Daily Forex Market Preview, 29/03/2016

The US Dollar ended a 5-day winning streak yesterday as tepid PCE, and slower pace of consumer spending sent the US Dollar index to ease back from a 5-day high. Hawkish Fed speech continued but did little to help support the Greenback. The British Pound managed to make the most of a weaker Greenback yesterday with prices gaining 0.85% for the day. The Dollar is likely to stay subdued into Janet Yellen's speech due later this afternoon as investors await for clues on further course of action from the Federal Reserve.

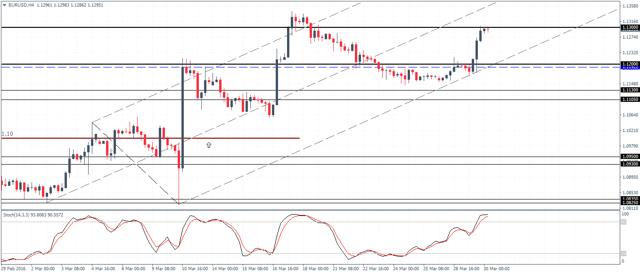

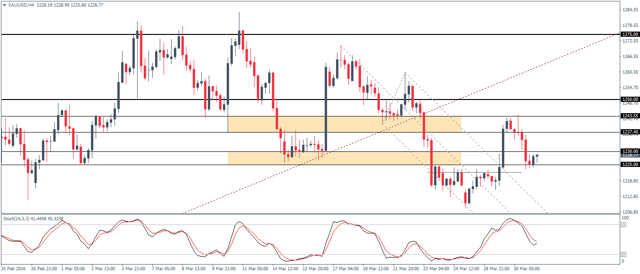

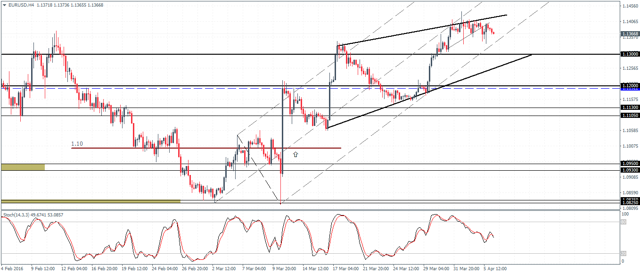

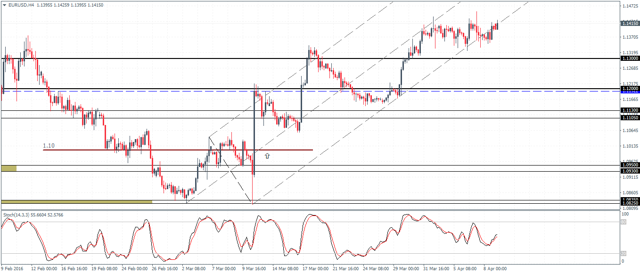

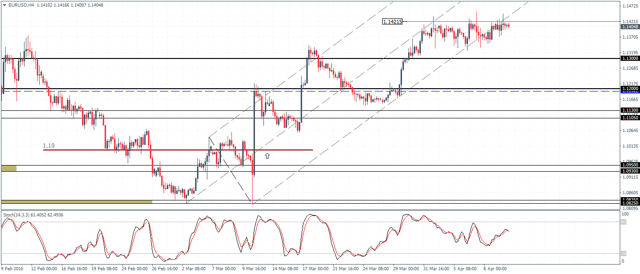

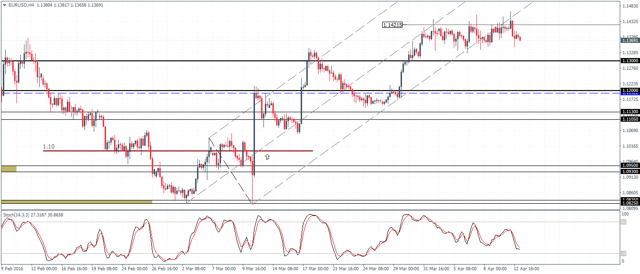

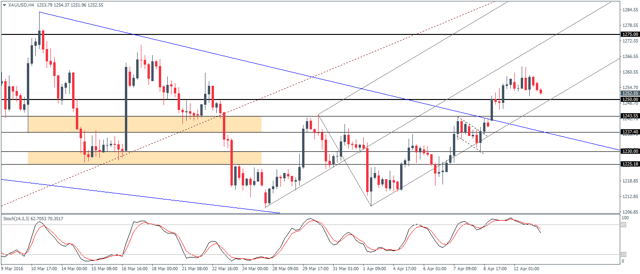

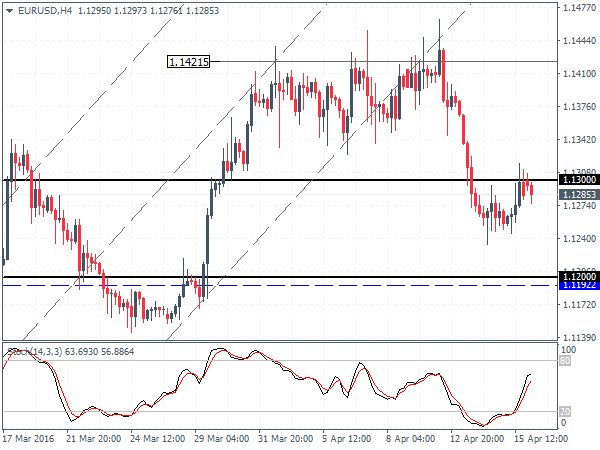

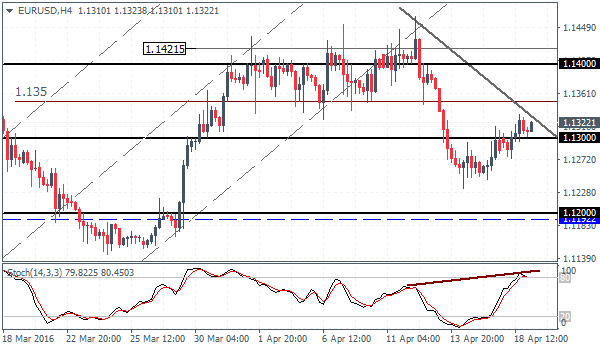

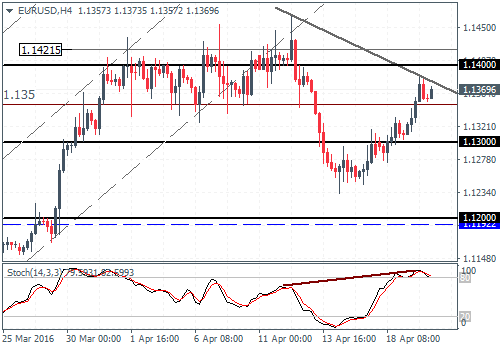

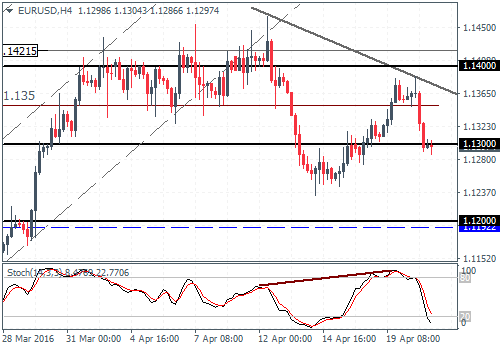

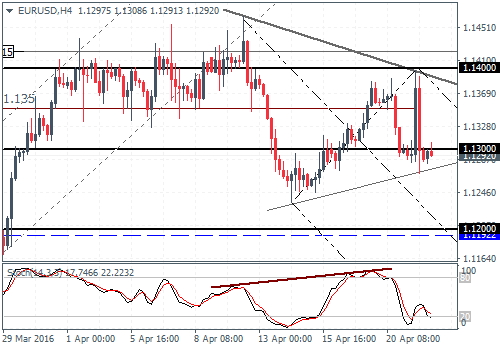

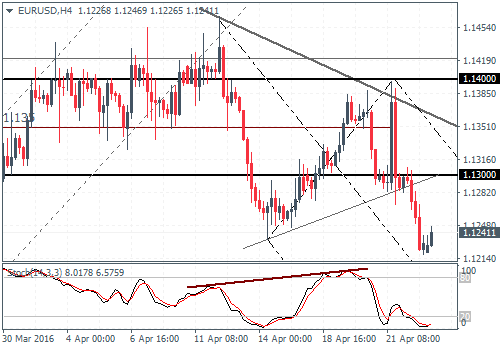

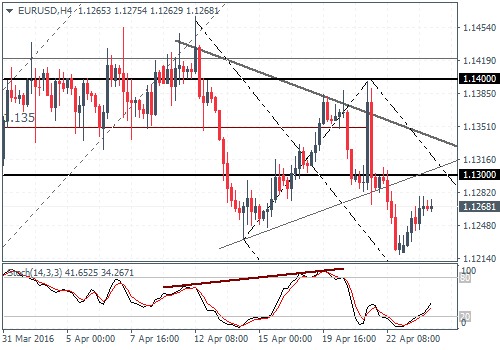

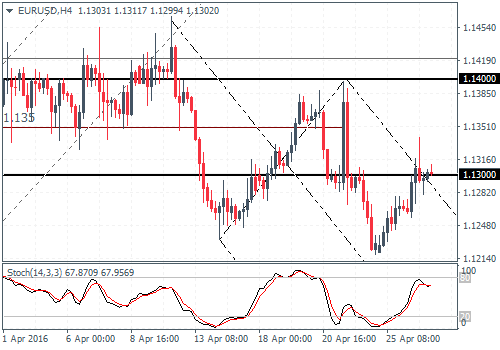

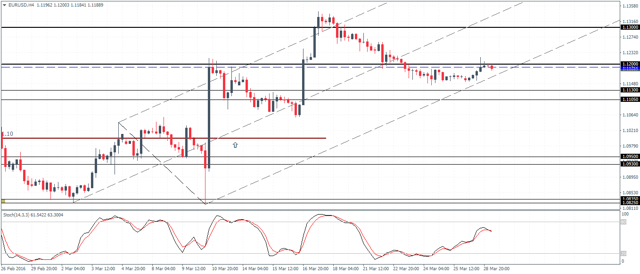

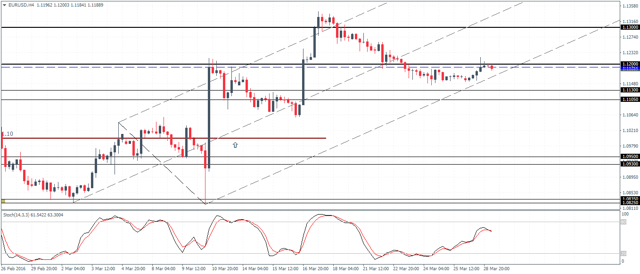

EURUSD Daily Analysis

(click to enlarge)

EURUSD (1.11): EURUSD managed to close with a bullish engulfing candlestick pattern on the daily chart after nearly 6-days of losing streak. Prices reversed off the lows near 1.1153. Further upside is likely provided 1.120 level of resistance is cleared in the near term which would keep EURUSD back inside the range of 1.13 - 1.12. On the 4-hour chart, the Stochastics has posted a higher high against price's lower high which indicates a short term decline lower. Support at 1.113 to 1.1105 is critical in this aspect.

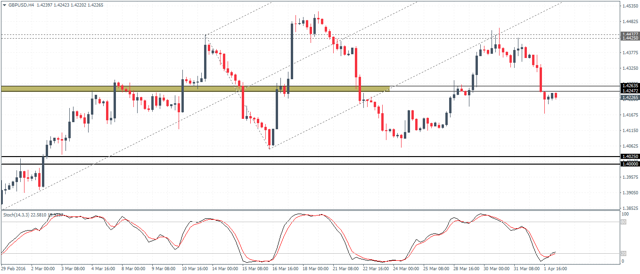

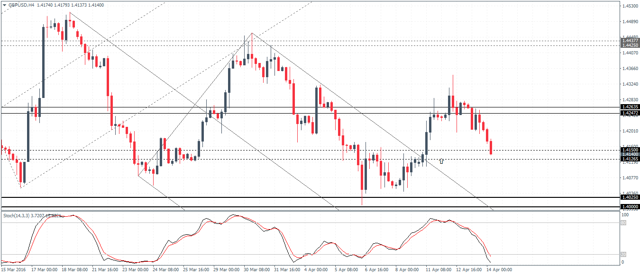

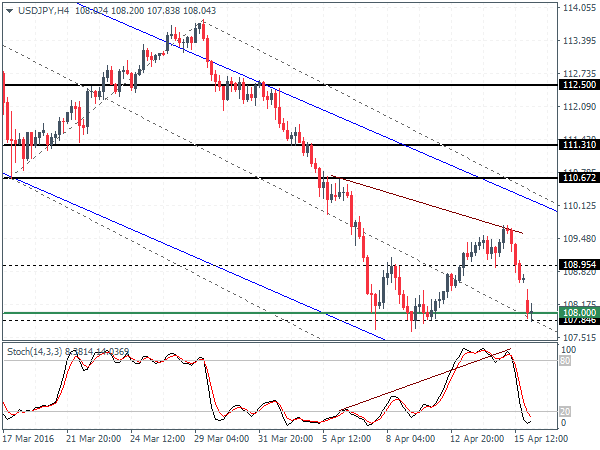

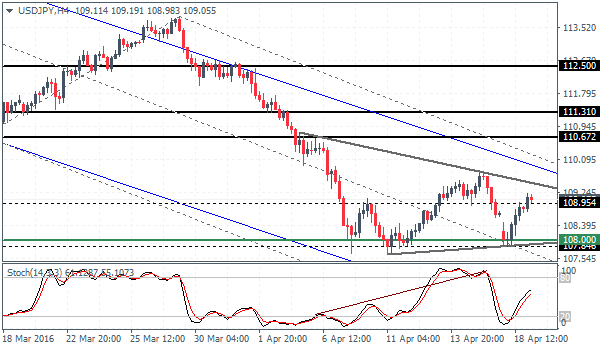

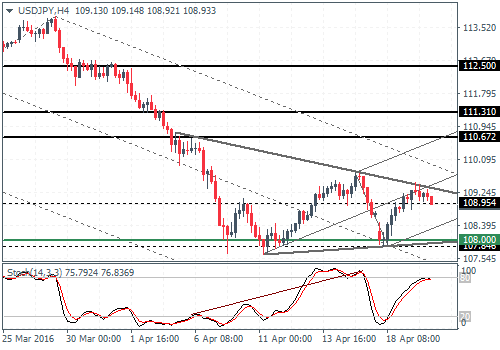

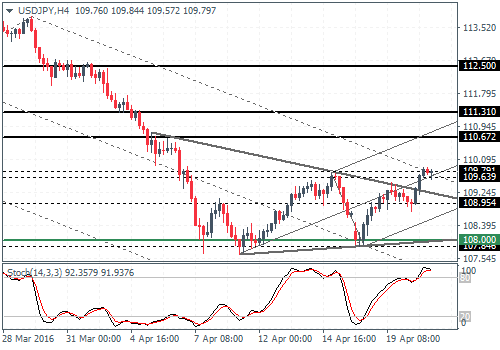

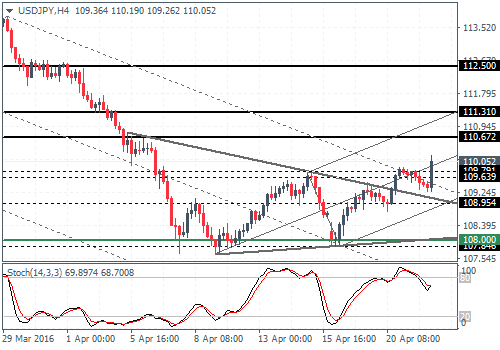

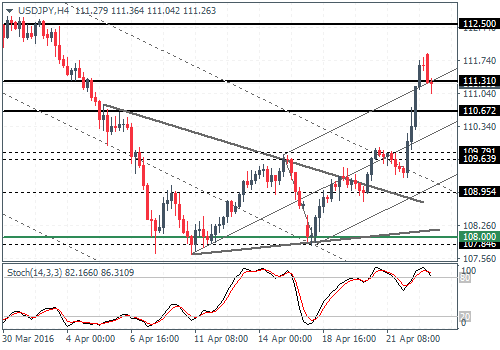

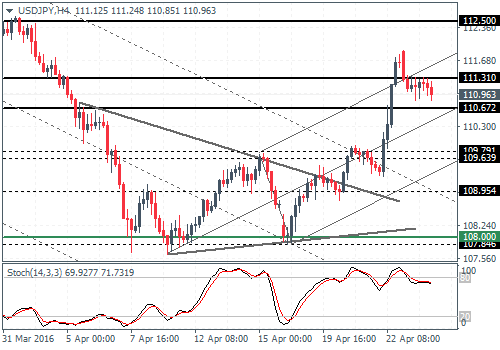

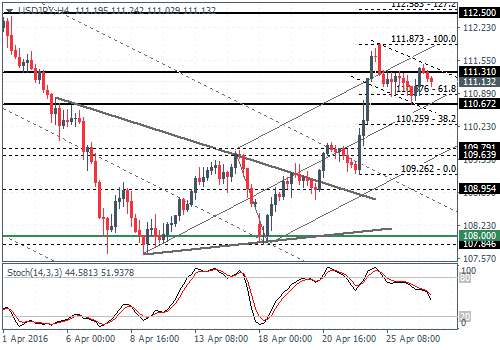

USDJPY Daily Analysis

(click to enlarge)

USDJPY (113.65): USDJPY has managed to close on a bullish note yesterday marking a 7-day bullish run. Price action remains biased to the downside however unless the resistance at 114.7 - 114.35 is cleared. Support at 112.5 will be in focus as a break below this level could send USDJPY lower to 111.31 support, keeping prices subdued.

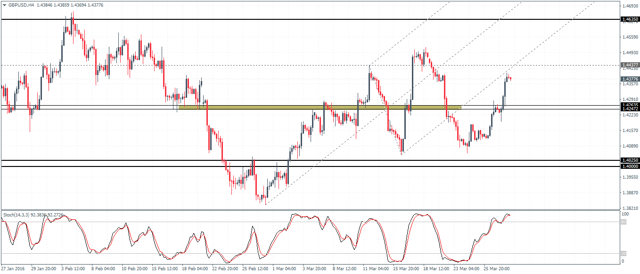

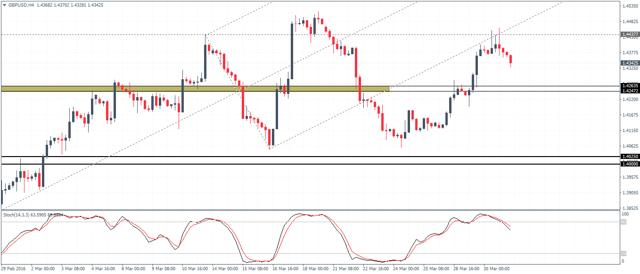

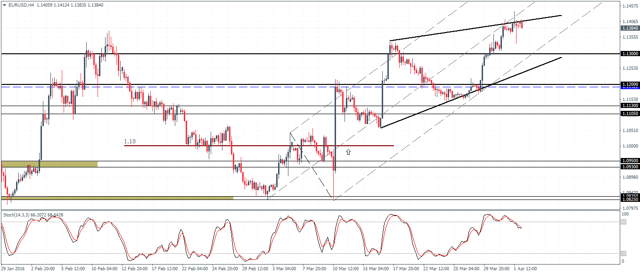

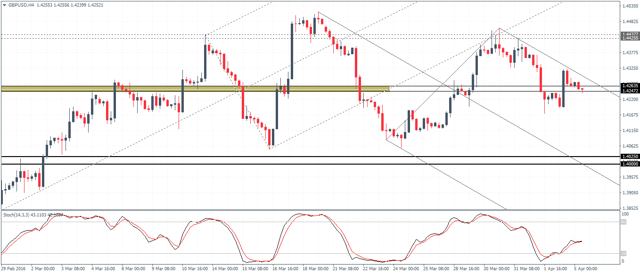

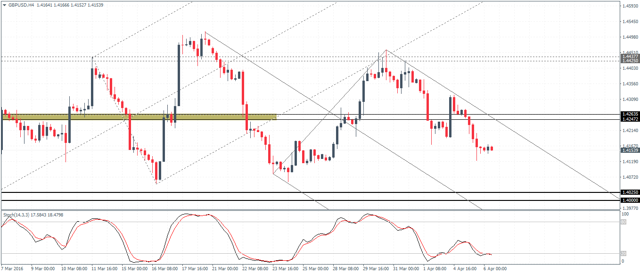

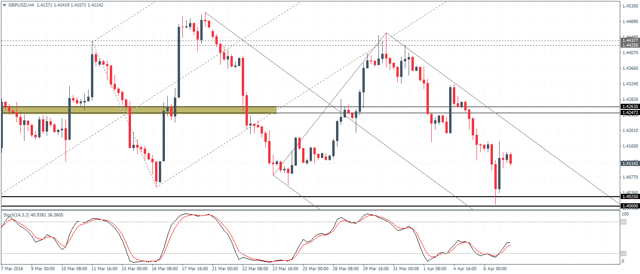

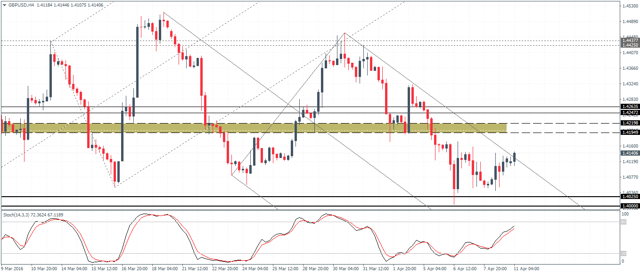

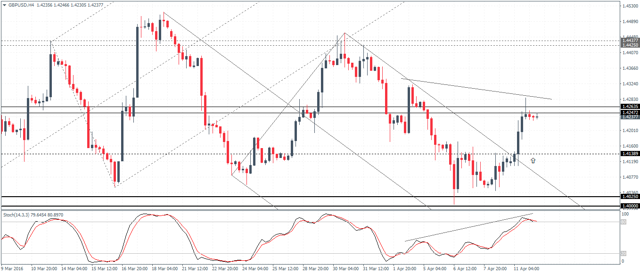

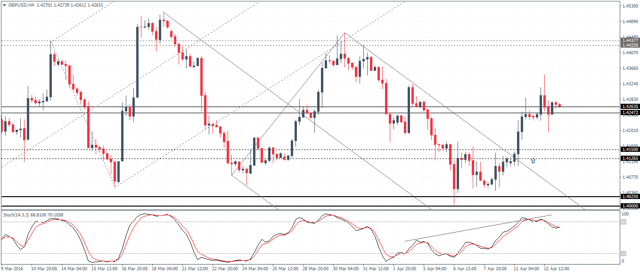

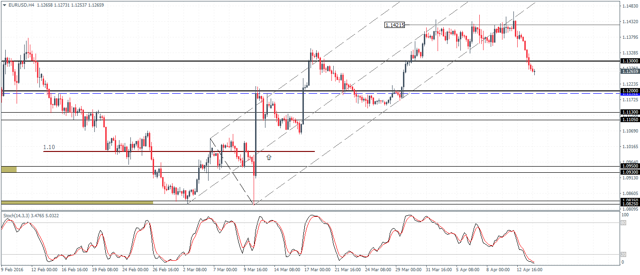

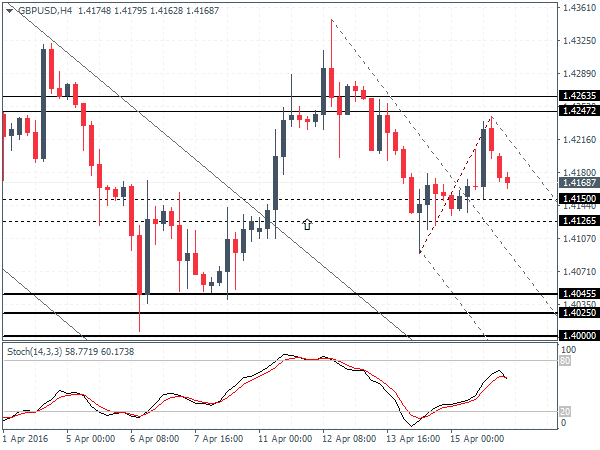

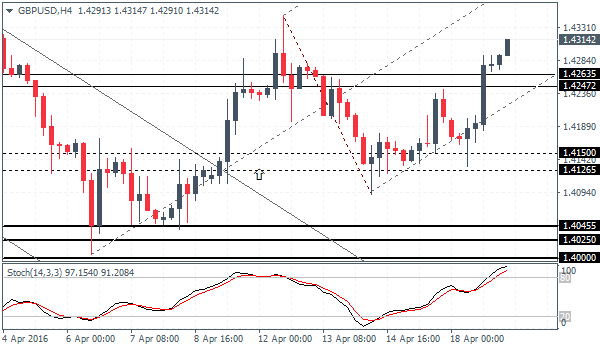

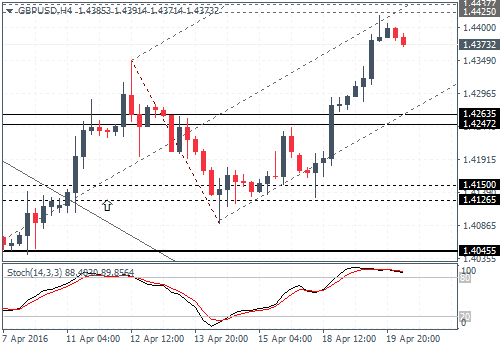

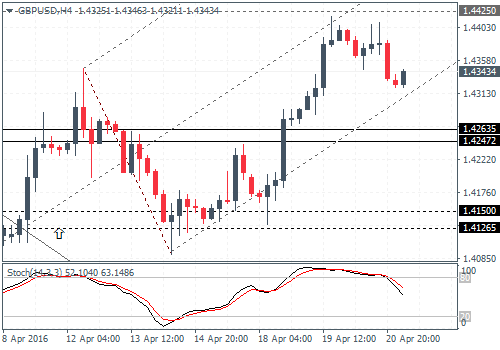

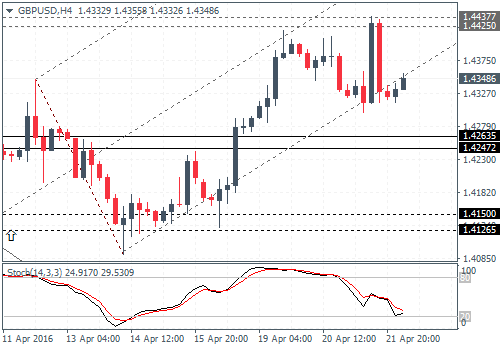

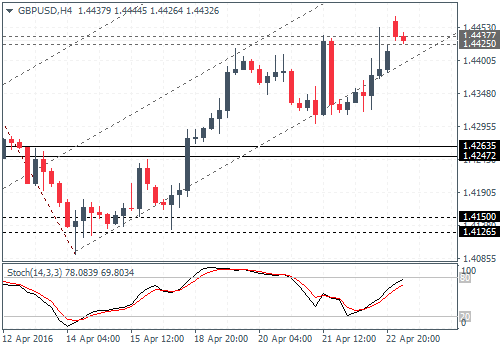

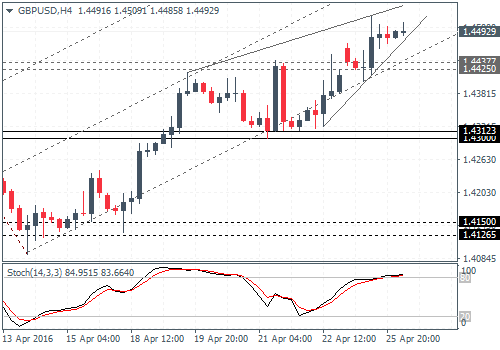

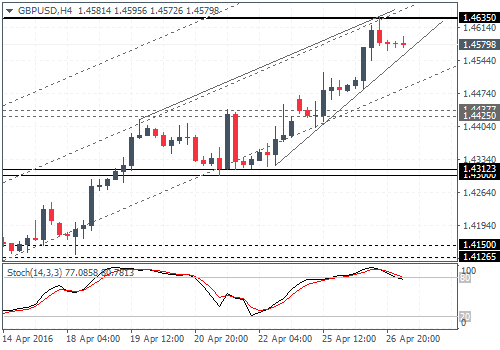

GBPUSD Daily Analysis

(click to enlarge)

GBPUSD (1.42): GBPUSD closed on a bullish note yesterday closing above the 1.420 handle. A dip back to 1.42 could establish support ahead of further gains to 1.4430. The current resistance at 1.4247 - 1.4263 will likely keep the gains capped with a test of support at 1.4025 - 1.40 showing the daily session's downside bias for a test of support.

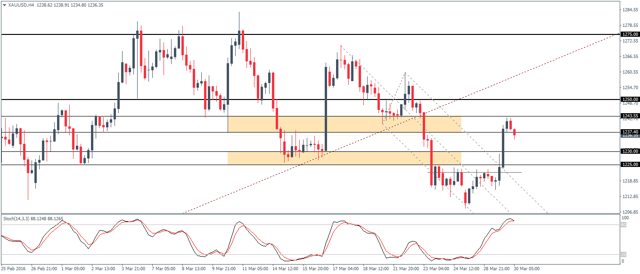

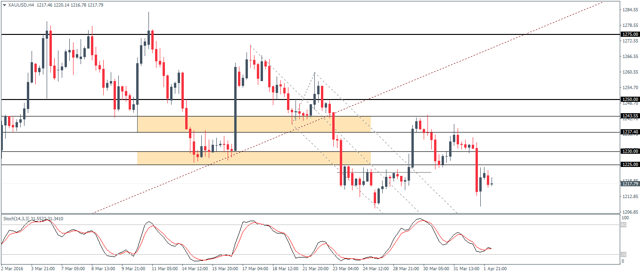

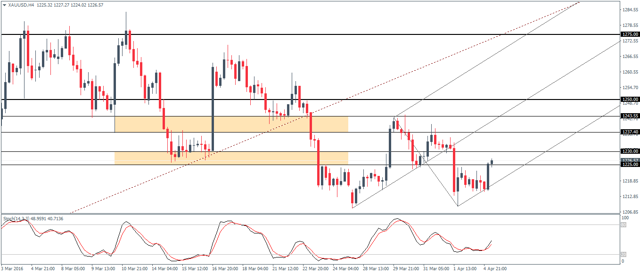

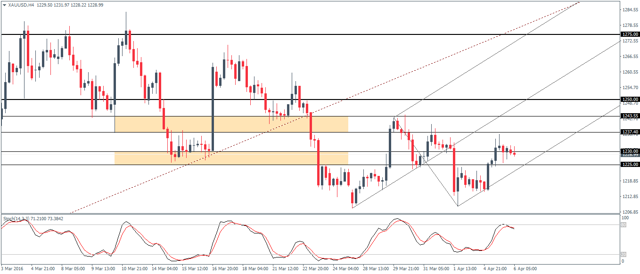

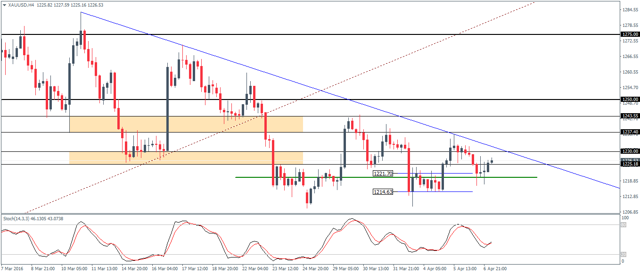

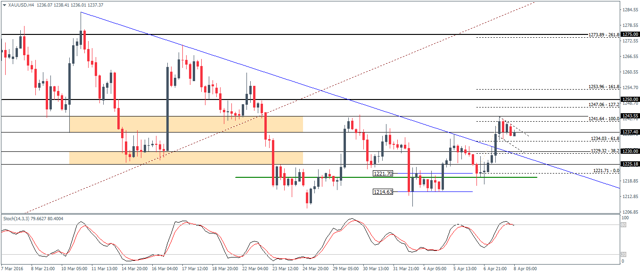

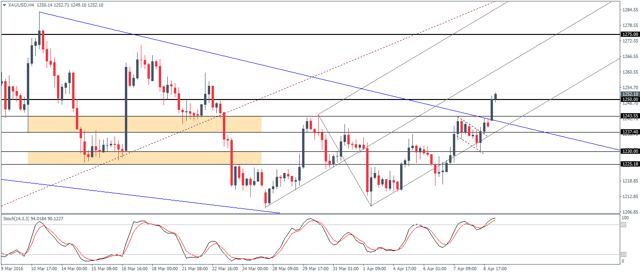

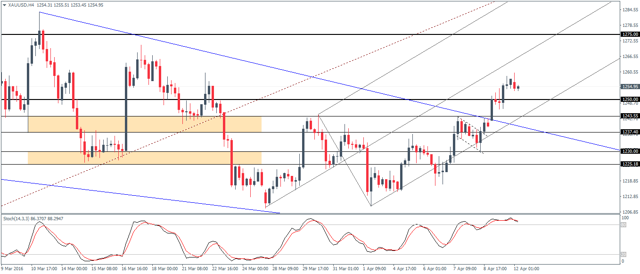

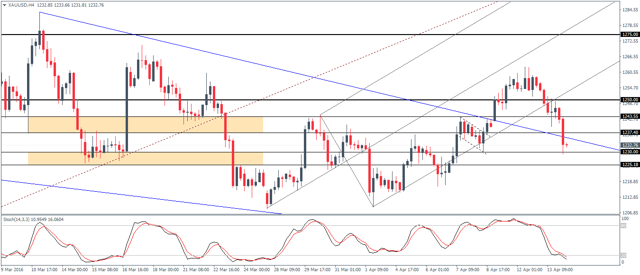

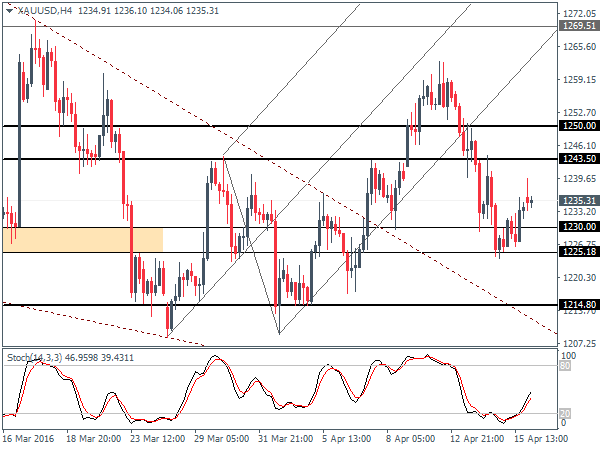

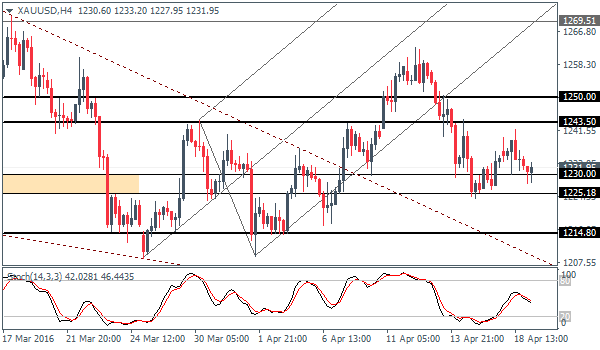

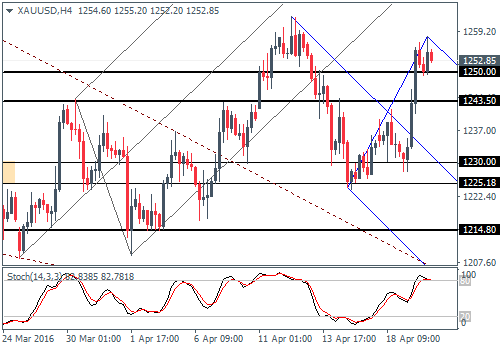

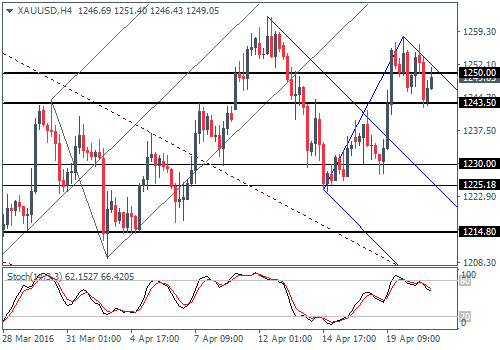

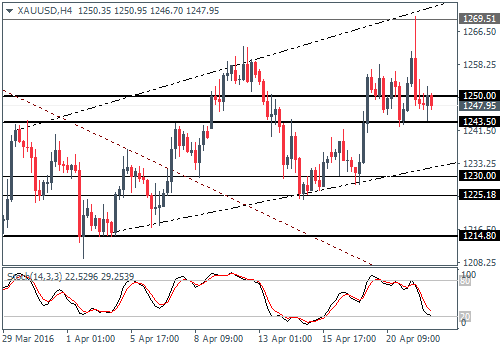

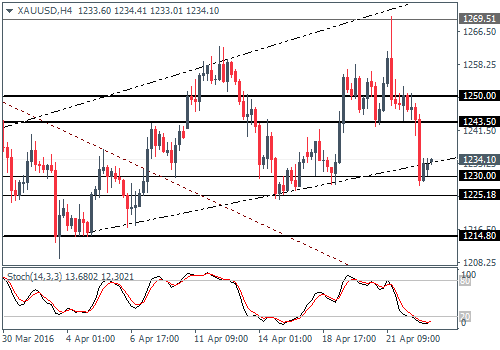

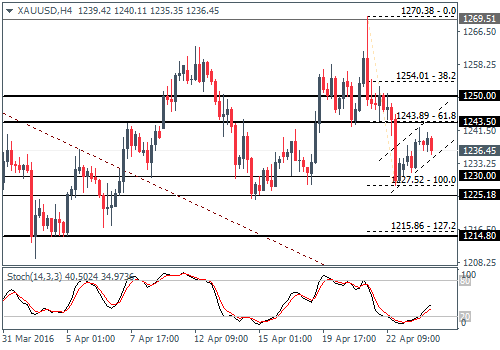

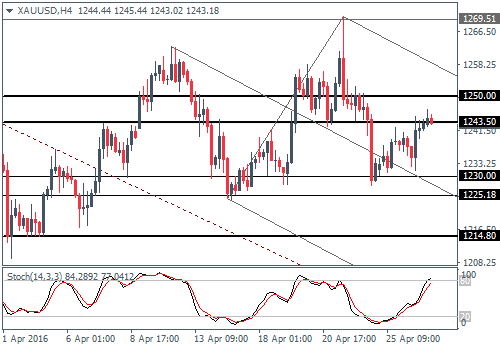

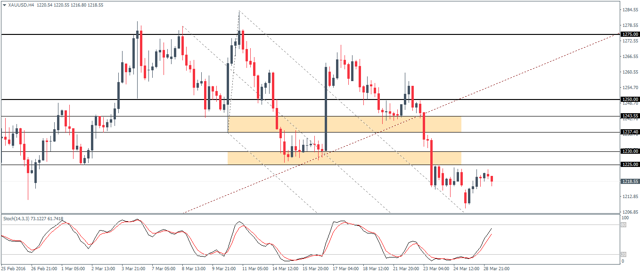

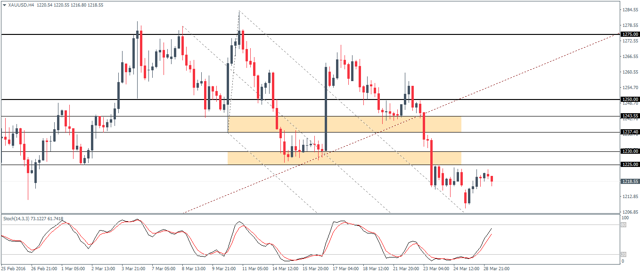

Gold Daily Analysis

(click to enlarge)

XAUUSD (1218): Gold prices managed to close bullish after a lower open yesterday. Prices closed near 1221 but the downside bias to 1200 remains. There is scope for Gold prices to post a rally towards the 1225 level of resistance ahead of the declines to 1200 which is likely to offer strong support, at least, the initial test to this level. The 4-hour chart currently shows a strong hidden bearish divergence which confirmed the downside bias.

The US Dollar ended a 5-day winning streak yesterday as tepid PCE, and slower pace of consumer spending sent the US Dollar index to ease back from a 5-day high. Hawkish Fed speech continued but did little to help support the Greenback. The British Pound managed to make the most of a weaker Greenback yesterday with prices gaining 0.85% for the day. The Dollar is likely to stay subdued into Janet Yellen's speech due later this afternoon as investors await for clues on further course of action from the Federal Reserve.

EURUSD Daily Analysis

(click to enlarge)

EURUSD (1.11): EURUSD managed to close with a bullish engulfing candlestick pattern on the daily chart after nearly 6-days of losing streak. Prices reversed off the lows near 1.1153. Further upside is likely provided 1.120 level of resistance is cleared in the near term which would keep EURUSD back inside the range of 1.13 - 1.12. On the 4-hour chart, the Stochastics has posted a higher high against price's lower high which indicates a short term decline lower. Support at 1.113 to 1.1105 is critical in this aspect.

USDJPY Daily Analysis

(click to enlarge)

USDJPY (113.65): USDJPY has managed to close on a bullish note yesterday marking a 7-day bullish run. Price action remains biased to the downside however unless the resistance at 114.7 - 114.35 is cleared. Support at 112.5 will be in focus as a break below this level could send USDJPY lower to 111.31 support, keeping prices subdued.

GBPUSD Daily Analysis

(click to enlarge)

GBPUSD (1.42): GBPUSD closed on a bullish note yesterday closing above the 1.420 handle. A dip back to 1.42 could establish support ahead of further gains to 1.4430. The current resistance at 1.4247 - 1.4263 will likely keep the gains capped with a test of support at 1.4025 - 1.40 showing the daily session's downside bias for a test of support.

Gold Daily Analysis

(click to enlarge)

XAUUSD (1218): Gold prices managed to close bullish after a lower open yesterday. Prices closed near 1221 but the downside bias to 1200 remains. There is scope for Gold prices to post a rally towards the 1225 level of resistance ahead of the declines to 1200 which is likely to offer strong support, at least, the initial test to this level. The 4-hour chart currently shows a strong hidden bearish divergence which confirmed the downside bias.