AUD/USD: the uptrend is strengthening

Current trend

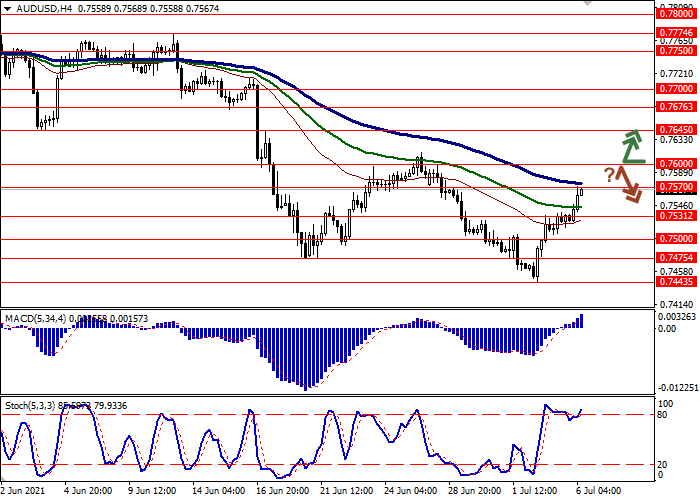

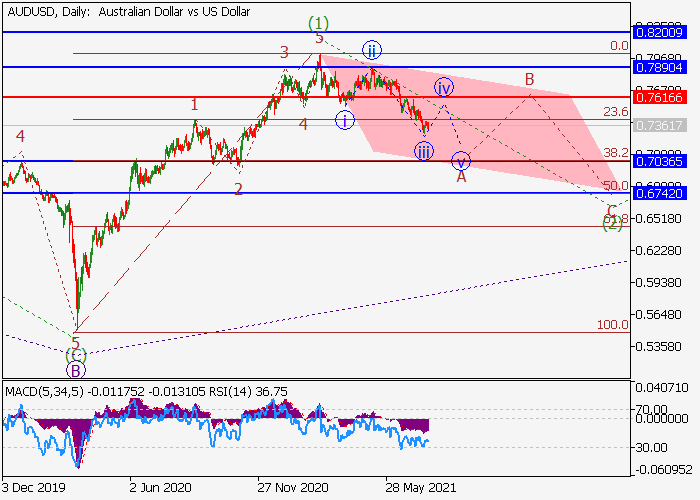

AUD has shown significant gains against USD in trading in Asia, updating local highs since the end of June and actively testing 0.7570 for a breakout.

The instrument significantly benefited from the publication of Friday's US labor market report, as investors rushed to look for alternatives to the "safe" USD, expecting that the US Fed will maintain its current monetary policy for a while. "Bullish" sentiment was supported yesterday by moderately optimistic macroeconomic statistics from Australia. In particular, investors reacted positively to a 0.4% MoM growth in retail sales in May after a 0.1% MoM growth in April.

Today, traders are focused on the meeting of the Reserve Bank of Australia (RBA), at which, as expected, the regulator left the interest rate level unchanged at 0.1%. As for the bond buyback program, the RBA intends to prolong it after completion in early September. The regulator is expected to buy bonds worth 4B dollars a week until at least mid-November.

Support and resistance

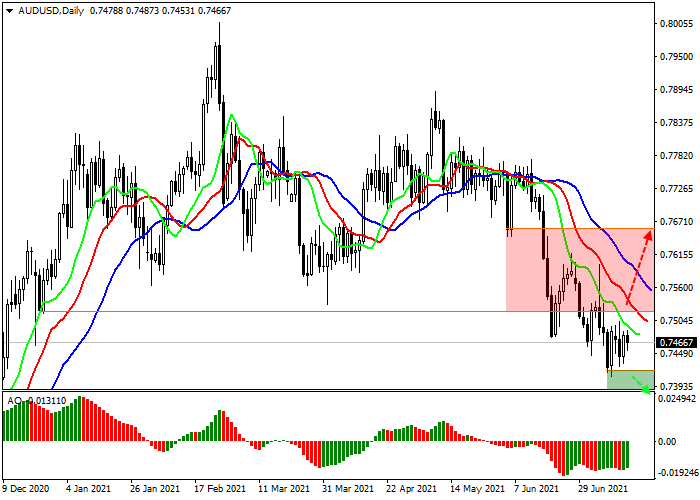

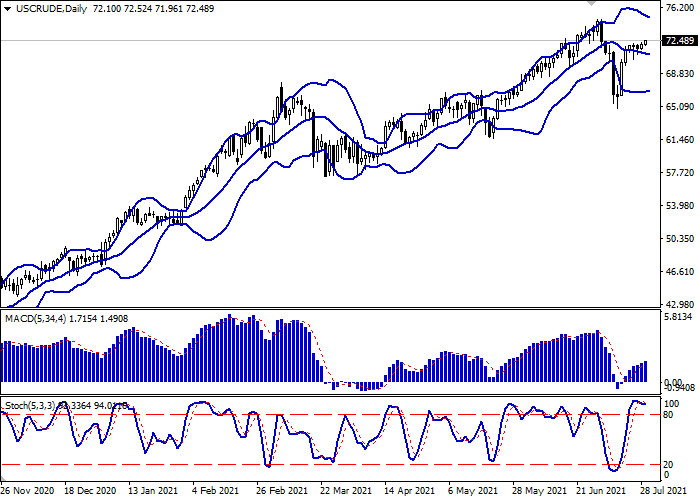

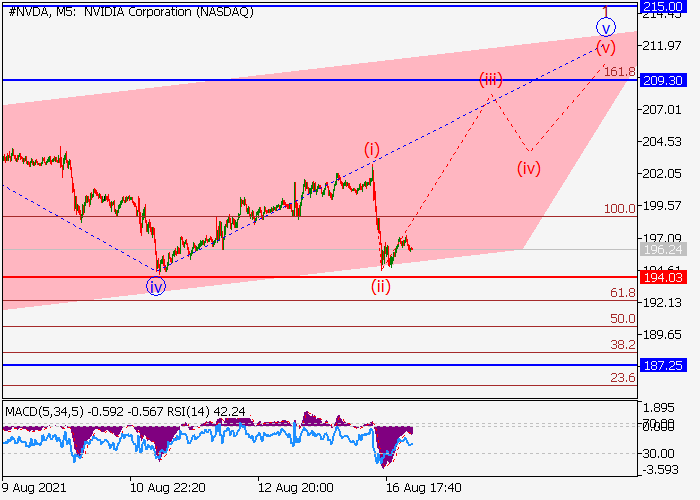

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is narrowing from above, being spacious enough for the current activity level in the market. MACD has reversed to growth having formed a strong buy signal (located above the signal line). Stochastic keeps its upward direction but is approaching its highs rapidly, which reflects risks of the overbought AUD in the ultra-short term.

Resistance levels: 0.7570, 0.7600, 0.7645, 0.7676.

Support levels: 0.7531, 0.7500, 0.7475, 0.7443.

Current trend

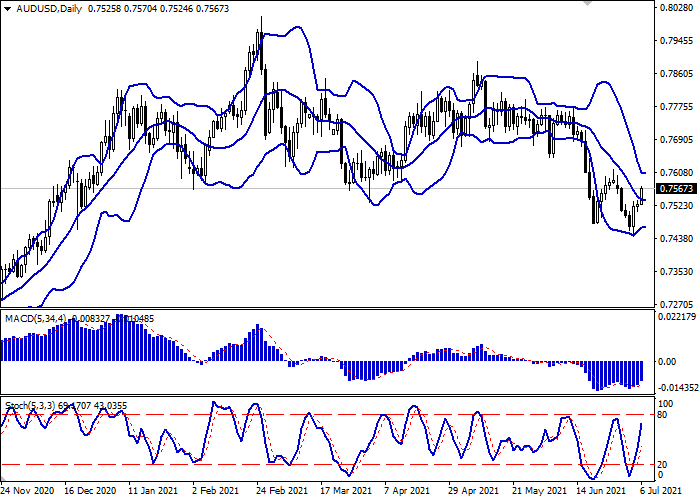

AUD has shown significant gains against USD in trading in Asia, updating local highs since the end of June and actively testing 0.7570 for a breakout.

The instrument significantly benefited from the publication of Friday's US labor market report, as investors rushed to look for alternatives to the "safe" USD, expecting that the US Fed will maintain its current monetary policy for a while. "Bullish" sentiment was supported yesterday by moderately optimistic macroeconomic statistics from Australia. In particular, investors reacted positively to a 0.4% MoM growth in retail sales in May after a 0.1% MoM growth in April.

Today, traders are focused on the meeting of the Reserve Bank of Australia (RBA), at which, as expected, the regulator left the interest rate level unchanged at 0.1%. As for the bond buyback program, the RBA intends to prolong it after completion in early September. The regulator is expected to buy bonds worth 4B dollars a week until at least mid-November.

Support and resistance

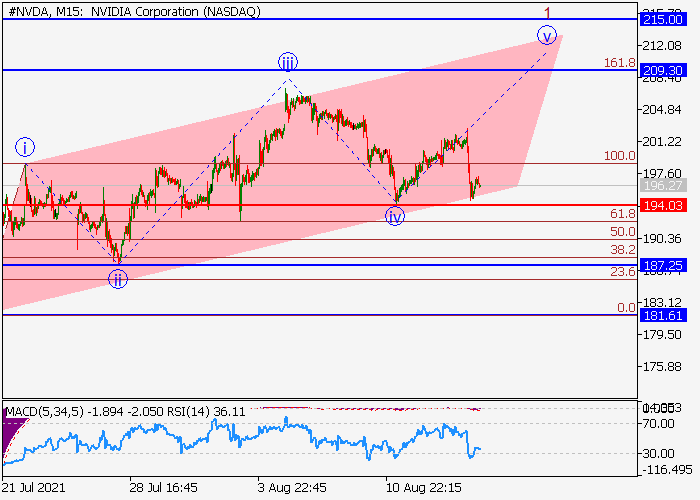

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is narrowing from above, being spacious enough for the current activity level in the market. MACD has reversed to growth having formed a strong buy signal (located above the signal line). Stochastic keeps its upward direction but is approaching its highs rapidly, which reflects risks of the overbought AUD in the ultra-short term.

Resistance levels: 0.7570, 0.7600, 0.7645, 0.7676.

Support levels: 0.7531, 0.7500, 0.7475, 0.7443.