RoboForex adds over 500 instruments to R StocksTrader, including fractional shares

Dear Clients and Partners,

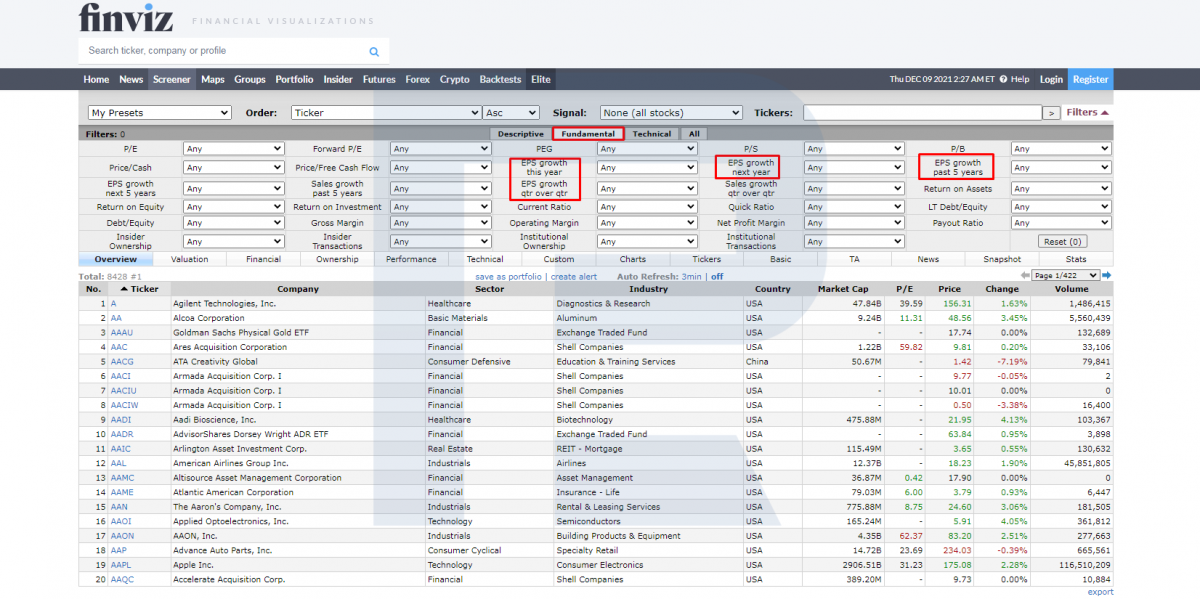

RoboForex updated R StocksTrader, which now offers over 500 new instruments for trading, including fractional shares and CFDs on shares of American, Brazilian, British, and European companies.

Access to trading fractional shares will enable clients to acquire both full shares and "slices" of stocks that represent a partial share. For example, a client can buy 1.5 of an Amazon or Netflix share. Meanwhile, the minimum volume of shares to buy remains the same – 1 share.

Why are fractional shares convenient?

Other updates to R StocksTrader:

We’re always striving to provide quality services and add new instruments and update the platform functionality. Due to this, the commission for trading Stocks and CFDs on stocks has been pushed to competitive levels. Updated commission conditions can be viewed on the "R StocksTrader" page.

Sincerely,

RoboForex team

Dear Clients and Partners,

RoboForex updated R StocksTrader, which now offers over 500 new instruments for trading, including fractional shares and CFDs on shares of American, Brazilian, British, and European companies.

Access to trading fractional shares will enable clients to acquire both full shares and "slices" of stocks that represent a partial share. For example, a client can buy 1.5 of an Amazon or Netflix share. Meanwhile, the minimum volume of shares to buy remains the same – 1 share.

Why are fractional shares convenient?

- Fractional shares cost less than full shares and that’s an excellent opportunity to invest in securities with less money.

- Fractional shares enable clients to diversify their investment portfolios by acquiring fractional shares of a wider range of companies.

Other updates to R StocksTrader:

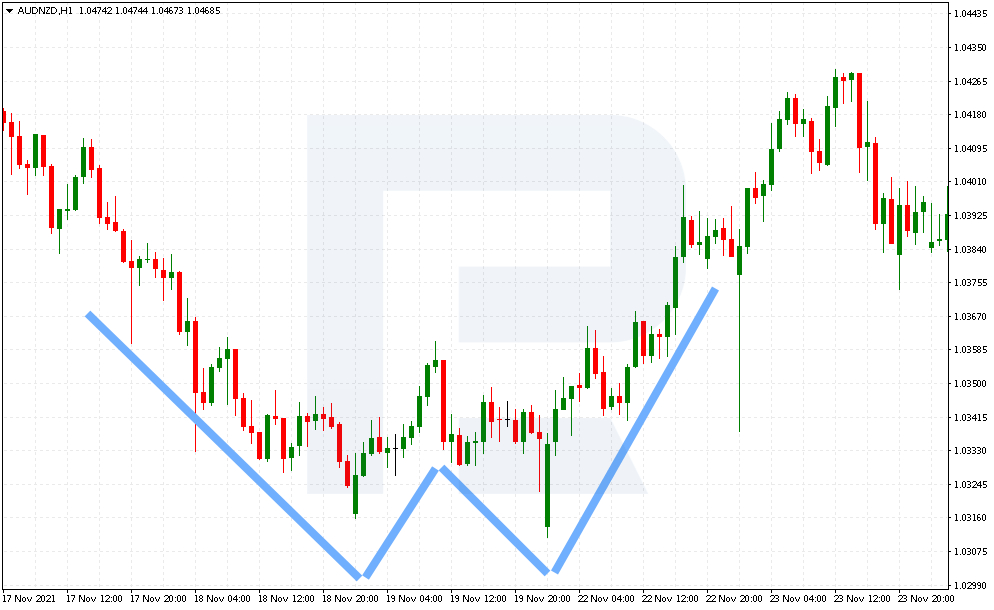

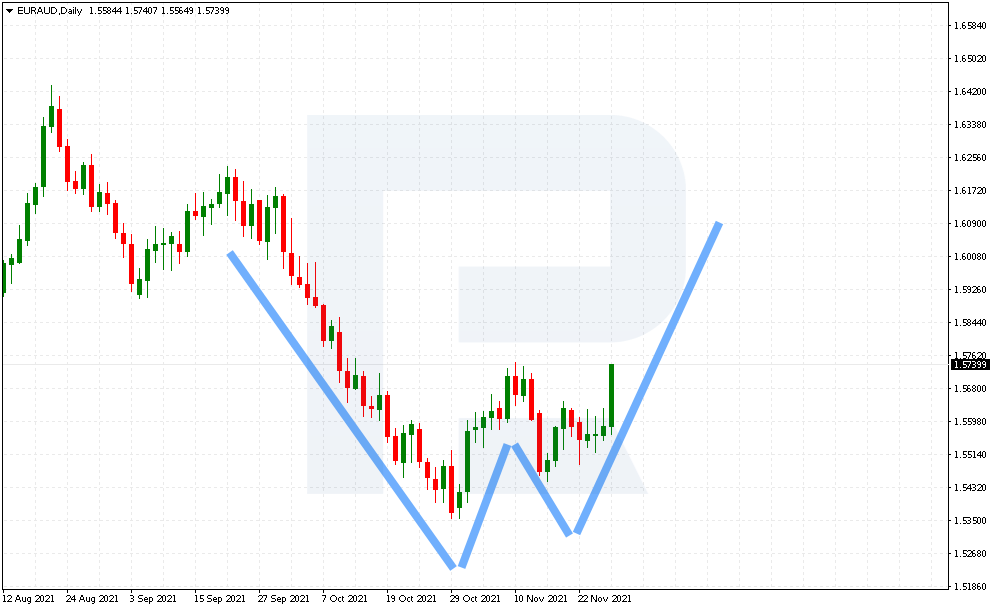

- New CFDs on American, Brazilian, and European stocks, including such popular instruments as Lucid Group Inc (LCID), Rivian Automotive Inc (RIVN), Udemy Inc. (UDMY), and others.

- 8 additional languages: Danish, Italian, Dutch, Norwegian, Rumanian, Finnish, French, and Swedish.

- Improved mobile application: enhanced security, direct access to deposit/withdrawal of funds, and the registration of trading accounts.

We’re always striving to provide quality services and add new instruments and update the platform functionality. Due to this, the commission for trading Stocks and CFDs on stocks has been pushed to competitive levels. Updated commission conditions can be viewed on the "R StocksTrader" page.

Start trading fractional shares and other popular instruments on

R StocksTrader today!

Learn more about trading Stocks >

R StocksTrader today!

Learn more about trading Stocks >

Sincerely,

RoboForex team