Julia NordFX

Broker Representative

Generalized Forex Forecast for 25 – 29 July 2016

First, a review of last week’s forecast:

– as to EUR/USD, the majority of experts believed that the pair would continue moving in a sideways channel. This prediction may be deemed as panned out, if we consider the month range of 1.0970–1.1180, at which the pair appeared to stall after Brexit. With this, it should be mentioned that only 25% of analysts predicted that the pair would go down and strive to retest the low of June 24 at the level of 1.0900, and there are only around 50-60 points left before it reaches this level;

– GBP/USD. The powers of bulls and bears turned out to be almost equal, and during the entire week the pair had been fluctuating within 1.3070–1.3290 with the pivot point of 1.3200, which complies with the low of June 24 and which is due to absence of any significant news in respect of Brexit;

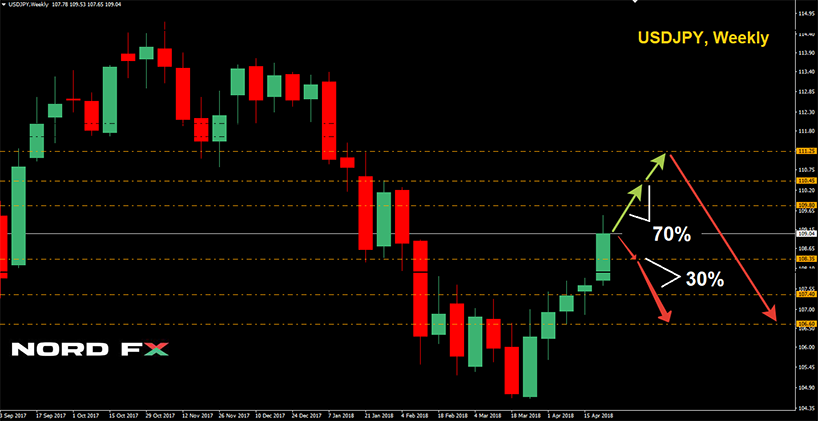

– the forecast about acting of USD/JPY was 100% fulfilled. The analysts reckoned that the upward rebound, seen two weeks ago, was only a retracement. In their opinion the pair should change over to the sideways movement with the resistance at 106.50, which it virtually did. The area of 107.80 was indicated as the next resistance, which the pair tried to reach on Thursday, but as the experts expected, the powers of bulls weakened, and the pair returned to the level of 106.00;

– USD/CHF – as it was expected, the pair kept bullish bias, however, so far it failed to get to the level of 1.0000. Having bounced off the support of 0.9800, the pair soared to the high of 0.9800, but afterwards it rebounded downwards again and wrapped up the week at the level of 0.9860.

***

Forecast for the Upcoming Week:

Summing up the opinions of several dozen analysts from world leading banks and broker companies as well as forecasts based on different methods of technical and graphical analysis, the following can be suggested:

– as to EUR/USD, 70% of experts, backed by 100% of indicators, tend to believe that during the upcoming week or two the pair will make attempts to reach the level of 1.0900. The remaining 30% of analysts and the graphical analysis on H1 represent an alternative viewpoint, they reckon that for a while the pair will continue moving in a sideways channel with the support of 0.9550 and the pivot point of 1.1000. The United States Federal Reserve Interest Rate Decision and the corresponding statements on Wednesday may change this trend;

– Brexit picture is so mixed, that the graphical analysis for GBP/USD on all main time frames doesn’t allow making any forecasts. As to the majority of experts (75%), in their view bearish sentiment continues at the market, and the pair, having finished the retracement, will strive to the support within 1.2850–1.2900, and 95% of indicators on Н4 and D1 agree with this scenario;

- opinions of the analysts and indicators as well as the graphical analysis about the future of USD/JPY can be narrowed down to the thing, that the pair will continue moving in a sideways channel, and afterwards, having bounced off the resistance in the area of 107.40–107.60, will go south and, having broken through the support of 105.50, will go down by further 200 points – to the support of 103.50. But here, Bank of Japan Interest Rate Decision, released in the early Friday morning, can make certain adjustments;

– as to the last pair of our review – USD/CHF, everything remains unchanged: the bullish bias of the pair attempting to reach the level of 1.0000, the pivot point at 0.9880, the first support will be at 0.9840, the second – at 0.9840, and if it will be broken through – fall to the level of 0.9700.

Roman Butko, NordFX

Notice: These materials should not be deemed as a recommendation for investment or guidance for working on financial markets and they are for informative purposes only. Trading on financial markets is risky and it can lead to loss of money deposited.

First, a review of last week’s forecast:

– as to EUR/USD, the majority of experts believed that the pair would continue moving in a sideways channel. This prediction may be deemed as panned out, if we consider the month range of 1.0970–1.1180, at which the pair appeared to stall after Brexit. With this, it should be mentioned that only 25% of analysts predicted that the pair would go down and strive to retest the low of June 24 at the level of 1.0900, and there are only around 50-60 points left before it reaches this level;

– GBP/USD. The powers of bulls and bears turned out to be almost equal, and during the entire week the pair had been fluctuating within 1.3070–1.3290 with the pivot point of 1.3200, which complies with the low of June 24 and which is due to absence of any significant news in respect of Brexit;

– the forecast about acting of USD/JPY was 100% fulfilled. The analysts reckoned that the upward rebound, seen two weeks ago, was only a retracement. In their opinion the pair should change over to the sideways movement with the resistance at 106.50, which it virtually did. The area of 107.80 was indicated as the next resistance, which the pair tried to reach on Thursday, but as the experts expected, the powers of bulls weakened, and the pair returned to the level of 106.00;

– USD/CHF – as it was expected, the pair kept bullish bias, however, so far it failed to get to the level of 1.0000. Having bounced off the support of 0.9800, the pair soared to the high of 0.9800, but afterwards it rebounded downwards again and wrapped up the week at the level of 0.9860.

***

Forecast for the Upcoming Week:

Summing up the opinions of several dozen analysts from world leading banks and broker companies as well as forecasts based on different methods of technical and graphical analysis, the following can be suggested:

– as to EUR/USD, 70% of experts, backed by 100% of indicators, tend to believe that during the upcoming week or two the pair will make attempts to reach the level of 1.0900. The remaining 30% of analysts and the graphical analysis on H1 represent an alternative viewpoint, they reckon that for a while the pair will continue moving in a sideways channel with the support of 0.9550 and the pivot point of 1.1000. The United States Federal Reserve Interest Rate Decision and the corresponding statements on Wednesday may change this trend;

– Brexit picture is so mixed, that the graphical analysis for GBP/USD on all main time frames doesn’t allow making any forecasts. As to the majority of experts (75%), in their view bearish sentiment continues at the market, and the pair, having finished the retracement, will strive to the support within 1.2850–1.2900, and 95% of indicators on Н4 and D1 agree with this scenario;

- opinions of the analysts and indicators as well as the graphical analysis about the future of USD/JPY can be narrowed down to the thing, that the pair will continue moving in a sideways channel, and afterwards, having bounced off the resistance in the area of 107.40–107.60, will go south and, having broken through the support of 105.50, will go down by further 200 points – to the support of 103.50. But here, Bank of Japan Interest Rate Decision, released in the early Friday morning, can make certain adjustments;

– as to the last pair of our review – USD/CHF, everything remains unchanged: the bullish bias of the pair attempting to reach the level of 1.0000, the pivot point at 0.9880, the first support will be at 0.9840, the second – at 0.9840, and if it will be broken through – fall to the level of 0.9700.

Roman Butko, NordFX

Notice: These materials should not be deemed as a recommendation for investment or guidance for working on financial markets and they are for informative purposes only. Trading on financial markets is risky and it can lead to loss of money deposited.