How to Invest 1,000 USD? Three Versions for Beginners

Author: Andrey Goilov

Dear Clients and Partners,

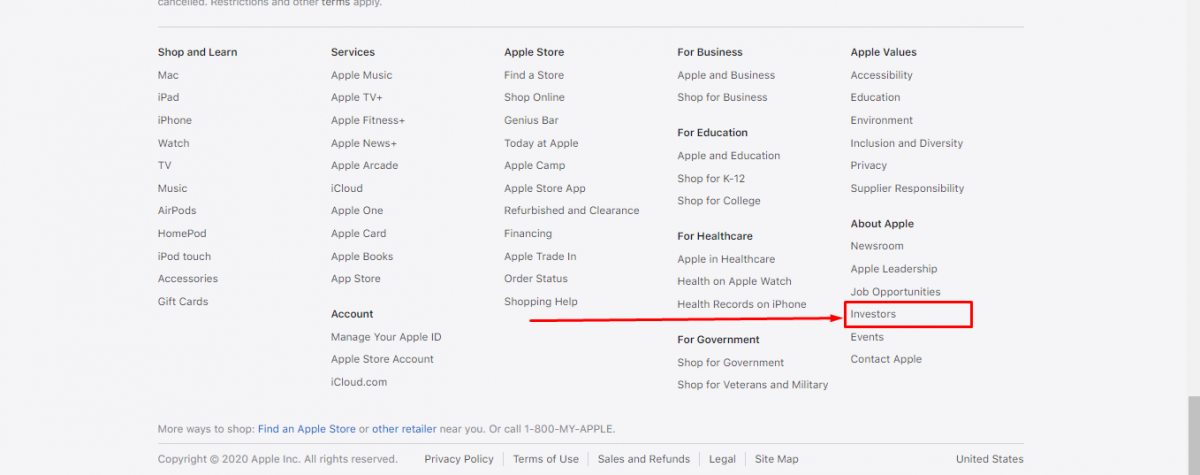

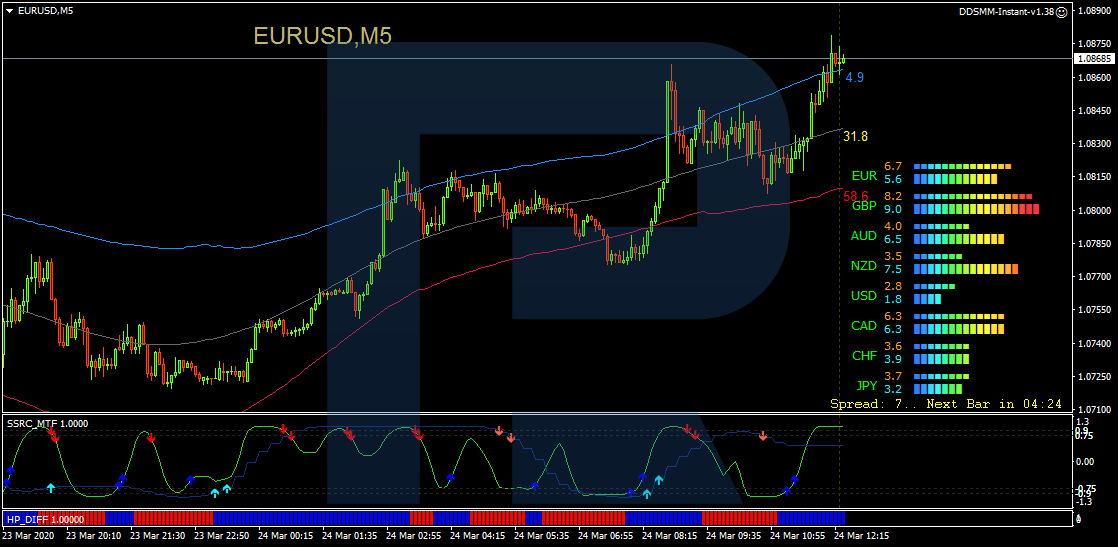

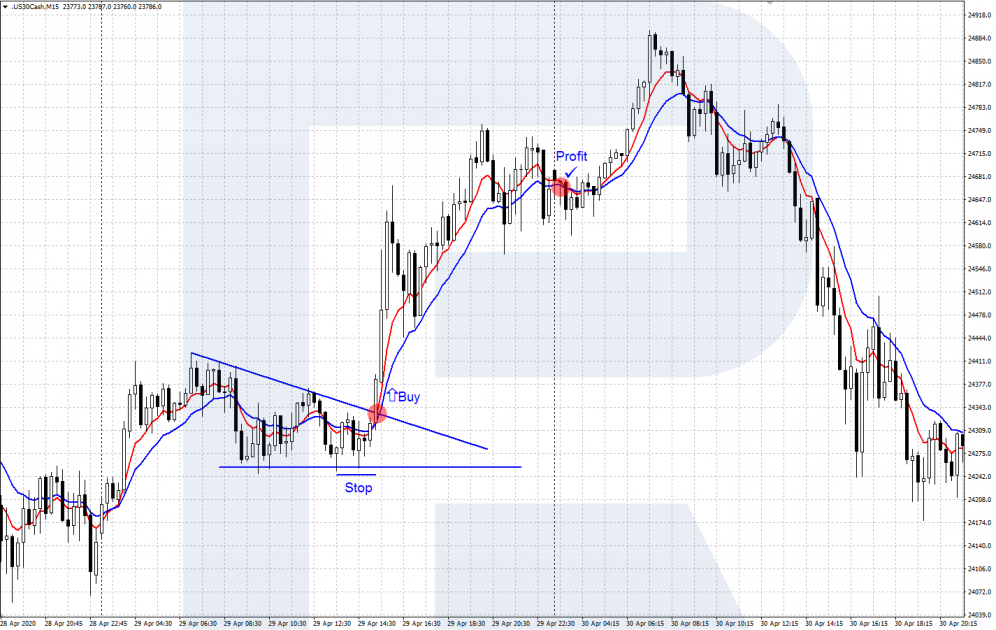

A bank deposit will not bring a lot of profit from 1,000 USD; the profit is unlikely to cover up for inflation even. The first thing that comes up in your mind is marginal trading. It allows opening trades for sums much larger than you have on your deposit. Leverage is most often used in the currency market, however, it requires the knowledge of tech analysis and constant monitoring of what is going on. Also, leverage entails additional risks for the investor.

Our blog is about trading, so let us try to make up our mind about investing in risky assets and whether you can make money there, or whether it is better to invest your 1,000 USD conservatively.

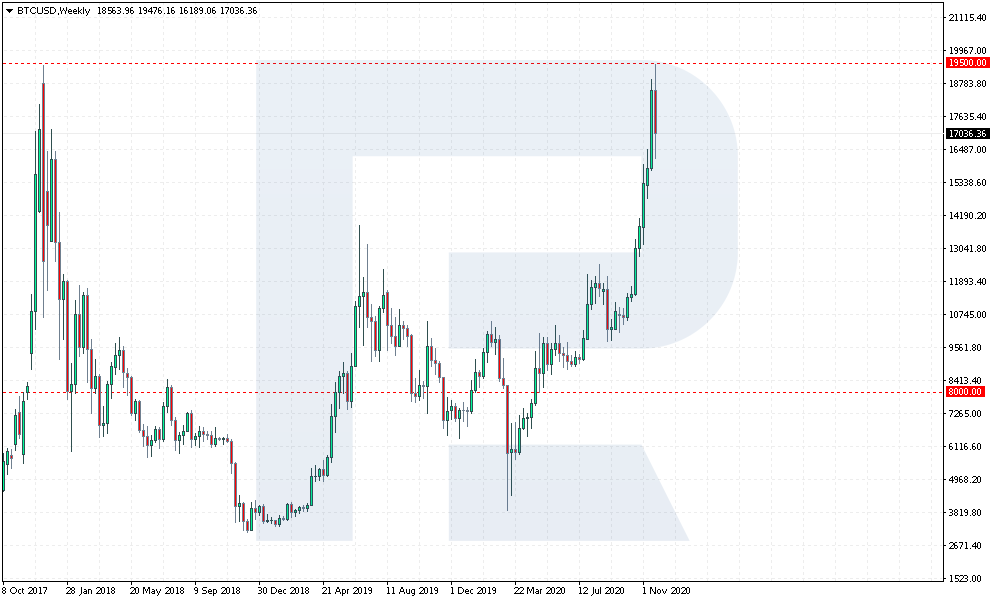

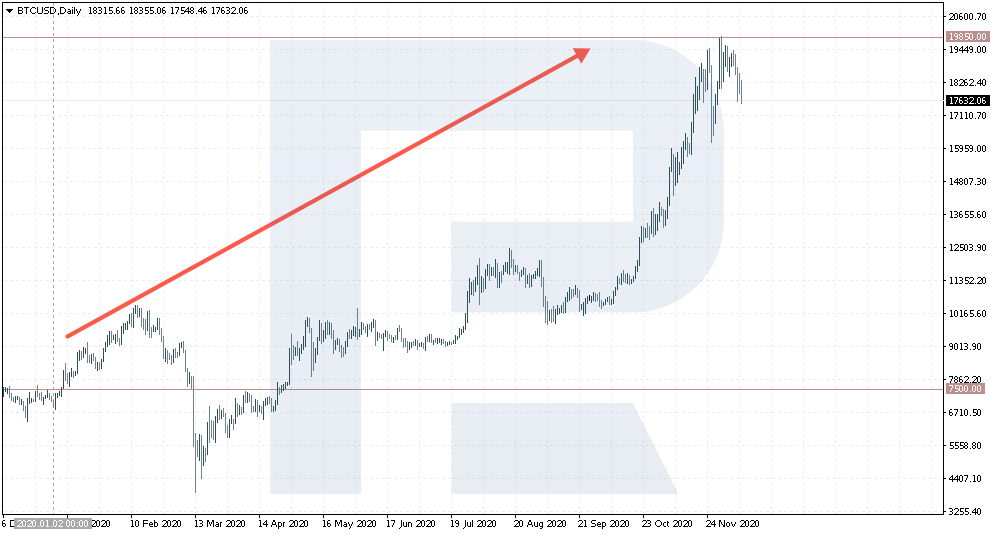

Investments in cryptocurrencies

Among super-profitable ones, crypto investments have become trendy. The price for such assets has been sky-rocketing for the last three years. However, after incredible growth, cryptocurrencies switched to downtrends and flats. But the uptrend managed to restore, and since this year, the price for the BTC has grown from 7,500 USD to 19,850 USD. For example, if you bought the Bitcoin for 1,000 USD at the beginning of 2020, you could receive 2,500 USD today, which makes 1,500 USD of profit.

Today, people are investing in cryptocurrencies again. A company that heated the market tangibly is PayPal that made storing and buying crypto possible for citizens of the USA. In the company, they say that the demand for such services turned 3-4 times higher than expected. Investment funds are also considering cryptocurrencies as potentially profitable and add them to their strategies.

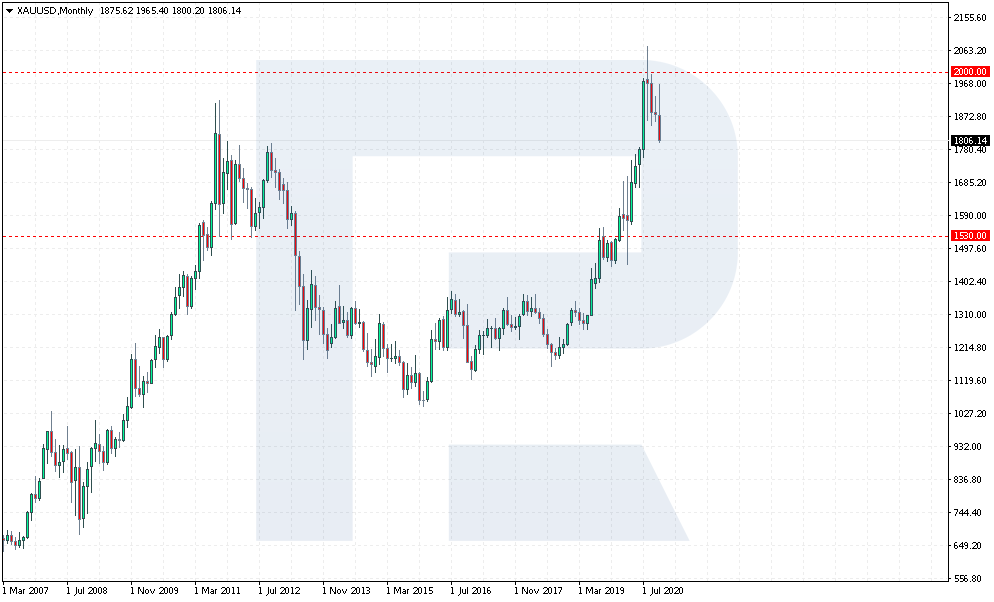

Investments in gold

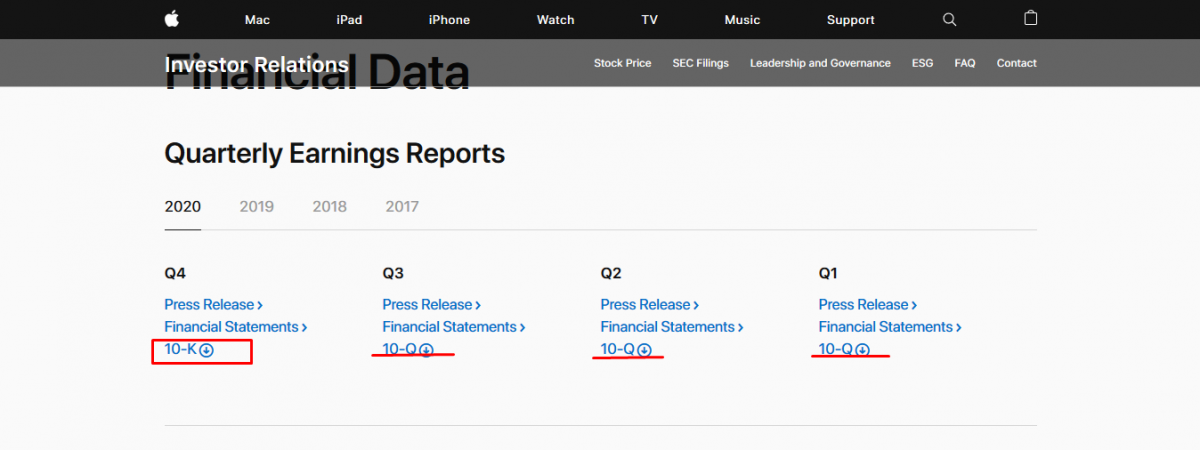

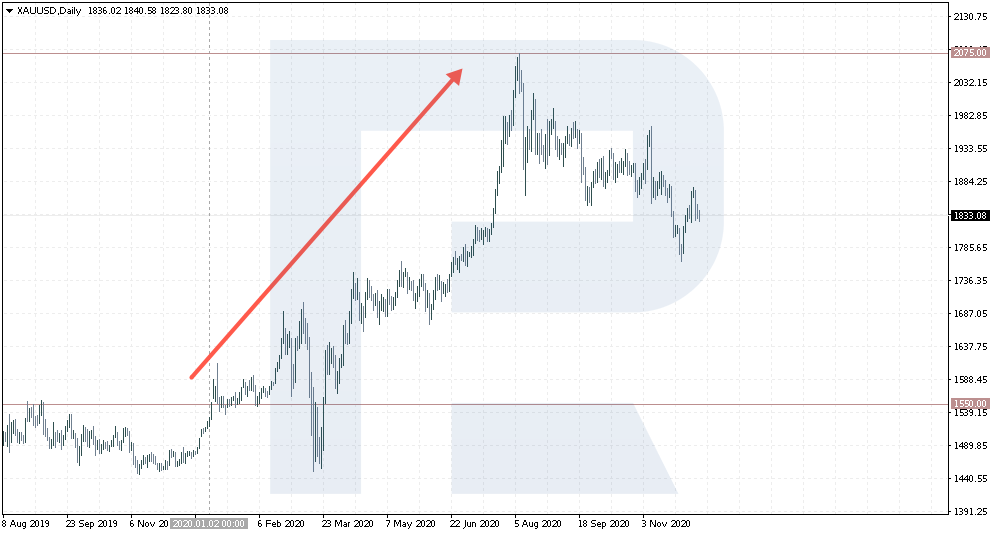

We have discussed investing in this precious metal in the article “How to Invest in Gold?”. The easiest way was, again, investing in CFDs. Such contracts allow for buying and selling gold without purchasing it physically, just making money on the difference in the prices.

At the beginning of 2020, gold cost 1,550 USD per troy ounce. In August, the quotations reached a high of 2,072 USD; currently, they are trading at 1,846 USD. By buying the instrument for 1,000 USD at the beginning of the year, you could make a good profit in the middle of the year already. As for the long run, the pandemics might cause investors to buy gold, which will provoke another increase in the price of the precious metal.

The growth of gold is unlikely to be as impressive as that of cryptocurrencies as it is a more conservative investment instrument. Anyway, many traders these days compare gold and the BTC noting that the latter is replacing the precious metal because it is to move and pay with, and it is supported by traders’ interest.

As for the charts, the crypto prices are at their highs while the gold price dropped from 2,070 to 1,846 USD. Cryptocurrencies are more volatile while conservative investors prefer gold.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team