Forex Forecast and Cryptocurrencies Forecast for October 15-19, 2018

First, a review of last week’s forecast:

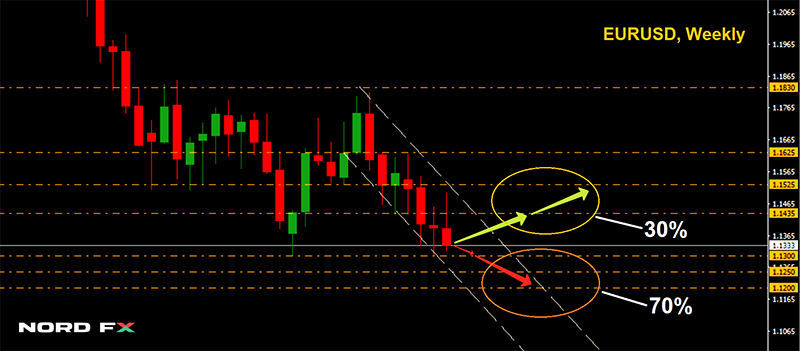

- EUR/USD. The US market sees a continuing correction, which leads to a weaker dollar. On Thursday, October 11, the US stock index S&P500 lost the next 2%, causing investors to get rid of dollar assets. The process was also pushed up by the news that Donald Trump wants to meet with his Chinese counterpart Xi Jingping during the G20 summit. This was taken as a possible weakening of the US position. As a result, having made a throw from south to north, the pair returned to the borders of the mid-term side corridor 1.1525-1.1830, which started in May, and completed the five-day period at 1.1560;

- GBP/USD. The weakening of the dollar could not help but affect this pair. On Friday, October 12, it rose to the height of 1.3255, and the difference between the two-week minimum and maximum exceeded 335 points. True, at the very end of the week, after an impressive growth, there followed a rebound down, and the pair met the end of the session at around 1.3150;

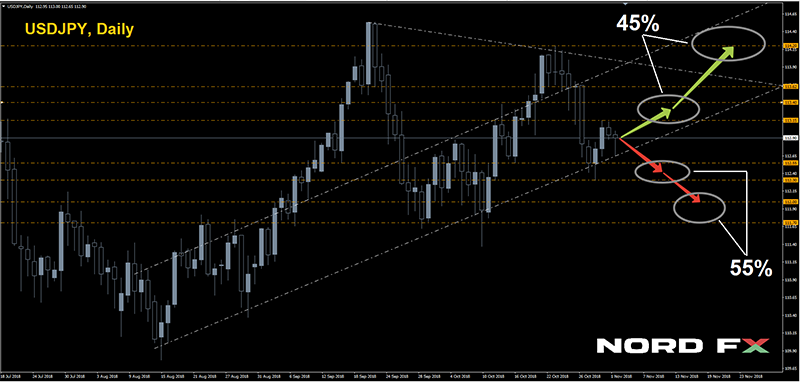

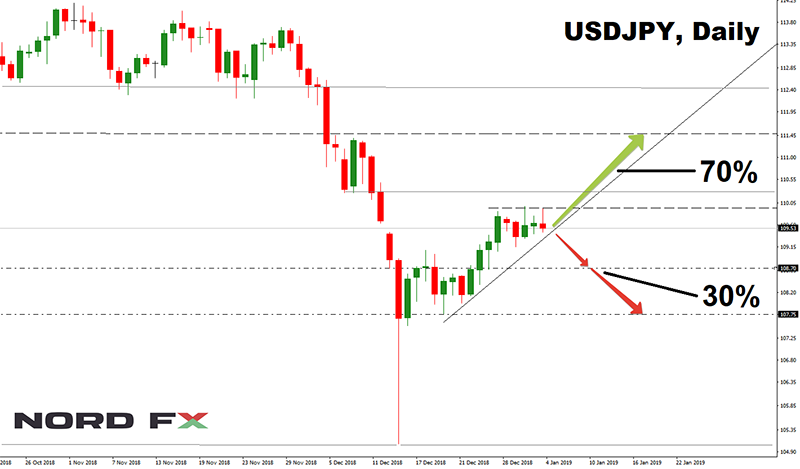

- USD/JPY. The Japanese yen returned to the mid-September values, thus strengthening against the dollar. The formation of this trend was influenced by the negative reaction of major players to the increasing volatility in the world markets and their desire to hide part of their capital in a quiet Japanese harbor. As a result, the final chord of the week sounded in the zone 112.20;

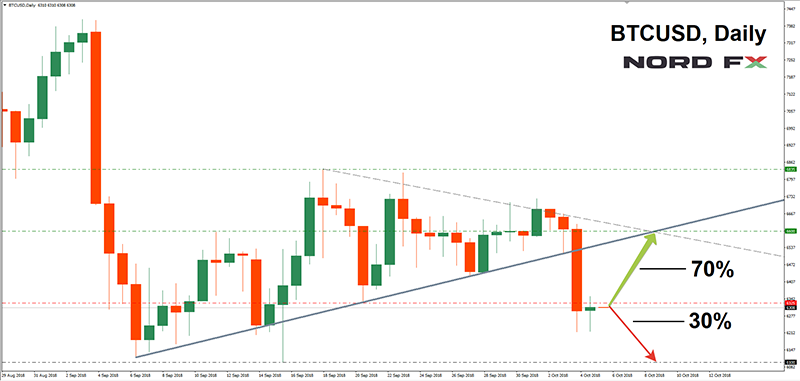

- Cryptocurrencies. One could say that there are no changes on the digital front, because the BTC/USD pair has not gone below the level of mining profitability. Although it made investors nervous, in just a few hours the price of bitcoin fell by $420, dropping to a three-week low of $6.215. The fall of the benchmark cryptocurrency was caused by the collapse of the US stock market and the IMF report, which spoke about the problems of cybersecurity and that digital currencies could become a new cause of the global financial system vulnerability. The absence of the American regulator (SEC) decision on the request for the ETF launch did not add optimism to the market either.

The rest of the top pairs followed the bitcoin down as well. The total capitalization of the crypto market declined by $15 billion. Although bitcoin and such altcoins as l litecoin (LTH/USD), ripple (XRP/USD) and ethereum (ETH/USD), managed to win back some losses by the end of the week, the victory remained for bears.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

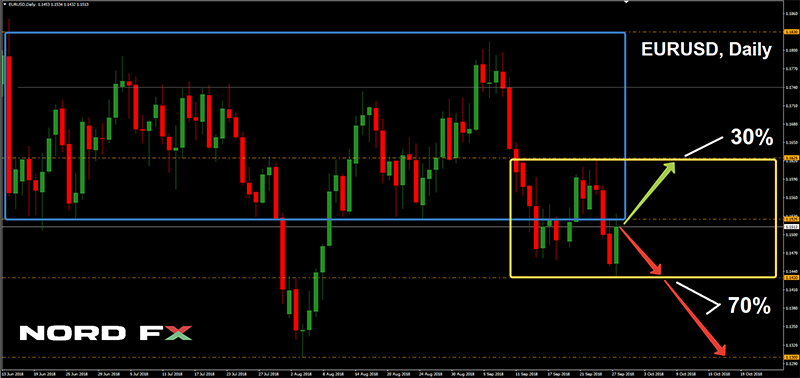

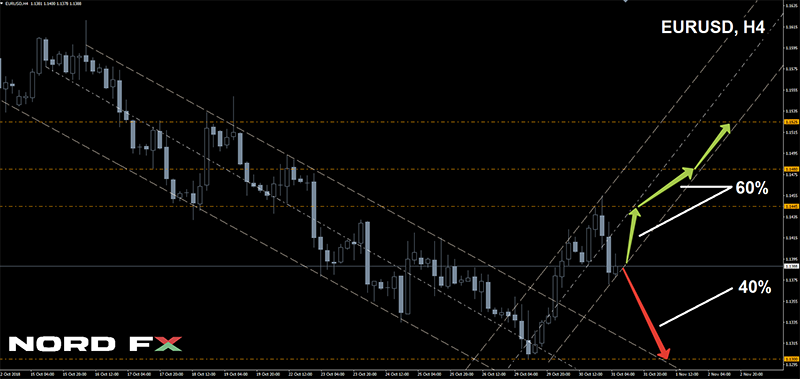

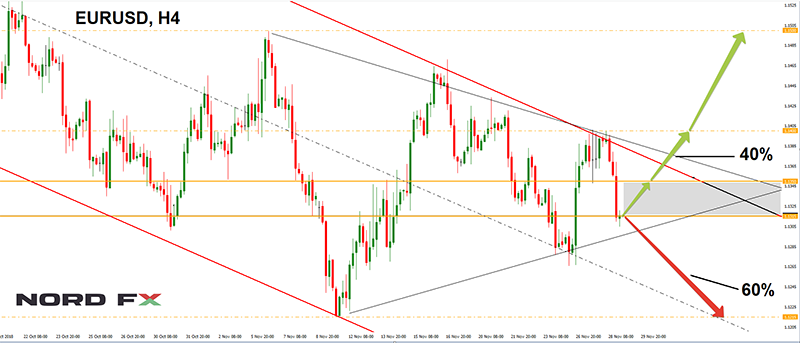

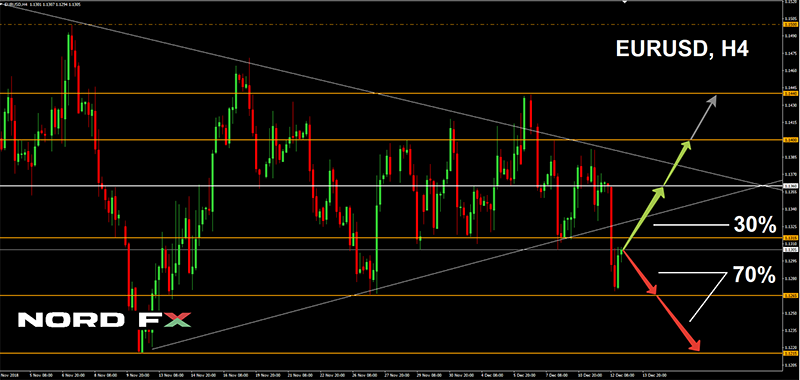

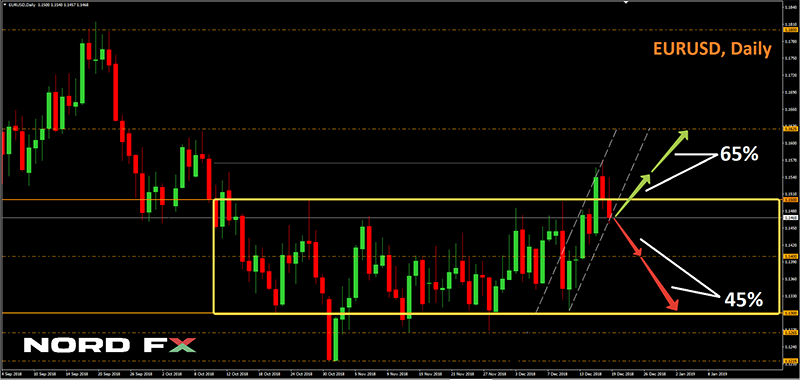

- EUR/USD. The next week is literally overflowing with events that may affect the formation of trends in the dollar pairs. These are both macroeconomic statistics from the USA, and data on inflation in the Eurozone, Great Britain and China. The current economic sentiment index will be presented by Germany and the EU, and the minutes of the US Federal Reserve Committee meeting will be published on Wednesday. A serious impact on the market will be rendered by the data on China's GDP, and, of course, the results of the EU Brexit summit.

All these events involve a huge number of scenarios. In such a situation, both oscillators and trend indicators are in complete confusion. But most experts (60%) believe that, returning to the boundaries of the corridor 1.1525-1.1830, the pair will move up for a while, first towards the center, and then towards the upper boundary of this channel. The targets are 1.1650 and 1.1735.

The alternative scenario is supported by the fact that, after updating the highs, the yield on 10-year US bonds went down, indicating a possible strengthening of the dollar. The support levels are 1.1430 and 1.1300;

- GBP/USD. As in the previous case, here again 60% of analysts have given their votes for the upward movement of the pair. In their opinion, the pair should rise to the zone 1.3225-1.3245. The next target is the height of 1.3300. According to the experts, there are still many opportunities for the pound to strengthen, and, first of all, the market is waiting for positive news regarding Brexit.

80% of trend indicators and 70% of oscillators on D1 also vote for the growth of the pair, and a number of them indicate that the pair is oversold.

It should be noted that in the medium term the odds go over to the bears and here it is already 55% of experts, supported by graphical analysis on D1, who expect the pair to fall to the lows of early October in the zone 1.2920;

- USD/JPY. For this pair, the bears win with a small margin (45%). In their opinion, the dollar will continue to fall, and the quotes will approach the level of 111.00. This scenario is supported by 70% of trend indicators and oscillators. However, it is already 20% of oscillators on D1 that signal about the pair being oversold.

35% of analysts vote for lateral movement, and the remaining 20% are for an uptrend with the targets of 113.15, 114.00 and 114.55.

As for the graphical analysis, according to its readings, the pair will first rise to the resistance of 113.15, and then abruptly go down to support 111.70, and then further, trying to reach the local bottom in the 111.00 zone;

- Cryptocurrencies. In its fall on Thursday, October 11, the bitcoin broke through the uptrend support line, which started back on September 8th. If the fall continues, we will be able to see the pair BTC/USD in the $6,100 zone. The next support is at the level of $5,870. However, in the absence of sharply negative news, the most likely, according to analysts, is the return of the bitcoin to the $6,325-6,835 zone. This forecast is based, among other things, on the results of the Chainalysis study, which has shown that the major players very often try to stabilize the rate by buying coins during the time of correction. That is what is happening at the moment.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#eurusd #gbpusd #usdjpy #usdchf #forex #forex_example #signals #forex #cryptocurrencies #bitcoin

https://nordfx.com/