FxGrow Daily Technical Analysis – 20th Sept, 2016

By FxGrow Research & Analysis Team

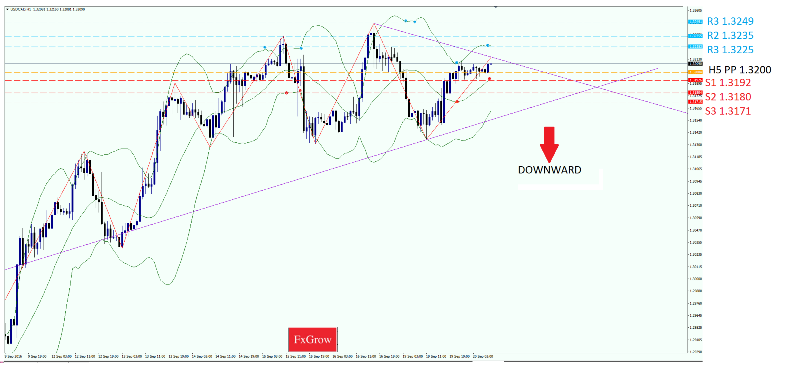

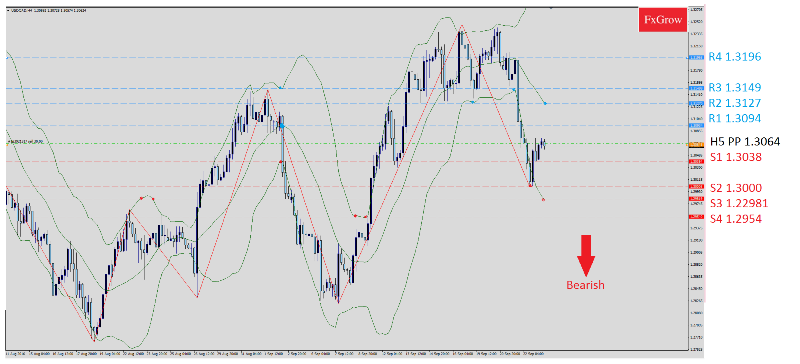

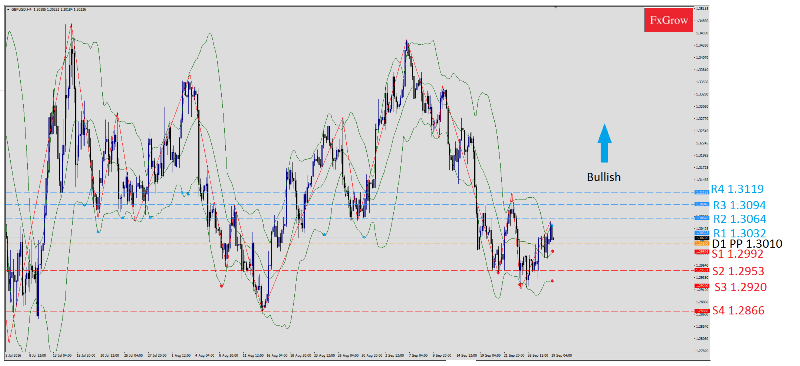

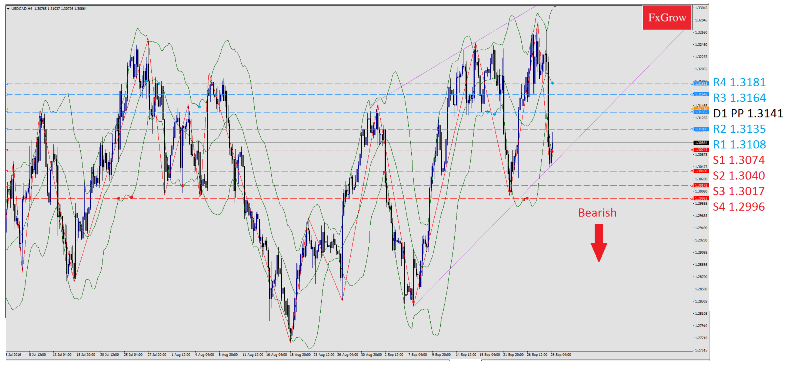

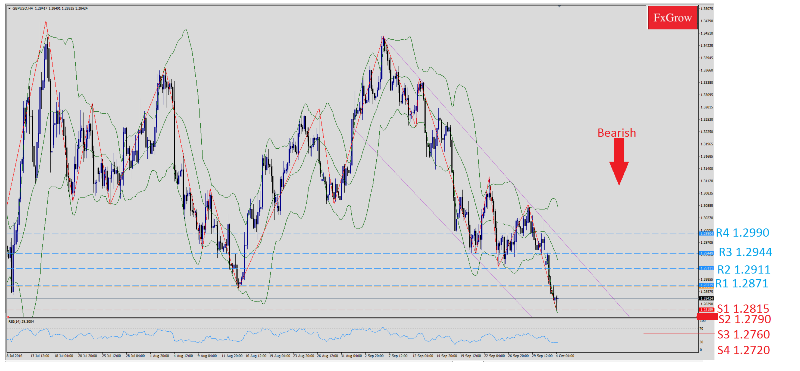

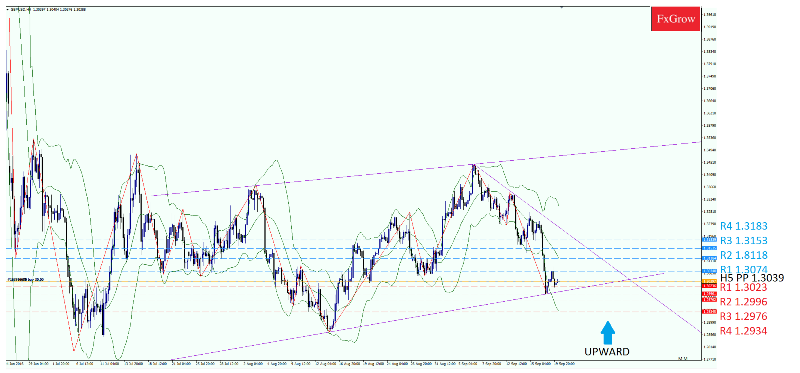

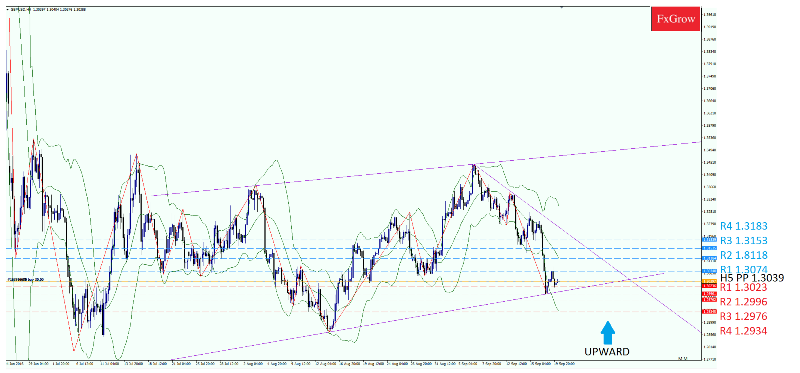

GBPUSD STARTS WITH THE SAME SCENARIO AS YESTERDAY, AFTER INVERTED HAMMER FORMATION

Just like yesterday, The GBP/USD started wit bullish trend, after dropping to 1.2998, the GBPUSD rallied again to 1.3046. Although there was buying pressure during previous sessions, the bulls were not able to sustain thee pressure and prices closed well off of their highs. Just like yesterday. Roles are mixed between GBP and USD, whose moving stronger facing each others.

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...alysis-fxgrow-free-forex-analysis-tools#close

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

By FxGrow Research & Analysis Team

GBPUSD STARTS WITH THE SAME SCENARIO AS YESTERDAY, AFTER INVERTED HAMMER FORMATION

Just like yesterday, The GBP/USD started wit bullish trend, after dropping to 1.2998, the GBPUSD rallied again to 1.3046. Although there was buying pressure during previous sessions, the bulls were not able to sustain thee pressure and prices closed well off of their highs. Just like yesterday. Roles are mixed between GBP and USD, whose moving stronger facing each others.

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...alysis-fxgrow-free-forex-analysis-tools#close

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.