Julia NordFX

Broker Representative

Generalized Forex Forecast for 23-27 March 2015

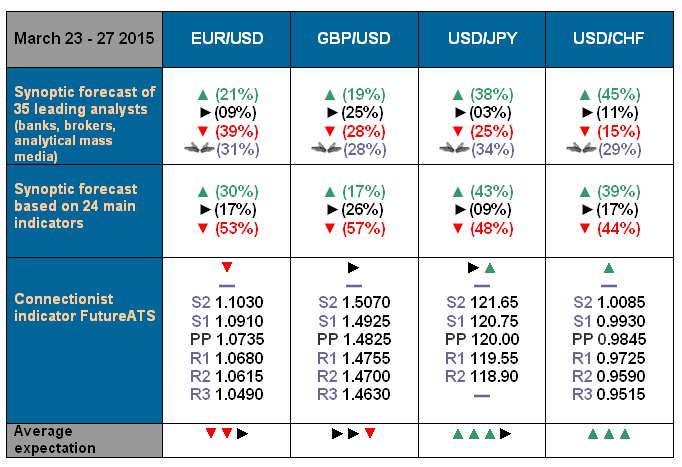

Summing up in a table the opinions of 35 analysts from world leading banks and broker companies and forecasts based on different methods of technical and graphical analysis, we had to introduce some changes. If you look at the analysts’ opinions row in the table, along with the symbols of upward, sideways and downward trends, you will find a new one – open hands. As you can imagine, this indicates those analysts who are at a total loss and don’t know what to say. This group is quite large (around 30%) but there are still a few desperate predictors whose opinions we take into account when compiling our forecasts. Therefore:

- despite EUR/USD’s rebound last week, the pair’s main trend of the last few months remains as is – down to 1.0000. (By the way, the downstream channel with all possible fluctuations is very clear on the H4 chart). The short-term upward trend may continue all the way to 1.0915-1.1040at the start of the week, after which everything should return to normal;

- the GBP/USD pair is expected to fluctuate again just like EUR/USD while at the same time moving in a sideways corridor between 1.4700 and 1.5000 under bearish influence;

- unlike the Brit, the USD/JPY pair will, on the contrary, strive upwards and try to regain last week’s losses, the nearest target being 121.20. With this, neither the indicators nor the analysts rule out that over the first day or two the pair will still continue to fall;

- judging by the indicators, the forecast for USD/CHF is as follows: at first (but not for long) strictly downwards and then strictly upwards, back to the coveted mark of 1.0000. Considering that the transfer of Friday’s indications to Monday is not that wise, it is possible that the pair will turn around and move upwards straight away, from the first tick. The analysts in general support this.

As for last week’s forecast:

- the analysts’ predictions for EUR/USD’s tendency turned out to be right. They forecast that the pair would rebound upwards to 1.1000-1.1200. Truth be told, the pair didn’t reach this level after all, although at its peak the rebound made almost 600 points;

- regarding the GBP/USD pair, we predicted that the proud Brit will continue to trail the Euro. Just have a look at last week’s charts;

- the USD/JPY pair didn’t meet our expectations. As predicted, the first half of the week it stayed in a lulling sideways trend within the narrow range of 121.140-121.50 but on Wednesday evening’s news, instead of shooting upwards, it plunged breaking through the support around 120.65-120.80;

- as for USD/CHF, if its collapse in January was called “Black Thursday,” the events of last Wednesday can be safely dubbed “Dark Grey Wednesday.” We hope that the heavy clouds will disperse soon and the Swiss Frank will once again see the boundlessly blue Alpine skies.

Roman Butko, NordFX

Summing up in a table the opinions of 35 analysts from world leading banks and broker companies and forecasts based on different methods of technical and graphical analysis, we had to introduce some changes. If you look at the analysts’ opinions row in the table, along with the symbols of upward, sideways and downward trends, you will find a new one – open hands. As you can imagine, this indicates those analysts who are at a total loss and don’t know what to say. This group is quite large (around 30%) but there are still a few desperate predictors whose opinions we take into account when compiling our forecasts. Therefore:

- despite EUR/USD’s rebound last week, the pair’s main trend of the last few months remains as is – down to 1.0000. (By the way, the downstream channel with all possible fluctuations is very clear on the H4 chart). The short-term upward trend may continue all the way to 1.0915-1.1040at the start of the week, after which everything should return to normal;

- the GBP/USD pair is expected to fluctuate again just like EUR/USD while at the same time moving in a sideways corridor between 1.4700 and 1.5000 under bearish influence;

- unlike the Brit, the USD/JPY pair will, on the contrary, strive upwards and try to regain last week’s losses, the nearest target being 121.20. With this, neither the indicators nor the analysts rule out that over the first day or two the pair will still continue to fall;

- judging by the indicators, the forecast for USD/CHF is as follows: at first (but not for long) strictly downwards and then strictly upwards, back to the coveted mark of 1.0000. Considering that the transfer of Friday’s indications to Monday is not that wise, it is possible that the pair will turn around and move upwards straight away, from the first tick. The analysts in general support this.

As for last week’s forecast:

- the analysts’ predictions for EUR/USD’s tendency turned out to be right. They forecast that the pair would rebound upwards to 1.1000-1.1200. Truth be told, the pair didn’t reach this level after all, although at its peak the rebound made almost 600 points;

- regarding the GBP/USD pair, we predicted that the proud Brit will continue to trail the Euro. Just have a look at last week’s charts;

- the USD/JPY pair didn’t meet our expectations. As predicted, the first half of the week it stayed in a lulling sideways trend within the narrow range of 121.140-121.50 but on Wednesday evening’s news, instead of shooting upwards, it plunged breaking through the support around 120.65-120.80;

- as for USD/CHF, if its collapse in January was called “Black Thursday,” the events of last Wednesday can be safely dubbed “Dark Grey Wednesday.” We hope that the heavy clouds will disperse soon and the Swiss Frank will once again see the boundlessly blue Alpine skies.

Roman Butko, NordFX