Julia NordFX

Broker Representative

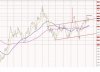

Euro Began to Go Up

Yesterday world financial markets closed with a drop in major indices. In Europe, as such, Germany’s DAX 30 shed 0.47 percent down to 8,260.48 points, France’s CAC 40 grew 0.2 percent and made 4,038.49 points whereas London’s FTSE 100 fell 1.41 percent down to 6,511.21 points.

In Russia the stock index MICEX went down by 0.13 percent to 1,362.91 points, and the RTS index fell 0.28 percent down to 1,301.28 points.

In the United States the Dow Jones dropped 0.31 percent down to 15,470.67 points, the S&P – 0.38 percent down to 1,690.91 points and the Nasdaq – 0.32 percent down to 3,654.01.

The official prices of oil futures reached the lowest points for the past six trading days. The day before, for the first time since 30 July 2013, the price of Brent oil sank below $108 a barrel, with the WTI oil price settling below $105 a barrel.

This week a number of Federal Reserve representatives spoke about the regulator’s plans to start scaling back the QE program during the year. Atlanta Fed Bank President Dennis Lockhart suggested that this might happen at one of the meetings to be held in 2013. Chicago Fed Bank CEO Charles Evans didn’t rule out the program pullback happening already in September, that is following the next scheduled Federal Reserve meeting. Upon completing the two-day meeting commenced on Wednesday, the Bank of Japan may also announce its unwillingness to expand the economic stimulus program.

On the Forex market, EUR/USD is going up. The pair could reach 1.3417 today.

Anna Gorenkova

NordFX Analyst

Yesterday world financial markets closed with a drop in major indices. In Europe, as such, Germany’s DAX 30 shed 0.47 percent down to 8,260.48 points, France’s CAC 40 grew 0.2 percent and made 4,038.49 points whereas London’s FTSE 100 fell 1.41 percent down to 6,511.21 points.

In Russia the stock index MICEX went down by 0.13 percent to 1,362.91 points, and the RTS index fell 0.28 percent down to 1,301.28 points.

In the United States the Dow Jones dropped 0.31 percent down to 15,470.67 points, the S&P – 0.38 percent down to 1,690.91 points and the Nasdaq – 0.32 percent down to 3,654.01.

The official prices of oil futures reached the lowest points for the past six trading days. The day before, for the first time since 30 July 2013, the price of Brent oil sank below $108 a barrel, with the WTI oil price settling below $105 a barrel.

This week a number of Federal Reserve representatives spoke about the regulator’s plans to start scaling back the QE program during the year. Atlanta Fed Bank President Dennis Lockhart suggested that this might happen at one of the meetings to be held in 2013. Chicago Fed Bank CEO Charles Evans didn’t rule out the program pullback happening already in September, that is following the next scheduled Federal Reserve meeting. Upon completing the two-day meeting commenced on Wednesday, the Bank of Japan may also announce its unwillingness to expand the economic stimulus program.

On the Forex market, EUR/USD is going up. The pair could reach 1.3417 today.

Anna Gorenkova

NordFX Analyst