Walt Disney and Sony Stocks: Will Entertainment Industry Survive?

Author: Maks Artemov

There are plenty of companies and corporations in the entertainment sphere, and all of them are noticeable to some extent. However, today I have picked up the companies that are suffering from COVID-19, as many others are, but manage to stay the course. Its The Walt Disney Company (NYSE: DIS) and Sony Corporation (NYSE: SNE).

They are the giants of entertainment, video, and television. Each company has its activity streams but they are united in one sphere - the entertainment industry, in which they are the leaders. Each corporation has its specialties that help not only to survive the crisis but only make a profit in an unstable market situation.

Now, let us consider these companies and their stocks separately and compare the fundamental data to tech analysis. We will try to draw parallels between the corporations and forecast their future market behavior.

The Walt Disney Company

When the quarantine began, many people all over the world stopped going to the cinema and amusement parks; the Walt Disney Company was the one to suffer first, nonetheless, the company found a way out.

Fundamental analysis of Disney

The growth of the number of clients on the streaming platforms somewhat compensates for a lack of them in the amusement parks: from the end of March till the beginning of May 2020, the number of the subscribers of Disney+ online services grew from 33.5 million to 54.5 million, which was a record for the company.

It should be mentioned that the Disney platform is a serious rival to Netflix: it may not harm the latter gravely but will for sure play on the nerves. The reason for which Disney may not push Netflix out of the market is the fact that they have different subscribers.

Switching to online entertainment will help Disney cover up the significant losses that it suffers from the amusement parks and other offline entertainment facilities lying idle. During the last financial year, the income of Disney grew by 20.7% per annum. I think this is a serious promise of future success. These days, many of the company's rivals are struggling to minimize their losses, only dreaming about a profit.

Tech analysis of Disney stocks

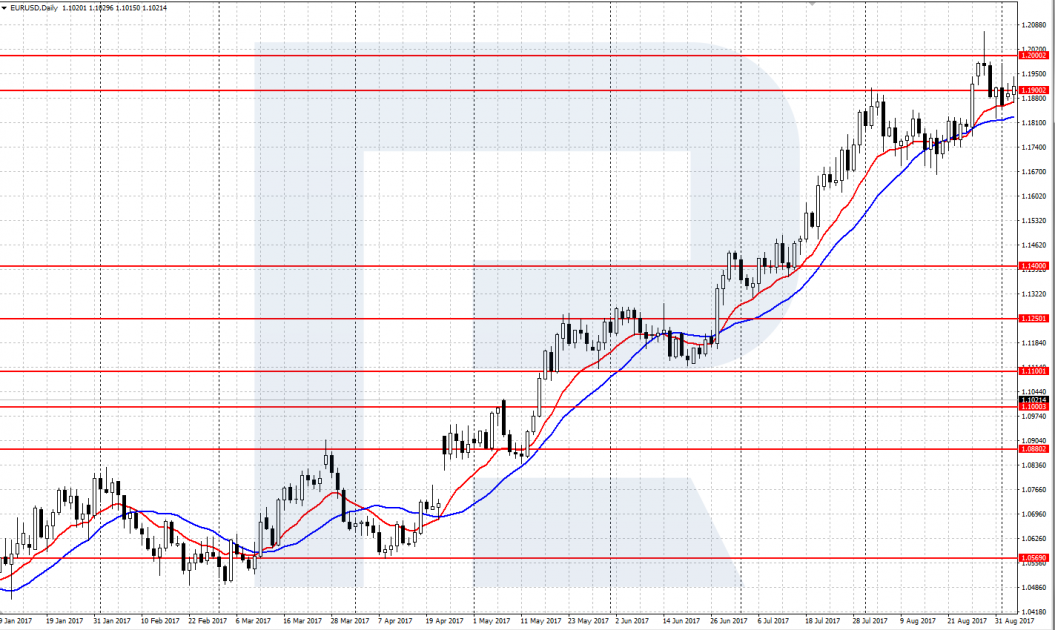

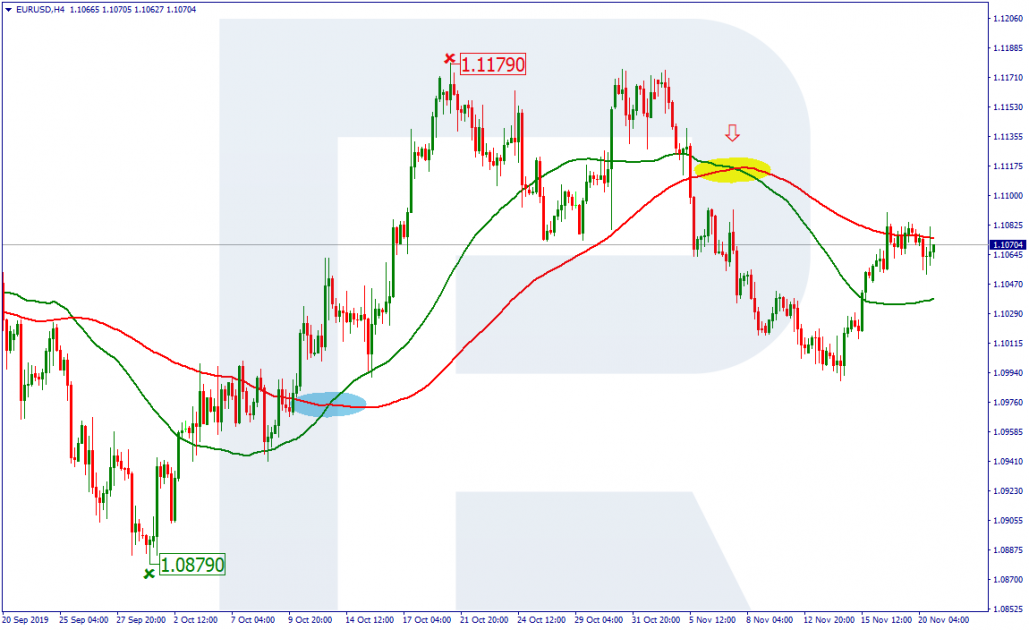

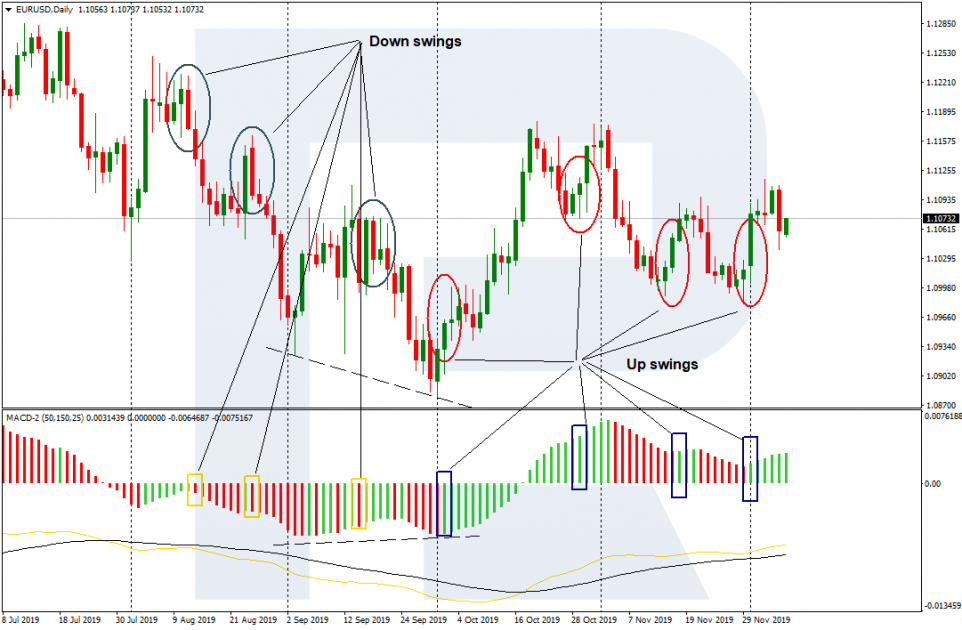

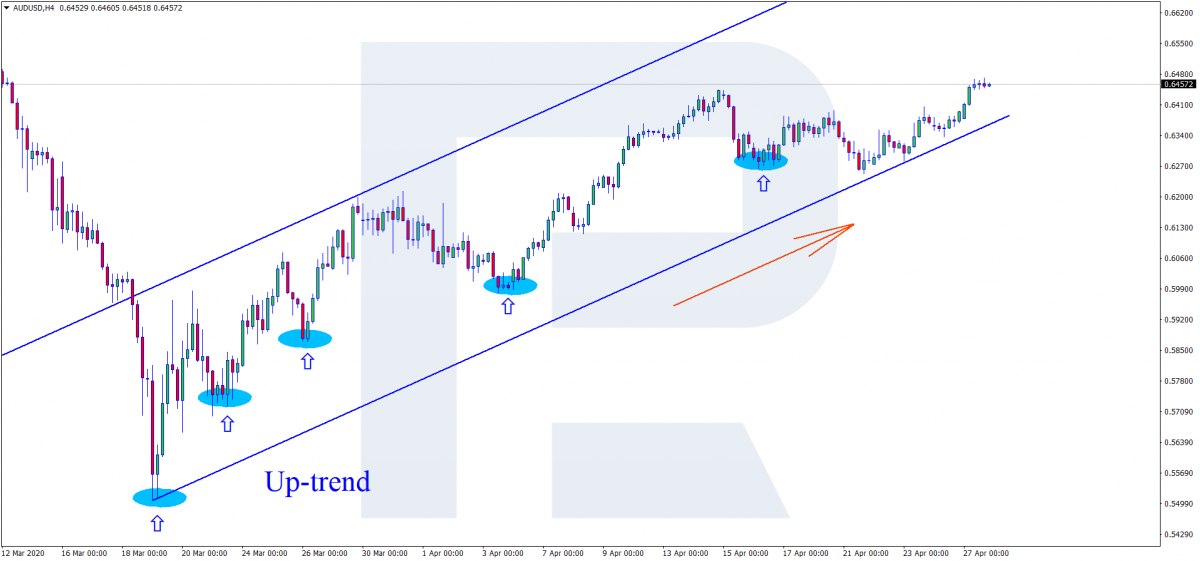

On D1, the stocks are restoring their positions after a swift decline. They keep growing with small pullbacks inside an ascending channel and have crossed the EMA50.

Crossing the EMA50 does not mean a trend reversal: while the price is heading for the EMA200, it might be too bold to forecast a change in the trend. However, the development of an uptrend is obvious, and many financial analysts also forecast further growth. I suppose we should agree with them.

The pandemics may slow down the growth a bit, however, I still recommend buying. The aim of the growth is currently $125.00 - $127.00. The price may correct on its way, remaining inside the ascending channel borders.

Sony Corporation

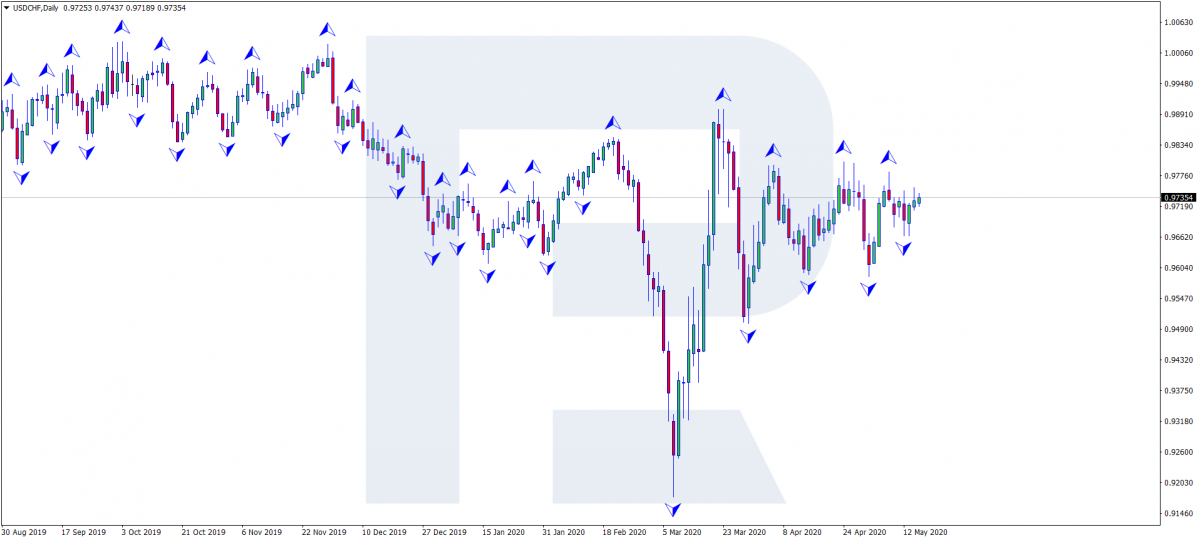

Regardless of the company's specialization being the production of electronic devices and gadgets, Sony is currently a strong rival to Disney. In the sphere of technology, the competition is too tough for Sony but it is trying hard. However, it is doing much better in the sphere of entertainment.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team