CryptoNews

- Some Bitcoin miners are at danger due to negative oil prices. Miners are actively looking for cheap electricity in anticipation of the halving in order to keep competitive. In North America, several of these firms use energy from a gas torch generated by oil extraction or refining. And if the oil companies close under pressure of low or negative prices, it will hit the miners. The Great American Mining founder Marty Brent said in a comment for CoinDesk that just one field he works with can provide hundreds of megawatts for mining. According to the publication, such companies will remain profitable even if Bitcoin does not grow in 2020. But oil prices are one of the key variables in their business model.

- Malaysian law enforcement officers arrested Chinese attackers accused of cryptocurrency fraud. This is reported by news agency South China Morning Post. According to the police, the detainees formed groups in WeChat and QQ, where they persuaded potential investors to invest in their allegedly successful projects. A total of 14 people were arrested, who, in addition to 10 years of imprisonment for fraud, also face a fine and up to six lashes for violation of immigration legislation.

- According to a survey conducted by The Economist magazine commissioned by Crypto.com, 26% of respondents trust cryptocurrencies, while 38% of respondents believe cryptocurrencies unreliable. But the digital currencies of Central banks (CBDC) are trusted by the majority of respondents (54%). Among the main obstacles to the adoption of cryptocurrencies, respondents pointed to a lack of understanding of their application areas (44%) and technology safety (32%). In most cases (34%) cryptocurrencies are used for online payments, another 24% consider them as a short-term investment, 23% - as a long-term investment.

- U.S. citizens have started to receive $1200 allocated by the government as financial support during the crisis caused by the coronavirus pandemic. At the same time, the number of deposits of exactly the same amount on the American cryptocurrency exchange Coinbase have increased by 4 times, as its head Brian Armstrong said in his Twitter account.

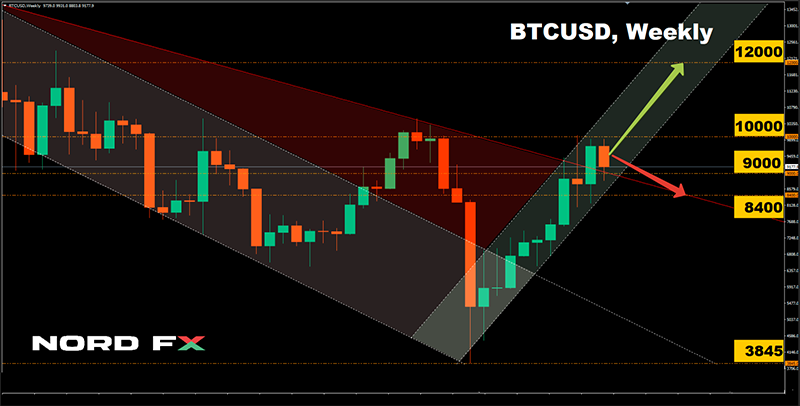

- According to analyst Peter Brandt, crypto traders should be cautious about the current market situation. During the discussion on Twitter Brandt noted that corporations hardly use cryptocurrencies, and, therefore, one should not expect them to support the cryptocurrency revolution. And although many accept Bitcoin as a means of storing wealth, this will not affect its rate. “What percentage of world trade is made through cryptocurrency? How many international corporations do their business with Bitcoin?" the expert asked. At the same time, he noted that over time, enterprises, especially financial organizations, will gradually switch to the use of digital currencies, but it will not necessarily be Bitcoin. In March, Peter Brandt wrote that BTC could fall to $1,000. In his opinion, if you look at the chart "without bias", the bottom may be even lower than this value.

- During the online crypto conference BlockDown, the CEO of ShapeShift (a company that offers digital asset trading via web and mobile platforms) Eric Voorhees predicted the future of the flagship cryptocurrency. He noted that Bitcoin has many opportunities for growth. So, the upcoming halving of block rewards may become a catalyst that will push its price to new historical highs. “I believe that it is possible the Bitcoin rate exceeds $50,000 in twelve months, the probability of this event is quite high - 80%”, Voorhees said. In his opinion, as unemployment rises and oil prices fall, investors will simply need a quiet harbour, which can be cryptocurrencies to a certain extent. But Voorhees said that he could be "completely wrong, because it is stupid to try to predict such things."

- Co-founder of Morgan Creek Digital investment company Anthony Pompliano has announced in a recent interview that Bitcoin (BTC) is on the verge of a new long-term growth of 1288% — from current levels of $7,200 to $100,000. According to Pompliano, the macroeconomic background and the May halving will be the main reasons for the rise in the Bitcoin price, and the printing of money by Central banks around the world will force people to invest in anti-inflationary assets.

- Another forecast is given by the cryptocurrency analyst Dave the Wave. In July 2019, he gave a correct prediction of a decline in the BTC from $11,600 to $6,000 by the end of the year, saying that the first cryptocurrency was up to a parabolic drop. Now he has updated his long-term forecast using curve models based on the BTC price history. In his opinion, the bitcoin volatility will decline, but it will still face a few ups and downs. Dave the Wave expects the first cryptocurrency to grow to $130,000 by 2023 and then gradually decline to $40,000. Then, the Bitcoin exchange rate will again gradually grow, and by 2029 it could reach $400,000.

#eurusd #gbpusd #usdjpy #usdchf #forex #forex_example #signals #forex #cryptocurrencies #bitcoin

https://nordfx.com/

- Some Bitcoin miners are at danger due to negative oil prices. Miners are actively looking for cheap electricity in anticipation of the halving in order to keep competitive. In North America, several of these firms use energy from a gas torch generated by oil extraction or refining. And if the oil companies close under pressure of low or negative prices, it will hit the miners. The Great American Mining founder Marty Brent said in a comment for CoinDesk that just one field he works with can provide hundreds of megawatts for mining. According to the publication, such companies will remain profitable even if Bitcoin does not grow in 2020. But oil prices are one of the key variables in their business model.

- Malaysian law enforcement officers arrested Chinese attackers accused of cryptocurrency fraud. This is reported by news agency South China Morning Post. According to the police, the detainees formed groups in WeChat and QQ, where they persuaded potential investors to invest in their allegedly successful projects. A total of 14 people were arrested, who, in addition to 10 years of imprisonment for fraud, also face a fine and up to six lashes for violation of immigration legislation.

- According to a survey conducted by The Economist magazine commissioned by Crypto.com, 26% of respondents trust cryptocurrencies, while 38% of respondents believe cryptocurrencies unreliable. But the digital currencies of Central banks (CBDC) are trusted by the majority of respondents (54%). Among the main obstacles to the adoption of cryptocurrencies, respondents pointed to a lack of understanding of their application areas (44%) and technology safety (32%). In most cases (34%) cryptocurrencies are used for online payments, another 24% consider them as a short-term investment, 23% - as a long-term investment.

- U.S. citizens have started to receive $1200 allocated by the government as financial support during the crisis caused by the coronavirus pandemic. At the same time, the number of deposits of exactly the same amount on the American cryptocurrency exchange Coinbase have increased by 4 times, as its head Brian Armstrong said in his Twitter account.

- According to analyst Peter Brandt, crypto traders should be cautious about the current market situation. During the discussion on Twitter Brandt noted that corporations hardly use cryptocurrencies, and, therefore, one should not expect them to support the cryptocurrency revolution. And although many accept Bitcoin as a means of storing wealth, this will not affect its rate. “What percentage of world trade is made through cryptocurrency? How many international corporations do their business with Bitcoin?" the expert asked. At the same time, he noted that over time, enterprises, especially financial organizations, will gradually switch to the use of digital currencies, but it will not necessarily be Bitcoin. In March, Peter Brandt wrote that BTC could fall to $1,000. In his opinion, if you look at the chart "without bias", the bottom may be even lower than this value.

- During the online crypto conference BlockDown, the CEO of ShapeShift (a company that offers digital asset trading via web and mobile platforms) Eric Voorhees predicted the future of the flagship cryptocurrency. He noted that Bitcoin has many opportunities for growth. So, the upcoming halving of block rewards may become a catalyst that will push its price to new historical highs. “I believe that it is possible the Bitcoin rate exceeds $50,000 in twelve months, the probability of this event is quite high - 80%”, Voorhees said. In his opinion, as unemployment rises and oil prices fall, investors will simply need a quiet harbour, which can be cryptocurrencies to a certain extent. But Voorhees said that he could be "completely wrong, because it is stupid to try to predict such things."

- Co-founder of Morgan Creek Digital investment company Anthony Pompliano has announced in a recent interview that Bitcoin (BTC) is on the verge of a new long-term growth of 1288% — from current levels of $7,200 to $100,000. According to Pompliano, the macroeconomic background and the May halving will be the main reasons for the rise in the Bitcoin price, and the printing of money by Central banks around the world will force people to invest in anti-inflationary assets.

- Another forecast is given by the cryptocurrency analyst Dave the Wave. In July 2019, he gave a correct prediction of a decline in the BTC from $11,600 to $6,000 by the end of the year, saying that the first cryptocurrency was up to a parabolic drop. Now he has updated his long-term forecast using curve models based on the BTC price history. In his opinion, the bitcoin volatility will decline, but it will still face a few ups and downs. Dave the Wave expects the first cryptocurrency to grow to $130,000 by 2023 and then gradually decline to $40,000. Then, the Bitcoin exchange rate will again gradually grow, and by 2029 it could reach $400,000.

#eurusd #gbpusd #usdjpy #usdchf #forex #forex_example #signals #forex #cryptocurrencies #bitcoin

https://nordfx.com/