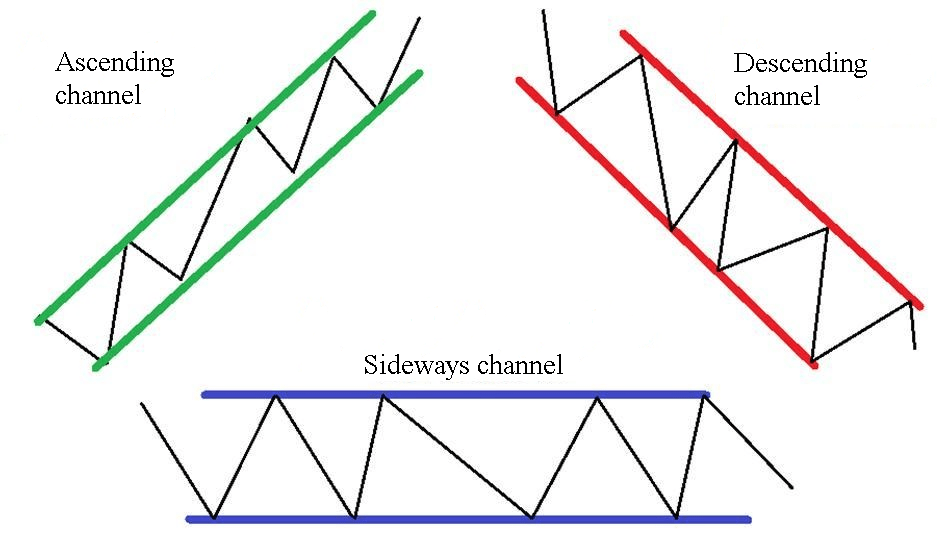

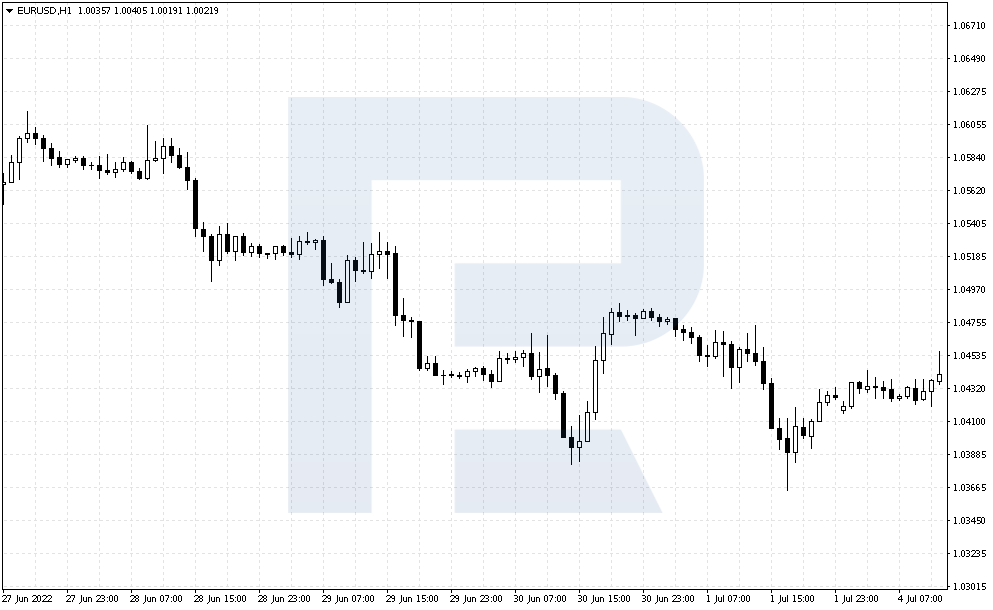

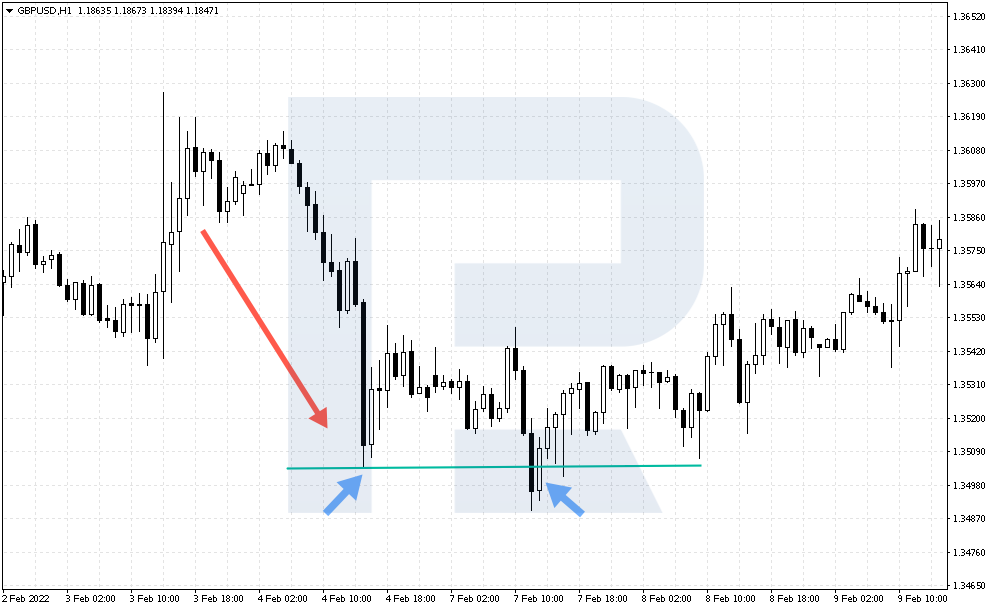

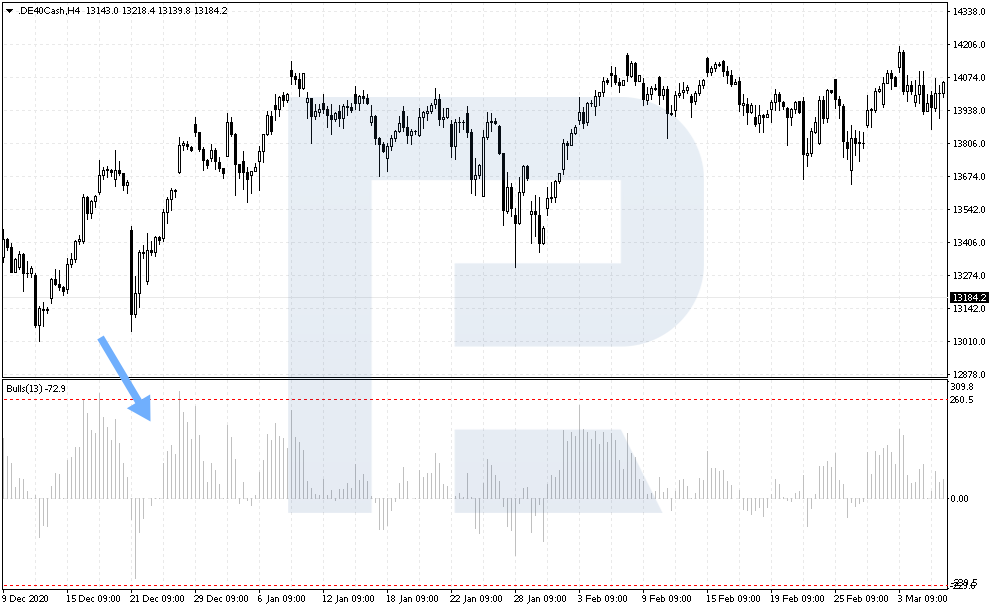

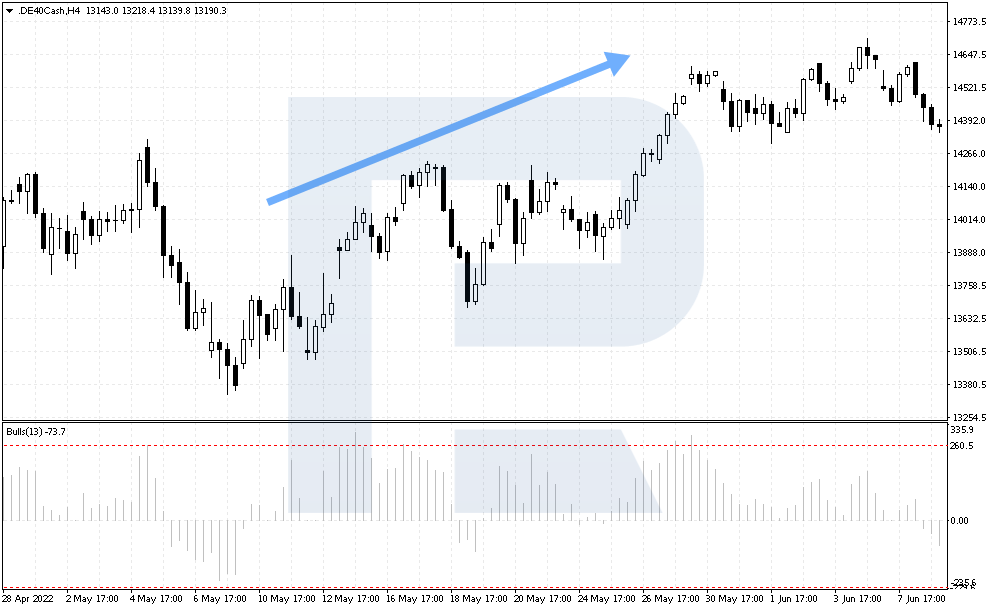

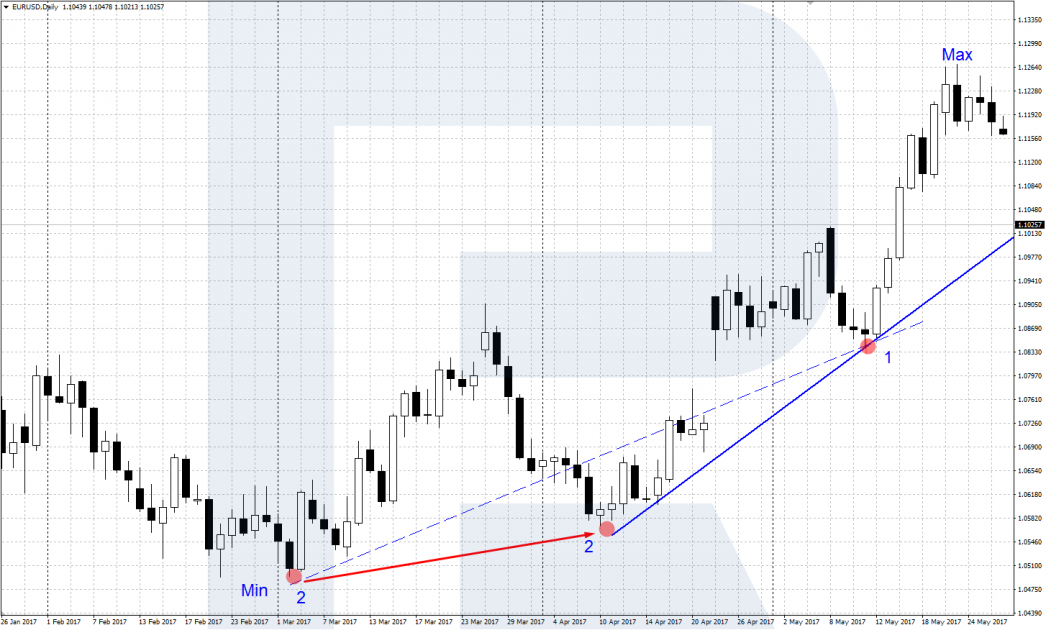

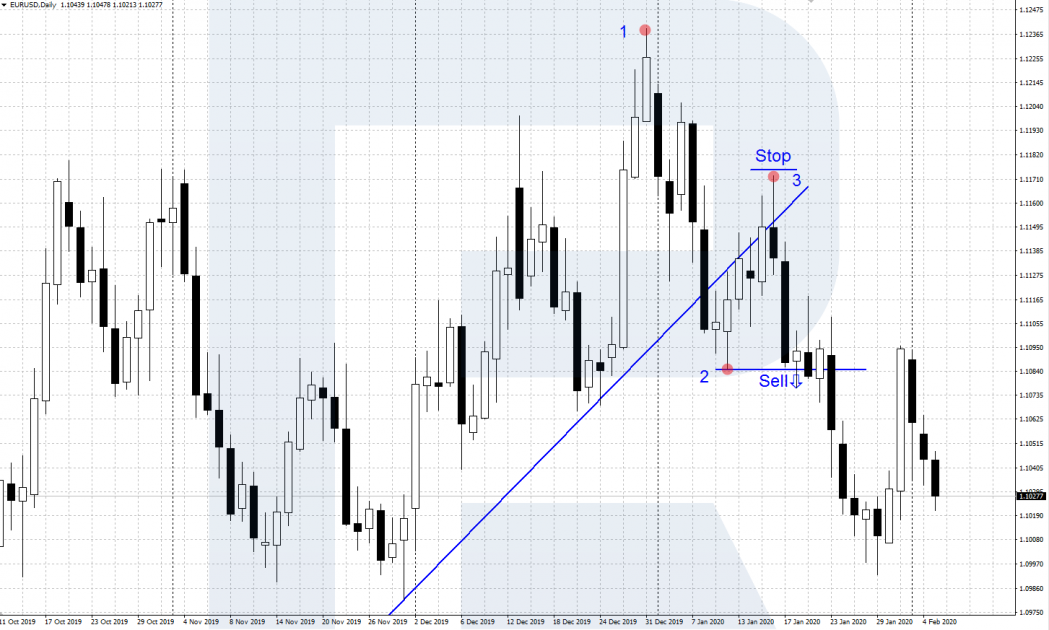

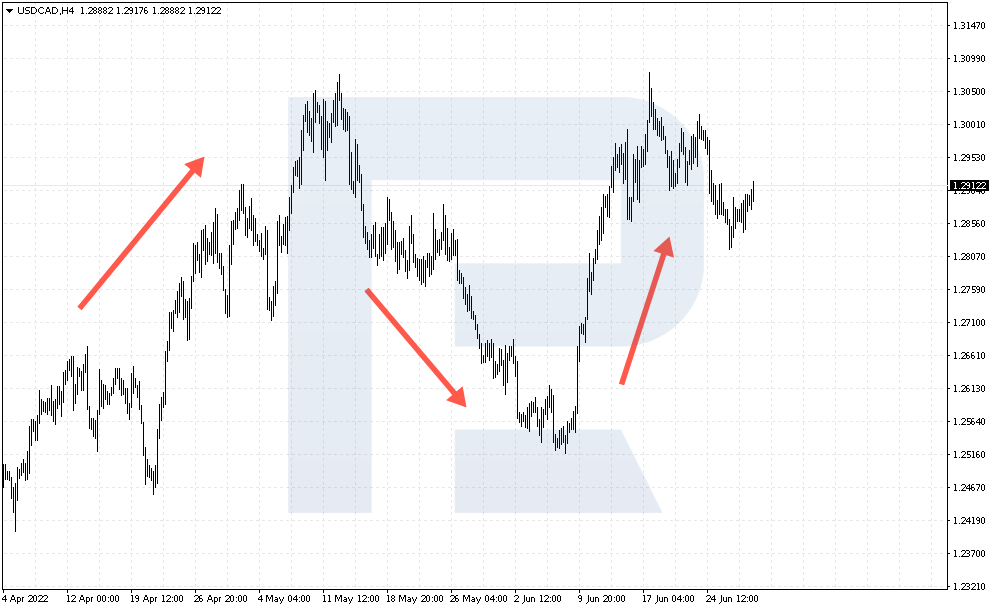

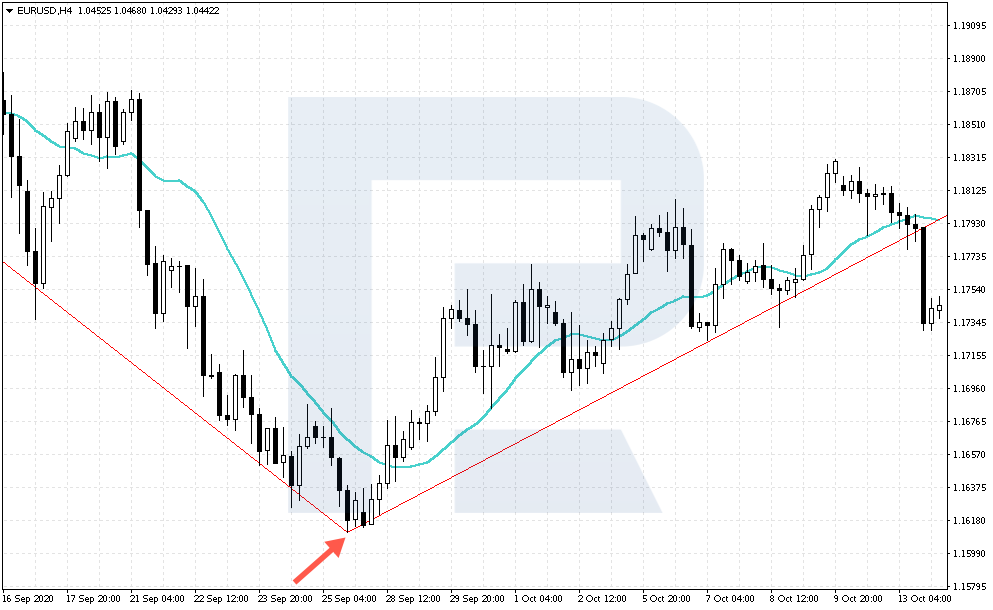

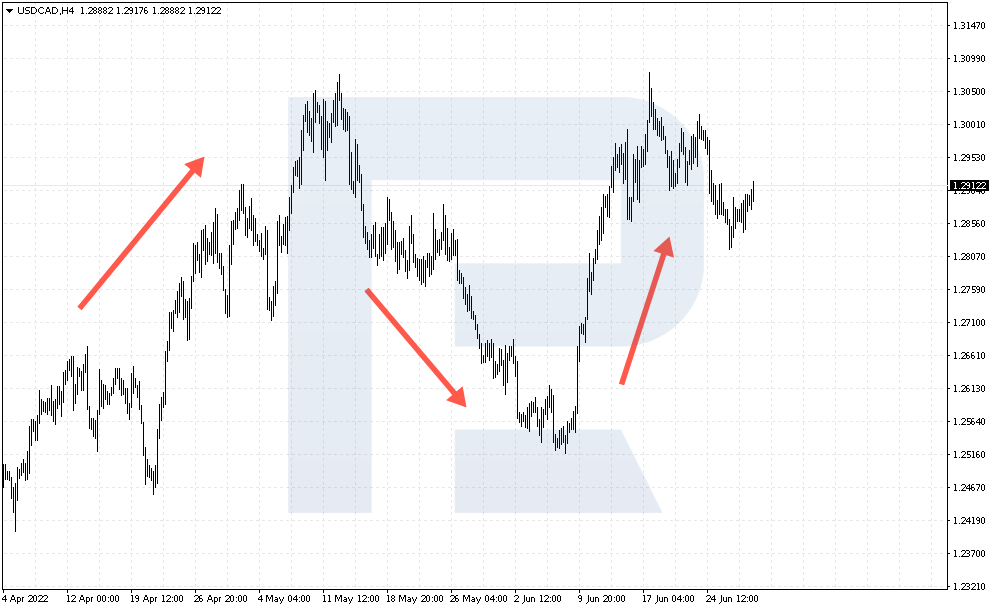

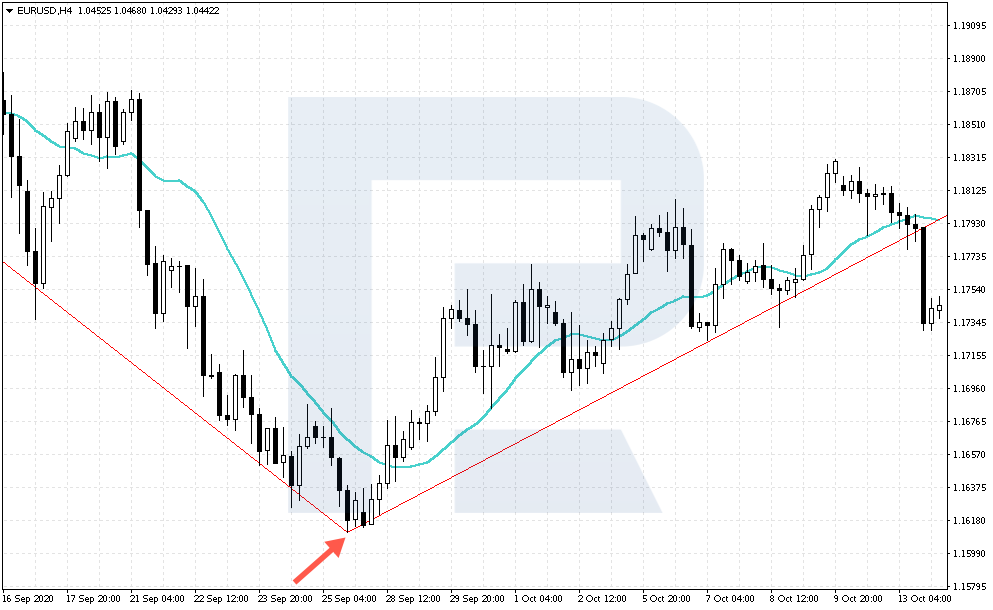

One of the main principles of tech analysis is “Trend is your friend”. Hence, some insist that for better results trading must occur by the trend only. However, any trend eventually comes to an end. A bull trend ends and changes or a bear one, and vice versa – see some examples on the charts.

The strategy we are about to discuss is called Reversal. The name makes it clear that here the trader is to wait for the trend to end and enter the market in the opposite direction. The timeframe is H4, which means the strategy does not require much time spent in front of the computer, tracking the price. The authors note that the method is quite easy to use, and risk management rules allow placing a Stop Loss much lower than the Take Profit.

In the article, we will see how to use the ZigZag and MA indicators to catch the end of the trend and enter by the new trend.

Setting up indicators for strategy

The method is applicable for two currency pairs only: EUR/USD and GBP/USD. These are popular instruments these days; also, movements of GBP/USD will be the strongest. To start trading, two indicators need to be added to the chart:

Simple Moving Average

The method is based on the signals given by the SMA. It is super user-friendly: if prices are above the indicator line, it is a signal to buy. And if the price breaks the line from above, look for signals to sell. As a rule, this indicator is used in every trend strategy.

How to buy by Reversal strategy

After adding all the instrument to the chart, let us look into the details of opening long positions:

1. ZigZag values reach their lows. The indicator helps define important levels on the chart. If the indicator values reach the lows, a good bounce upwards is likely to follow.

2. Price breaks through the SMA upwards. Check out the Close price of the candlestick: if the price turns out to be above the MA, the breakaway is true, so a buying trade can be opened at the opening of the next candlestick. This is the second signal by the strategy, which is necessary to avoid entering the market at each low shown by ZigZag. When the price breaks through the MA from below, this will be a signal for the beginning of an uptrend.

Bottom line

The Reversal strategy is an easy way to catch the change of the market trend. The advantages of the method are availability of the indicators: there is no need to look for anything extra and go deep into details. The potential goal is 3-4 times bigger than the loss, which allows for covering several losing trades by one profitable. However, trade occurs on H4 with altered ZigZag values, signals will be scarce, and only two currency pairs suit the strategy. This must be the only serious drawback of the strategy. Apart from this, this is a simple strategy with clear entry and exit rules.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team

Author: Andrey Goilov

Dear Clients and Partners,

One of the main principles of tech analysis is “Trend is your friend”. Hence, some insist that for better results trading must occur by the trend only. However, any trend eventually comes to an end. A bull trend ends and changes or a bear one, and vice versa – see some examples on the charts.

The strategy we are about to discuss is called Reversal. The name makes it clear that here the trader is to wait for the trend to end and enter the market in the opposite direction. The timeframe is H4, which means the strategy does not require much time spent in front of the computer, tracking the price. The authors note that the method is quite easy to use, and risk management rules allow placing a Stop Loss much lower than the Take Profit.

In the article, we will see how to use the ZigZag and MA indicators to catch the end of the trend and enter by the new trend.

Setting up indicators for strategy

The method is applicable for two currency pairs only: EUR/USD and GBP/USD. These are popular instruments these days; also, movements of GBP/USD will be the strongest. To start trading, two indicators need to be added to the chart:

- Simple Moving Average with period 18

- ZigZag with period 150

Simple Moving Average

The method is based on the signals given by the SMA. It is super user-friendly: if prices are above the indicator line, it is a signal to buy. And if the price breaks the line from above, look for signals to sell. As a rule, this indicator is used in every trend strategy.

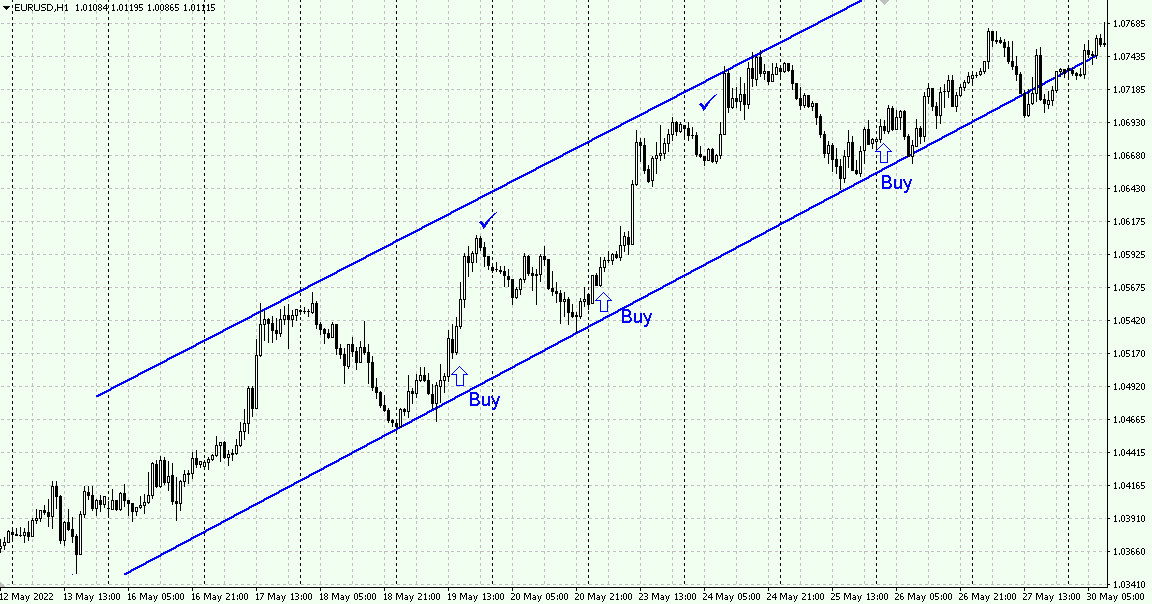

How to buy by Reversal strategy

After adding all the instrument to the chart, let us look into the details of opening long positions:

1. ZigZag values reach their lows. The indicator helps define important levels on the chart. If the indicator values reach the lows, a good bounce upwards is likely to follow.

2. Price breaks through the SMA upwards. Check out the Close price of the candlestick: if the price turns out to be above the MA, the breakaway is true, so a buying trade can be opened at the opening of the next candlestick. This is the second signal by the strategy, which is necessary to avoid entering the market at each low shown by ZigZag. When the price breaks through the MA from below, this will be a signal for the beginning of an uptrend.

Bottom line

The Reversal strategy is an easy way to catch the change of the market trend. The advantages of the method are availability of the indicators: there is no need to look for anything extra and go deep into details. The potential goal is 3-4 times bigger than the loss, which allows for covering several losing trades by one profitable. However, trade occurs on H4 with altered ZigZag values, signals will be scarce, and only two currency pairs suit the strategy. This must be the only serious drawback of the strategy. Apart from this, this is a simple strategy with clear entry and exit rules.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team