Daily Forex Market Preview, 26/02/2016

The British Pound closed in the positive yesterday for the first time this week, forming an inside bar, while EURUSD is attempting to rally following two days of doji candlesticks, as USDJPY slips back to test 112 support. The short pullbacks across these currencies are likely to indicate a larger move in the making. USD GDP estimates and PCE data will be the key fundamentals to watch for today.

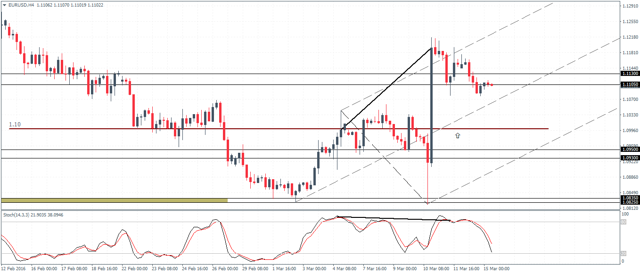

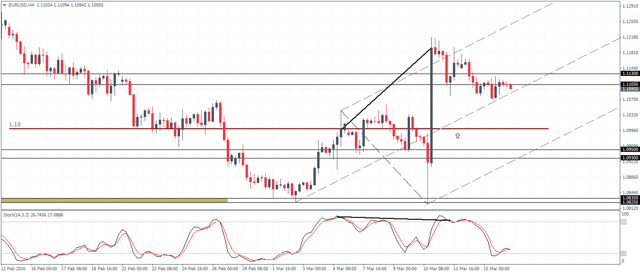

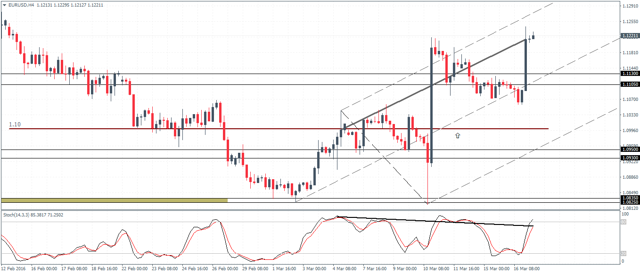

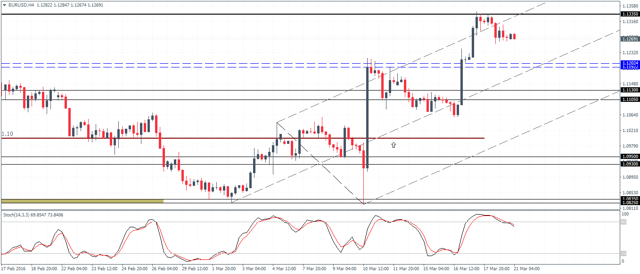

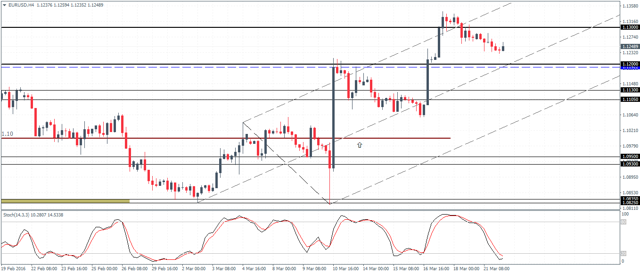

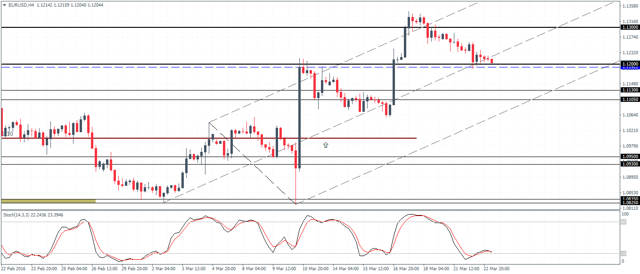

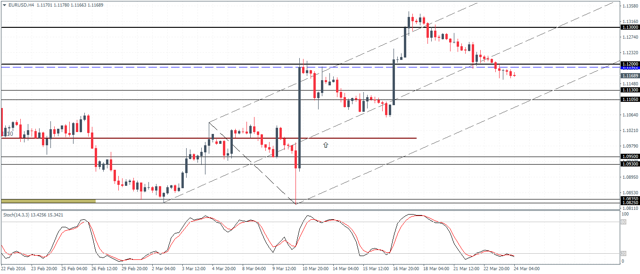

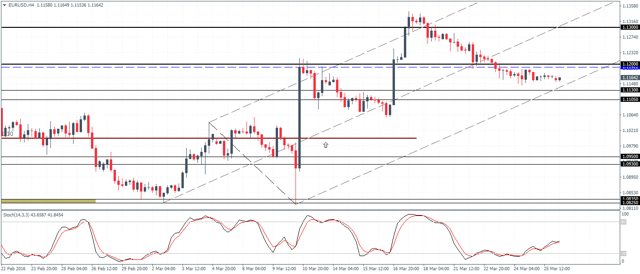

EURUSD Daily Analysis

(click to enlarge)

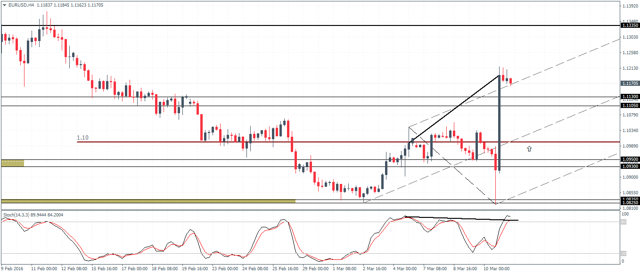

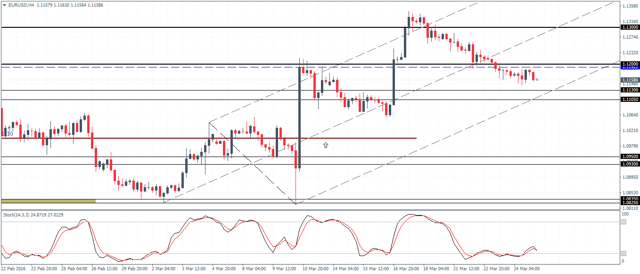

EURUSD (1.10): Following two days of indecision, EURUSD is currently attempting to rally higher. A daily close above 1.1046 is needed for any further attempts to push higher as 1.10 support is established. To the upside 1.11 - 1.113 resistance will be key to watch as the resistance could cap the gains. The Stochastics on H4 continues to print a hidden bearish divergence posting higher highs against price's lower highs, which further adds to the downside risks. EURUSD could remain range bound with the support/resistance levels but could also signal a potential breakout. Above 1.113, EURUSD could test 1.1285 resistance, while to the downside 1.095 - 1.093 support comes into the picture.

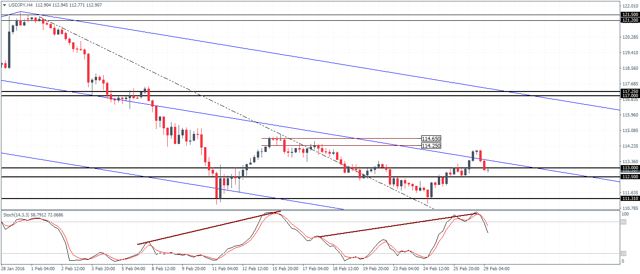

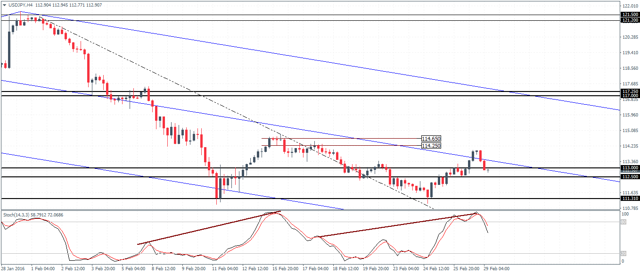

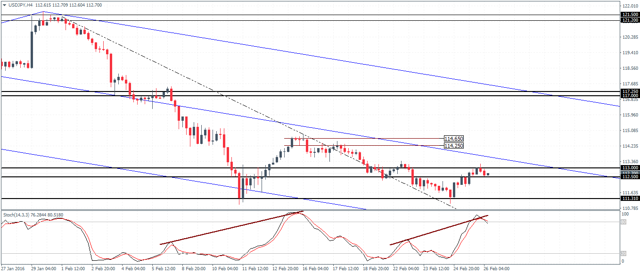

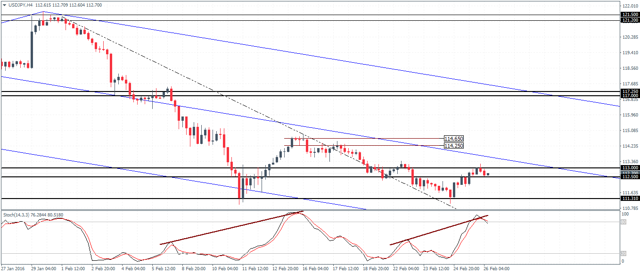

USDJPY Daily Analysis

(click to enlarge)

USDJPY (112.6): USDJPY closed on a bullish notice yesterday following the doji reversal near 112. Price action is currently slipped back and could possibly test 112 support again. If prices manage to remain above 112, a test to 116 and 117 is likely, but a break below 112 on the daily chart could signal further downside. On the H4 chart, price action is near the 113 - 112.5 resistance level. A dip below could see a test to 111.31 support. Depending on how the Stochastics will print this low, a bearish divergence here could see USDJPY eventually rally to 117 on a break above 113 resistance to the upside.

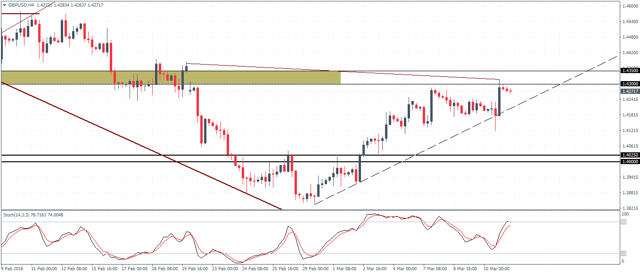

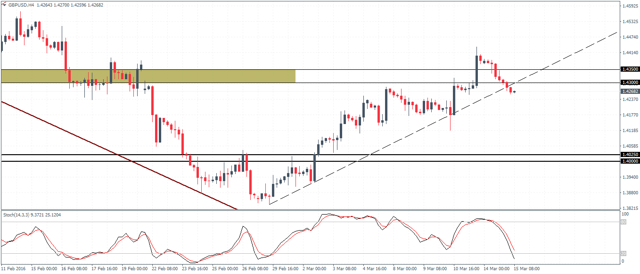

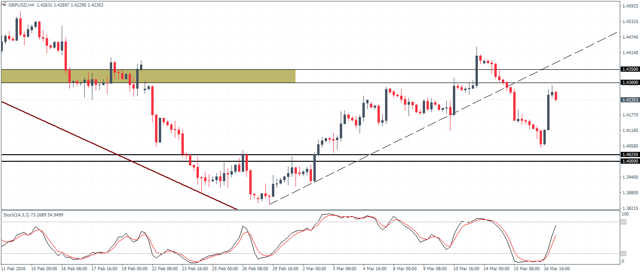

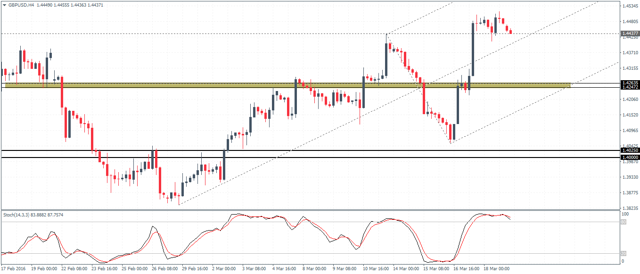

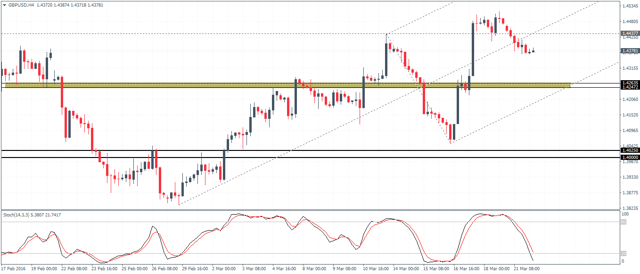

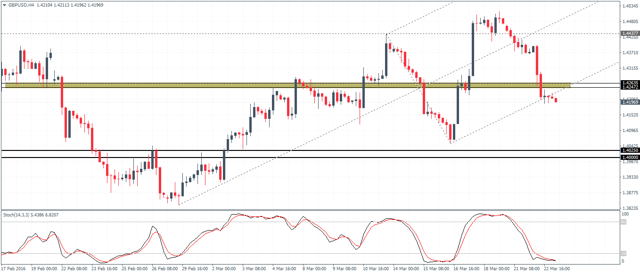

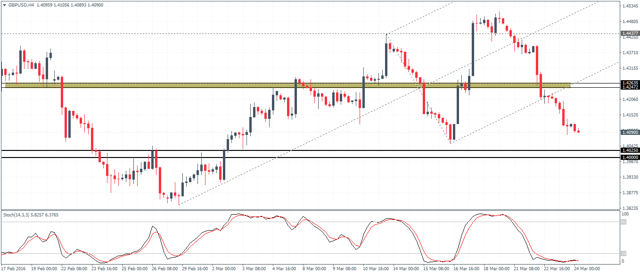

GBPUSD Daily Analysis

(click to enlarge)

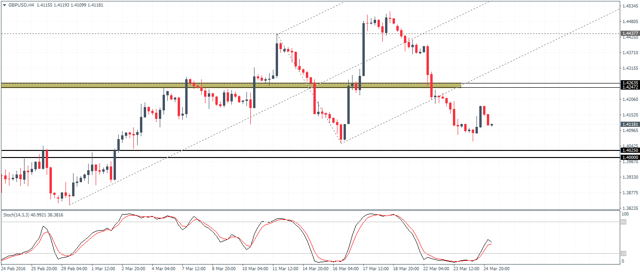

GBPUSD (1.396): GBPUSD managed to close in the positive yesterday, the first time this week since the strong losses started out on Monday. There is an inside bar being formed and a close above the previous high of 1.4028 is needed for GBPUSD to test the 1.42 resistance. The Stochastics is currently printing a higher low against price's lower low. A daily bullish close will confirm the move to the upside as prices correct to 1.42 broken support to establish resistance. On the H4 chart, 1.40 resistance is now currently in play and a break above 1.40 could trigger further upside. A break below the previous low could, however, see GBPUSD continue to trend lower.

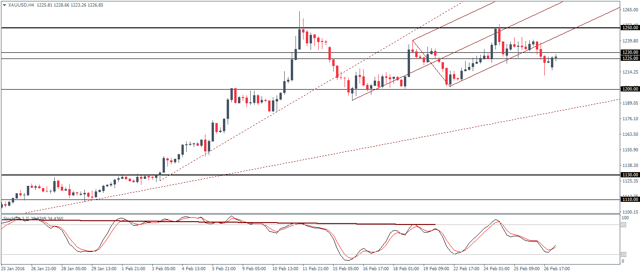

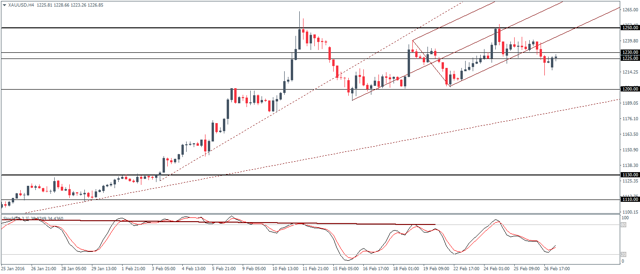

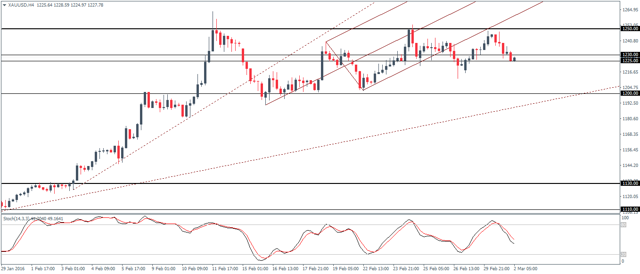

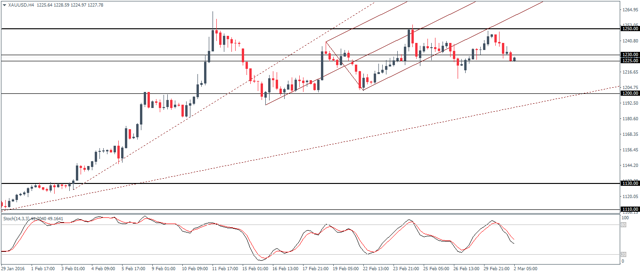

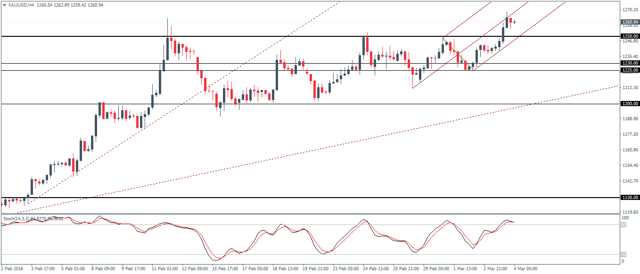

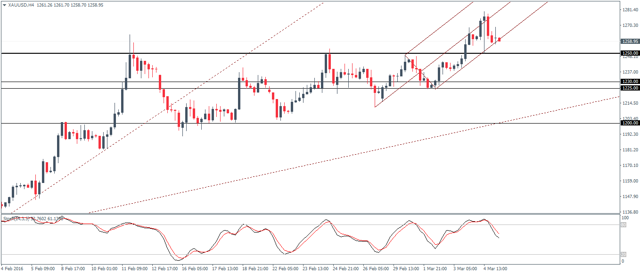

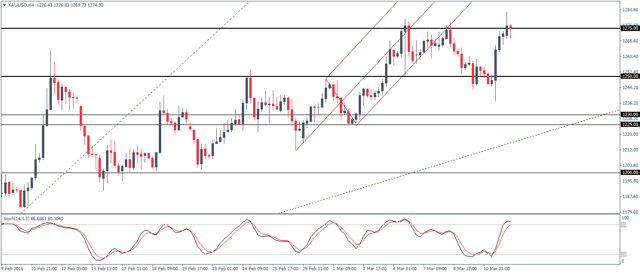

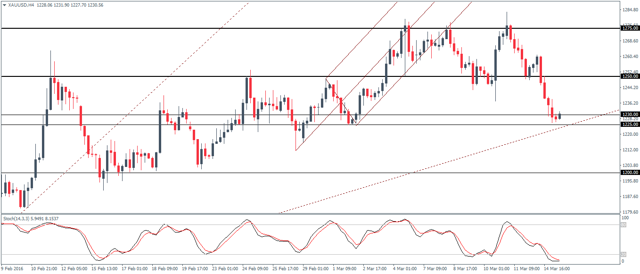

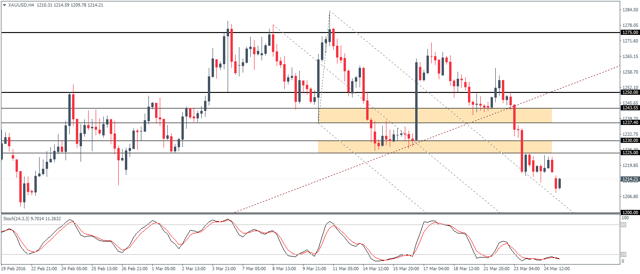

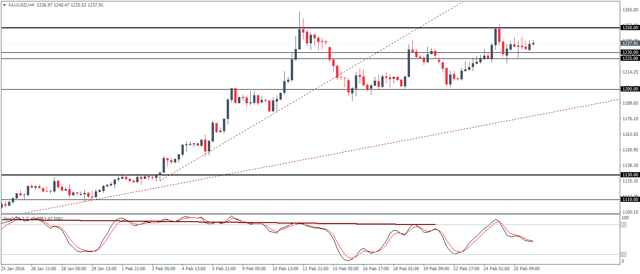

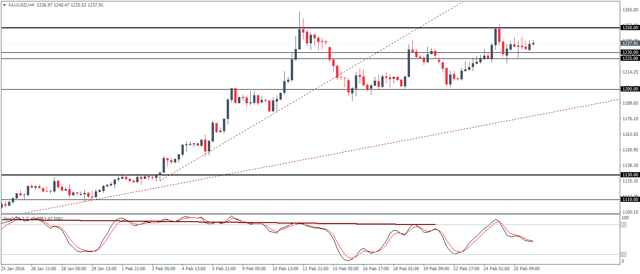

Gold Daily Analysis

(click to enlarge)

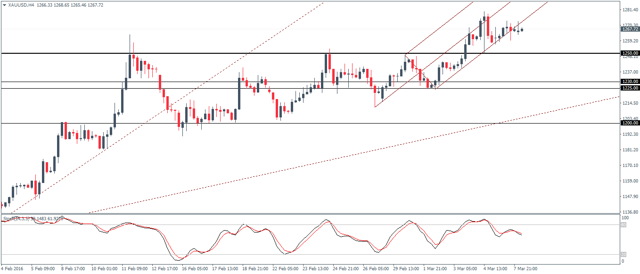

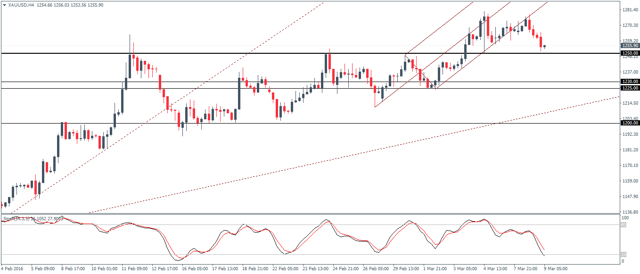

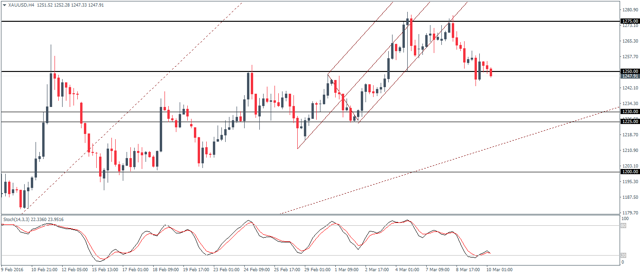

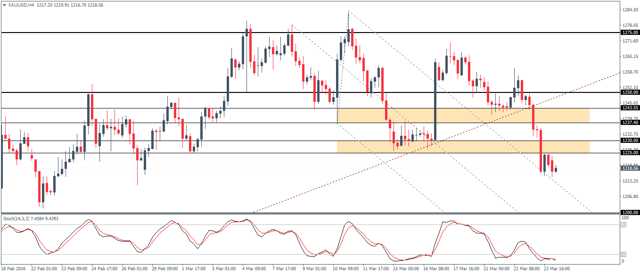

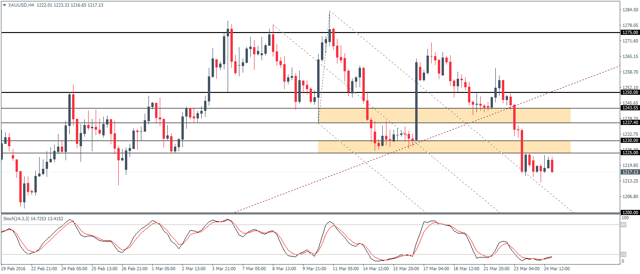

XAUUSD (1237): Gold prices remain range bound but trading below the previous highs near 1265. Support is found at 1230 - 1225 and Gold could remain trading sideways within 1250 and 1225, with only a breakout above or below these levels indicating further direction. To the downside 1200 remains a key support level to watch for, while to the upside, a break above 1250 could see Gold test 1275 - 1280 resistance which lies ahead.

The British Pound closed in the positive yesterday for the first time this week, forming an inside bar, while EURUSD is attempting to rally following two days of doji candlesticks, as USDJPY slips back to test 112 support. The short pullbacks across these currencies are likely to indicate a larger move in the making. USD GDP estimates and PCE data will be the key fundamentals to watch for today.

EURUSD Daily Analysis

(click to enlarge)

EURUSD (1.10): Following two days of indecision, EURUSD is currently attempting to rally higher. A daily close above 1.1046 is needed for any further attempts to push higher as 1.10 support is established. To the upside 1.11 - 1.113 resistance will be key to watch as the resistance could cap the gains. The Stochastics on H4 continues to print a hidden bearish divergence posting higher highs against price's lower highs, which further adds to the downside risks. EURUSD could remain range bound with the support/resistance levels but could also signal a potential breakout. Above 1.113, EURUSD could test 1.1285 resistance, while to the downside 1.095 - 1.093 support comes into the picture.

USDJPY Daily Analysis

(click to enlarge)

USDJPY (112.6): USDJPY closed on a bullish notice yesterday following the doji reversal near 112. Price action is currently slipped back and could possibly test 112 support again. If prices manage to remain above 112, a test to 116 and 117 is likely, but a break below 112 on the daily chart could signal further downside. On the H4 chart, price action is near the 113 - 112.5 resistance level. A dip below could see a test to 111.31 support. Depending on how the Stochastics will print this low, a bearish divergence here could see USDJPY eventually rally to 117 on a break above 113 resistance to the upside.

GBPUSD Daily Analysis

(click to enlarge)

GBPUSD (1.396): GBPUSD managed to close in the positive yesterday, the first time this week since the strong losses started out on Monday. There is an inside bar being formed and a close above the previous high of 1.4028 is needed for GBPUSD to test the 1.42 resistance. The Stochastics is currently printing a higher low against price's lower low. A daily bullish close will confirm the move to the upside as prices correct to 1.42 broken support to establish resistance. On the H4 chart, 1.40 resistance is now currently in play and a break above 1.40 could trigger further upside. A break below the previous low could, however, see GBPUSD continue to trend lower.

Gold Daily Analysis

(click to enlarge)

XAUUSD (1237): Gold prices remain range bound but trading below the previous highs near 1265. Support is found at 1230 - 1225 and Gold could remain trading sideways within 1250 and 1225, with only a breakout above or below these levels indicating further direction. To the downside 1200 remains a key support level to watch for, while to the upside, a break above 1250 could see Gold test 1275 - 1280 resistance which lies ahead.