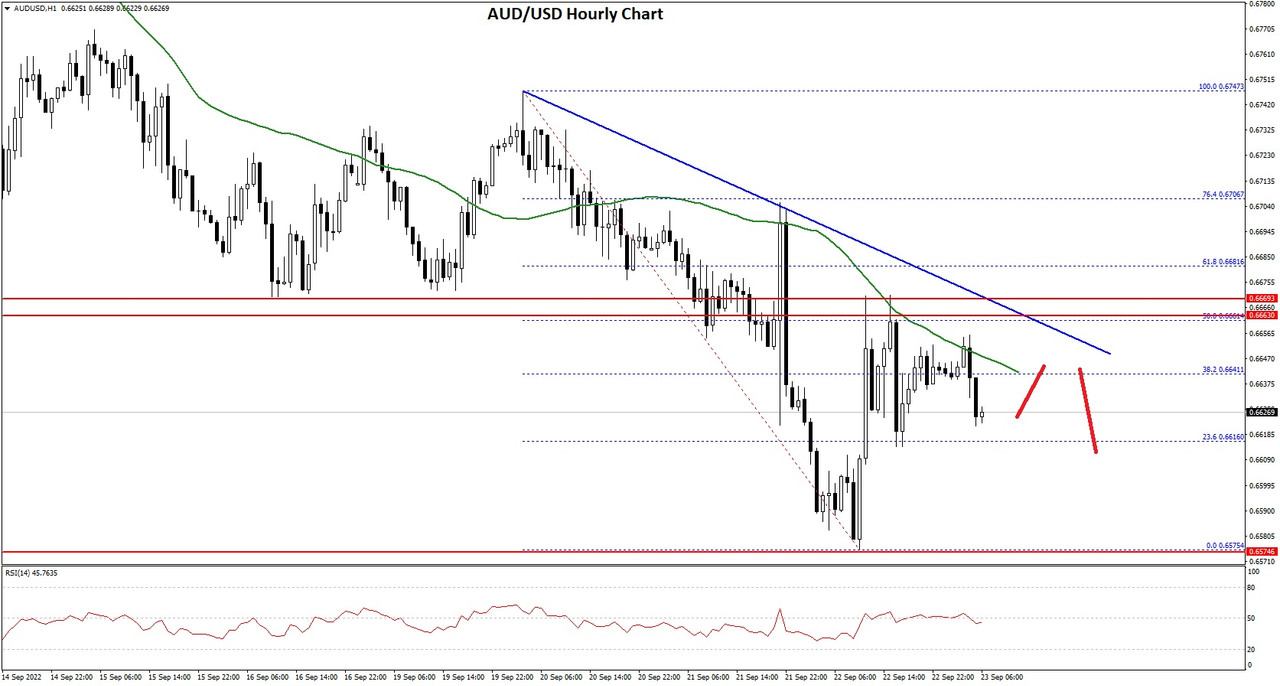

BTCUSD and XRPUSD Technical Analysis – 27th SEP 2022

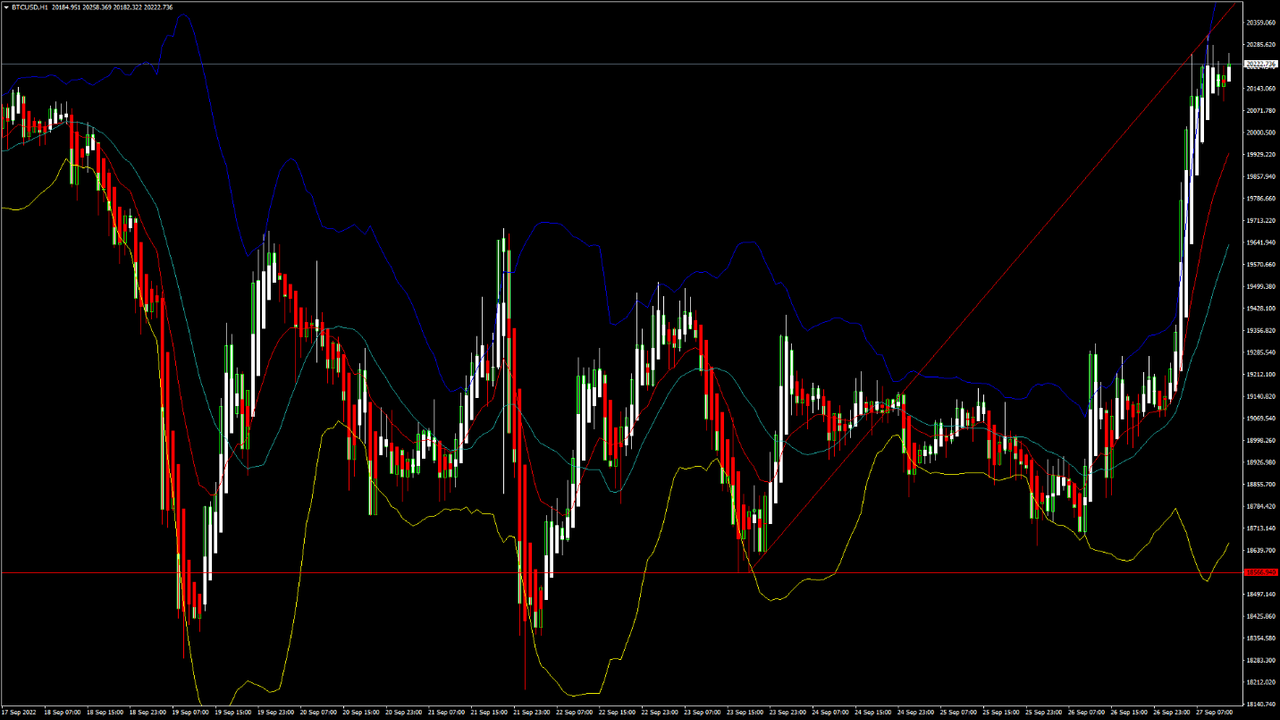

BTCUSD: Double Bottom Pattern Above $18566

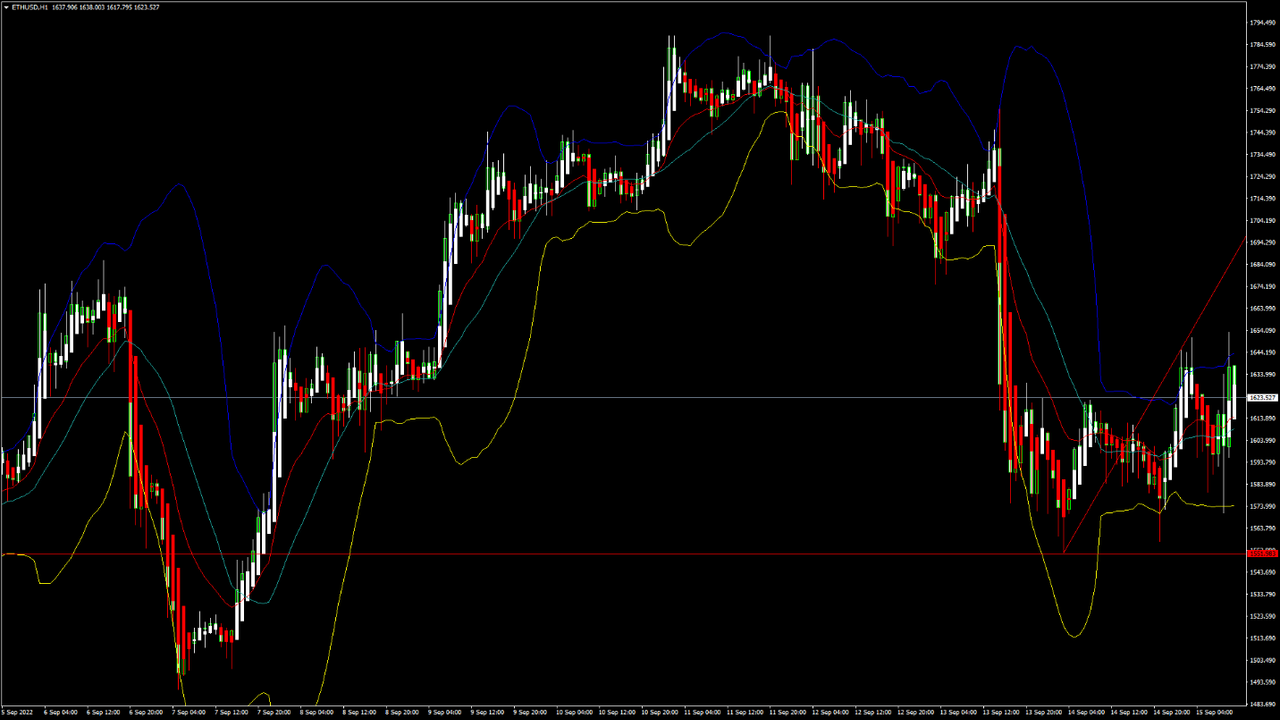

Bitcoin was unable to sustain its bearish momentum and after touching a low of 18279 on 21st Sep, the price has continued to escalate upwards and crossed the $20000 handle today in the European trading session.

This upside break was long overdue and now marks the beginning of rebound towards the $25000 level.

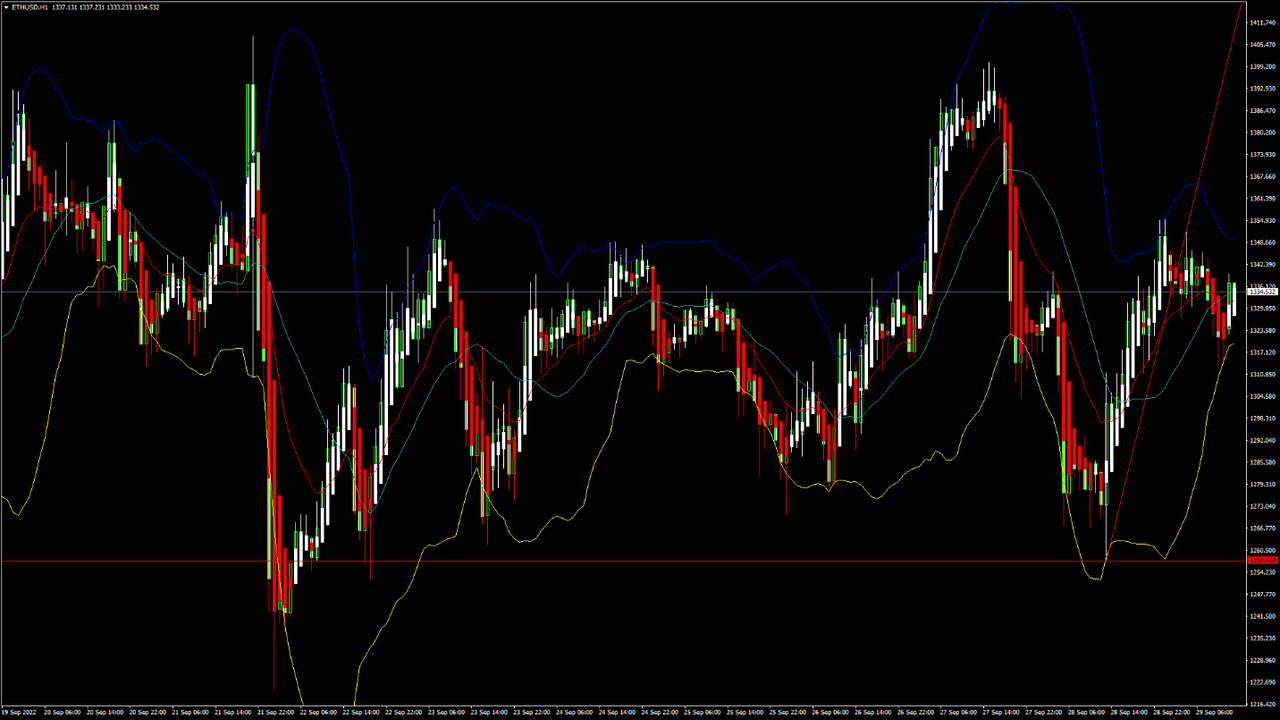

We can see the formation of bullish engulfing lines in the 15-minute and weekly time frames.

The momentum indicator is back over zero indicating a bullish scenario in both the 30-minute and daily time frames.

We can clearly see a double bottom pattern above the $18566 handle which is a bullish reversal pattern because it signifies the end of a downtrend and a shift towards an uptrend.

Bitcoin touched an intraday low of 19097 in the Asian trading session and an intraday high of 20310 in the European trading session today.

Both the STOCH and STOCHRSI are indicating overbought levels which means that in the immediate short term, a decline in the prices is expected.

The relative strength index is at 75 indicating an OVERBOUGHT market, and the possibility of some downwards correction due to profit taking by the medium-term investors.

Bitcoin is now moving above its 100 hourly simple moving average and below its 200 hourly exponential moving averages.

Most of the major technical indicators are giving a STRONG BUY signal, which means that in the immediate short term, we are expecting targets of 22000 and 23500.

The average true range is indicating LESS market volatility with a strong bullish momentum.

- Bitcoin: bullish reversal seen above $18566.

- The Williams percent range is indicating an overbought level.

- The price is now trading just above its pivot level of $20179.

- All of the moving averages are giving a STRONG BUY market signal.

Bitcoin: Bullish Reversal Seen Above $18566

The price of bitcoin continues to rise amid the buying pressure and improved investor sentiments. We are now looking at the important target levels of $22000 and $25000 in the medium-term ranges.

The adaptive moving averages AMA20 and AMA50 are both giving a bullish trend reversal signal in the 15-minute and daily timeframes.

We can see the formation of a bullish harami pattern in the 2-hour time frame.

We have also detected a bullish opening of the markets indicating the underlying bullish sentiment.

The immediate short-term outlook for bitcoin is bullish, the medium-term outlook has turned bullish, and the long-term outlook remains neutral under present market conditions.

Bitcoin’s support zone is located at $19000, and the price continues to remain above these levels for the continuation of the bullish reversal in the markets.

The price of BTCUSD is now facing its classic resistance level of 20253 and Fibonacci resistance level of 20298 after which the path towards 22000 will get cleared.

In the last 24hrs, BTCUSD has increased by 5.87% by 1120$ and has a 24hr trading volume of USD 48.845 billion. We can see an increase of 46.08% in the trading volume compared to yesterday, due to global buying pressure by the long-term investors.

The Week Ahead

The price of bitcoin is moving in a consolidation zone above the $20000 level. Further upsides are projected at $21000 and $22500 as the immediate targets.

The price of bitcoin reached its peak value of $69000 last year the month of November, and at the present level of $20000, we still need to recover ground towards the $40000 level, which if reached will mark a gain of 100% from the present market level.

The history of bitcoin price action shows that it is capable of doing so, and has done in the past.

The daily RSI is printing at 52 which indicates a neutral level and a move towards the consolidation phase in the markets.

The prices of BTCUSD will need to remain above the important support level of $19000 this week.

The weekly outlook is projected at $22000 with a consolidation zone of $21500.

Technical Indicators:

The moving averages convergence divergence (12,26): is at 323.90 indicating a BUY

The ultimate oscillator: is at 62.28 indicating a BUY

The rate of price change: is at 5.93 indicating a BUY

The average directional change (14): is at 51.06 indicating a BUY

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.