EUR/USD Daily Analytics

14:57 14.11.2017

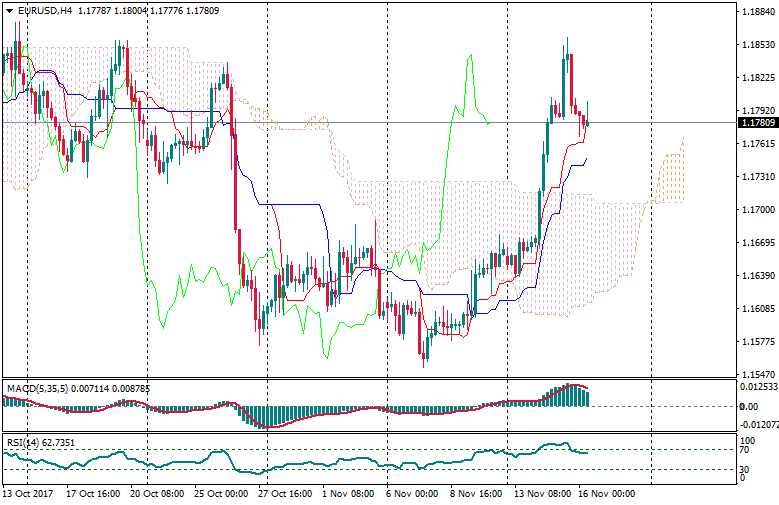

The price has broken all the Moving Averages, but there isn't any reversal pattern so far, cause all the last candles are bullish. So, if the 89 Moving Average acts as support, there'll be an opportunity to have another upward price movement.

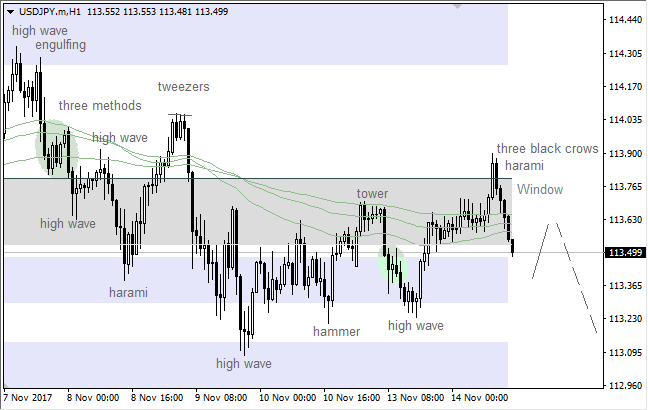

Bulls reached the "Window", but there isn't any reversal pattern for now. However, if any bearish pattern forms in the coming hours, we could have a downward correction.

More:

https://fbs.com/analytics/articles/eur-usd-bulls-reached-the-window-5077

14:57 14.11.2017

The price has broken all the Moving Averages, but there isn't any reversal pattern so far, cause all the last candles are bullish. So, if the 89 Moving Average acts as support, there'll be an opportunity to have another upward price movement.

Bulls reached the "Window", but there isn't any reversal pattern for now. However, if any bearish pattern forms in the coming hours, we could have a downward correction.

More:

https://fbs.com/analytics/articles/eur-usd-bulls-reached-the-window-5077