Japan’s economy will probably shrink for the first time for two years

More here: https://fbs.com/analytics/news/japa...nglish&utm_content=SebastianAnalyticsDCashPal

11.05.2018

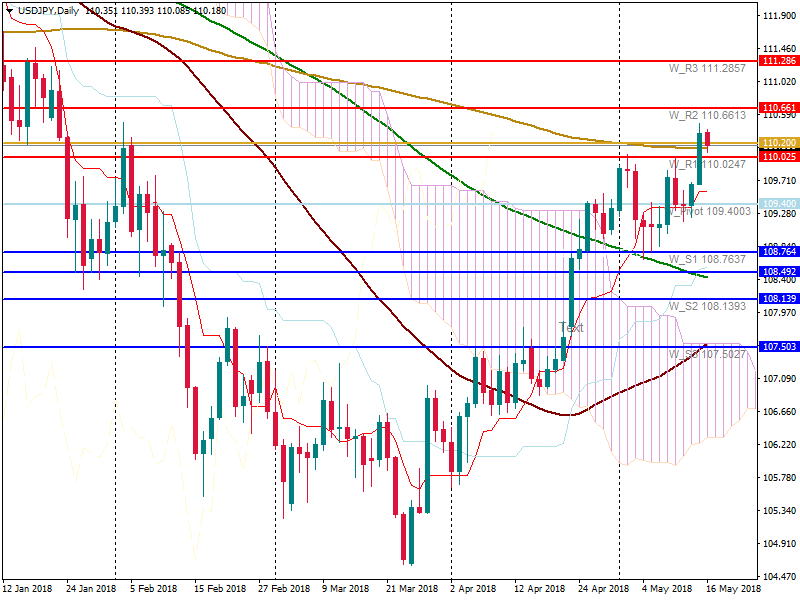

It’s expected that in the first quarter the Japanese economy will slump for the first time for two years due to poor private consumption as well as a milder export demand, the Reuters survey disclosed on Friday.

Negative reading, albeit quite insignificant, would mean the end of Japan's longest period of economic expansion – up to eight straight quarters of surge - since the bubble of the 1980s.

However, market experts told that the expected weakness in January-March could only be a temporary mild phenomenon, arguing that higher prices for fresh vegetables along with bad winter weather probably affected consumer spending in the first quarter.

The global economy is still firm, suggesting that Japan will restore momentum in the second quarter, as financial analysts pointed out.

According to a poll of 18 market experts, the gross domestic product headed south 0.2% in the first quarter after a 1.6% surge in the last quarter of the previous year.

It’s going to be the first reduction in the world's number three economy since the end of 2015.

The reduction on an annualized basis is going to provoke a zero reading for the previous quarter.

Market experts added that the Japanese economy has been reviving steadily, but it feels like it has temporarily stopped.

Economic indicators, including factory production and business sentiments of firms, have demonstrated a softening of economic dynamics. Apparently, data on GDP clearly reflects these phenomena.

Market experts are assured that this quarter there was no surge in private consumption, after it tacked on by 0.5% in the last quarter of the previous year. By the way, private consumption accounts for approximately 60% of GDP.

Additionally, the survey disclosed that external demand also didn’t contribute to this Asian country’s GDP.

More here: https://fbs.com/analytics/news/japa...nglish&utm_content=SebastianAnalyticsDCashPal

11.05.2018

It’s expected that in the first quarter the Japanese economy will slump for the first time for two years due to poor private consumption as well as a milder export demand, the Reuters survey disclosed on Friday.

Negative reading, albeit quite insignificant, would mean the end of Japan's longest period of economic expansion – up to eight straight quarters of surge - since the bubble of the 1980s.

However, market experts told that the expected weakness in January-March could only be a temporary mild phenomenon, arguing that higher prices for fresh vegetables along with bad winter weather probably affected consumer spending in the first quarter.

The global economy is still firm, suggesting that Japan will restore momentum in the second quarter, as financial analysts pointed out.

According to a poll of 18 market experts, the gross domestic product headed south 0.2% in the first quarter after a 1.6% surge in the last quarter of the previous year.

It’s going to be the first reduction in the world's number three economy since the end of 2015.

The reduction on an annualized basis is going to provoke a zero reading for the previous quarter.

Market experts added that the Japanese economy has been reviving steadily, but it feels like it has temporarily stopped.

Economic indicators, including factory production and business sentiments of firms, have demonstrated a softening of economic dynamics. Apparently, data on GDP clearly reflects these phenomena.

Market experts are assured that this quarter there was no surge in private consumption, after it tacked on by 0.5% in the last quarter of the previous year. By the way, private consumption accounts for approximately 60% of GDP.

Additionally, the survey disclosed that external demand also didn’t contribute to this Asian country’s GDP.